An auto insurance ID Card, a compact yet crucial document, serves as irrefutable proof of financial responsibility for a vehicle owner. It is a mandatory requirement in most jurisdictions, often demanded by law enforcement officials following traffic stops or accidents. This article delves into the intricacies of an auto insurance ID card template, elucidating its components, significance, and legal implications.

Core Elements of an Auto Insurance ID Card Template

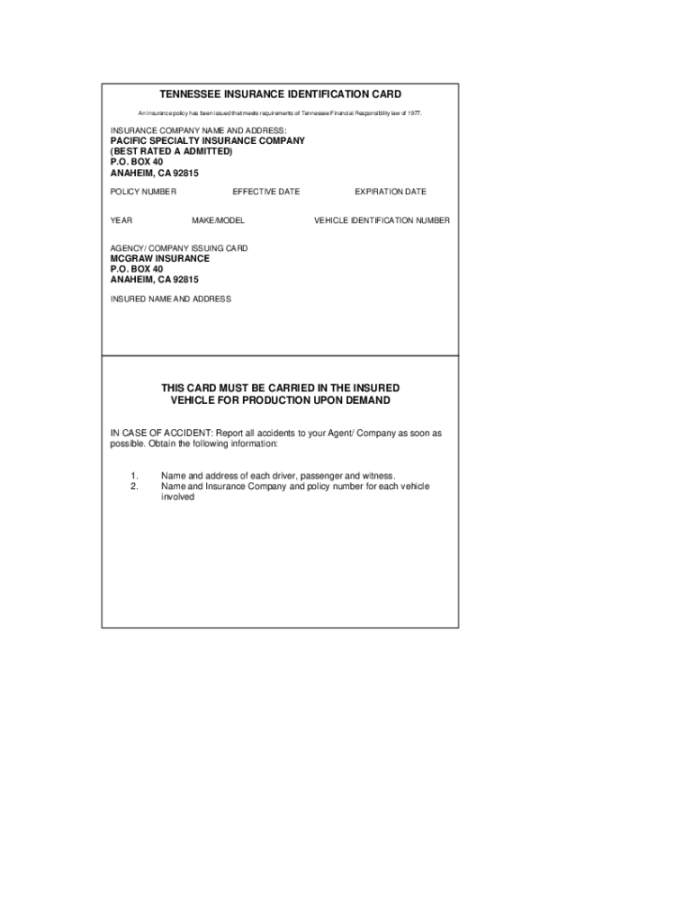

The standard auto insurance ID card template incorporates specific information essential for verification. The policyholder’s name and address constitute the foundational details, followed by the insurance company’s name, logo, and contact information. The vehicle’s description, encompassing make, model, year, and vehicle identification number (VIN), is indispensable. Crucially, the policy number, effective and expiration dates, and coverage limits are prominently featured. This data collectively establishes the authenticity of the insurance policy and its scope.

The Role of the Auto Insurance ID Card

Beyond mere compliance, the auto insurance ID card plays a pivotal role in various scenarios. In the event of an accident, it facilitates swift claims processing by providing essential policy details to the involved parties and insurance providers. Law enforcement agencies rely on the card to verify insurance coverage during traffic stops, deterring uninsured driving. Moreover, rental car agencies and other businesses often require proof of insurance, making the ID card a practical necessity.

Legal Implications of an Auto Insurance ID Card

Operating a vehicle without valid insurance carries severe legal consequences. Penalties range from hefty fines to license suspension or revocation. In some jurisdictions, driving uninsured may even lead to criminal charges. It is imperative to understand the specific laws in one’s region to avoid legal repercussions. Additionally, failure to present an insurance ID card upon request by law enforcement can result in citations or other penalties.

Conclusion

The auto insurance ID card, though seemingly simple, is a document of considerable legal and practical importance. It serves as a verifiable proof of insurance, shielding vehicle owners from financial liability in case of accidents. Adherence to insurance regulations and the possession of a valid ID card are indispensable for responsible and compliant driving.

FAQs

1. What information is typically included on an auto insurance ID card?

An auto insurance ID card typically includes the policyholder’s name and address, insurance company details, vehicle information (make, model, year, VIN), policy number, effective and expiration dates, and coverage limits.

2. Is it mandatory to carry an auto insurance ID card?

While specific requirements vary by jurisdiction, carrying an auto insurance ID card is generally mandatory. It is advisable to check the laws in your state or province.

3. What happens if I get pulled over without an auto insurance ID card?

Driving without proof of insurance can result in fines, license suspension, or even criminal charges depending on the jurisdiction. It is essential to carry a valid ID card at all times.

4. Can I use a digital copy of my auto insurance ID card?

Some jurisdictions accept digital proof of insurance, but it’s crucial to verify the legality of electronic versions. It’s generally safer to carry a physical copy of the ID card.

5. What should I do if my auto insurance ID card is lost or stolen?

Contact your insurance company immediately to request a replacement card. In the meantime, obtain temporary proof of insurance, if possible.