In an increasingly complex financial landscape, the integrity of lending practices stands as a cornerstone of consumer trust and institutional credibility. Financial institutions, from large banks to agile fintech startups, bear a significant responsibility to ensure their offerings are fair, transparent, and beneficial for their customers. This is precisely where an Anti Predatory Lending Policy Template becomes not just a guideline, but a vital defensive and proactive tool.

This comprehensive framework is designed to help organizations of all sizes establish robust internal controls, mitigate risks, and champion ethical lending. It’s an indispensable resource for compliance officers, legal teams, risk managers, and executive leadership who are committed to upholding the highest standards of financial conduct and safeguarding both their institution’s reputation and their customers’ financial well-being. By adopting and customizing such a template, any entity engaged in credit provision can clearly articulate its stance against exploitative practices, ensuring every loan product serves its intended purpose without undue burden.

Why Anti Predatory Lending Policy Template is Essential Today

The current economic environment, coupled with ever-evolving regulatory frameworks, makes an Anti Predatory Lending Policy Template an absolute necessity. Gone are the days when opaque lending practices could easily slip under the radar. Regulators at both federal and state levels, from the Consumer Financial Protection Bureau (CFPB) to state Attorneys General, are intensifying their scrutiny of lending activities. This means financial institutions face significant legal and financial repercussions for failing to prevent predatory tactics.

Moreover, consumer advocacy groups are more active than ever, shedding light on harmful lending practices that can trap individuals in cycles of debt. A strong Anti Predatory Lending Policy Template helps an institution proactively align with fair lending principles, ensuring compliance with critical legislation such as the Truth in Lending Act (TILA), the Real Estate Settlement Procedures Act (RESPA), and the Dodd-Frank Act. It’s not just about avoiding penalties; it’s about building a sustainable business model founded on trust and ethical engagement. In an era where negative news spreads rapidly, protecting an organization’s brand and public image is paramount, making clear, actionable policies against predatory lending practices indispensable.

Key Benefits of Using Anti Predatory Lending Policy Template

Adopting a well-crafted Anti Predatory Lending Policy Template offers a multitude of benefits that extend far beyond mere compliance. Primarily, it serves as a powerful instrument for risk mitigation. By clearly defining and prohibiting predatory behaviors, organizations drastically reduce their exposure to legal challenges, regulatory fines, and costly litigation. This proactive stance protects both financial assets and valuable reputational capital.

Secondly, it significantly enhances consumer trust and loyalty. When customers perceive a lender as transparent and ethical, they are more likely to engage with that institution for their long-term financial needs. A strong policy demonstrates a genuine commitment to fair dealings, fostering stronger relationships and positive word-of-mouth. This can lead to increased customer acquisition and retention, proving that ethical practice is good business.

Furthermore, an Anti Predatory Lending Policy Template contributes to operational efficiency and standardization. It provides clear guidelines for employees across all departments, from loan origination and underwriting to sales and customer service. This ensures consistency in how credit products are offered and managed, reducing errors, streamlining processes, and providing a unified approach to anti-predatory measures. It also serves as an invaluable training resource, educating staff on best practices and prohibited actions.

Finally, such a policy aids in proactive regulatory compliance. Rather than reacting to audits or complaints, institutions using a robust template can ensure their practices are continuously aligned with current laws and emerging regulatory expectations. This foresight allows for smoother examinations and a greater sense of security in an ever-changing legal landscape, underpinning the financial stability of the entire organization.

Customizing Your Anti Predatory Lending Policy Template

While an Anti Predatory Lending Policy Template provides a solid foundation, its true power lies in its adaptability. No two financial institutions are identical, and their operations, client bases, and credit products vary significantly. Therefore, customization is not just recommended, it’s essential for the policy to be truly effective and relevant.

Consider the type of lending your institution primarily engages in. A mortgage lender will need to tailor its policy to address specific risks related to home equity stripping, balloon payments, and deceptive refinancing practices, which might differ from a small-dollar loan provider focusing on payday or auto title loans, where issues like excessive fees and short repayment terms are more prevalent. Fintech lenders, operating with different technological platforms and often serving diverse customer segments, will need to incorporate aspects related to data privacy, algorithmic fairness, and digital disclosure requirements into their Anti Predatory Lending Policy Template.

Geographic location also plays a crucial role. While federal regulations provide a baseline, state laws often impose additional, stricter requirements regarding interest rate caps, permissible fees, and specific disclosure language. Your Anti Predatory Lending Policy Template must be updated to reflect all applicable state-specific statutes and consumer protection mandates. Scalability is another factor; a large national bank will have different internal governance and oversight mechanisms than a community credit union, requiring adjustments to reporting structures and enforcement protocols within the policy framework. Engaging legal counsel specializing in consumer finance law is paramount during this customization phase, ensuring that the tailored policy is legally sound and fully comprehensive for your unique operational context and diverse portfolio of loan agreements.

Essential Elements of an Anti Predatory Lending Policy Template

A truly effective Anti Predatory Lending Policy Template must be comprehensive, leaving no room for ambiguity regarding prohibited practices and expected conduct. Here are the key elements and fields that should be included:

- Policy Statement and Purpose: A clear declaration of the institution’s commitment to ethical lending and its zero-tolerance stance against predatory practices, outlining the policy’s objectives.

- Scope and Applicability: Clearly define who the policy applies to (all employees, third-party partners, specific departments) and which credit products and services it covers (mortgages, personal loans, credit cards, small-dollar loans, etc.).

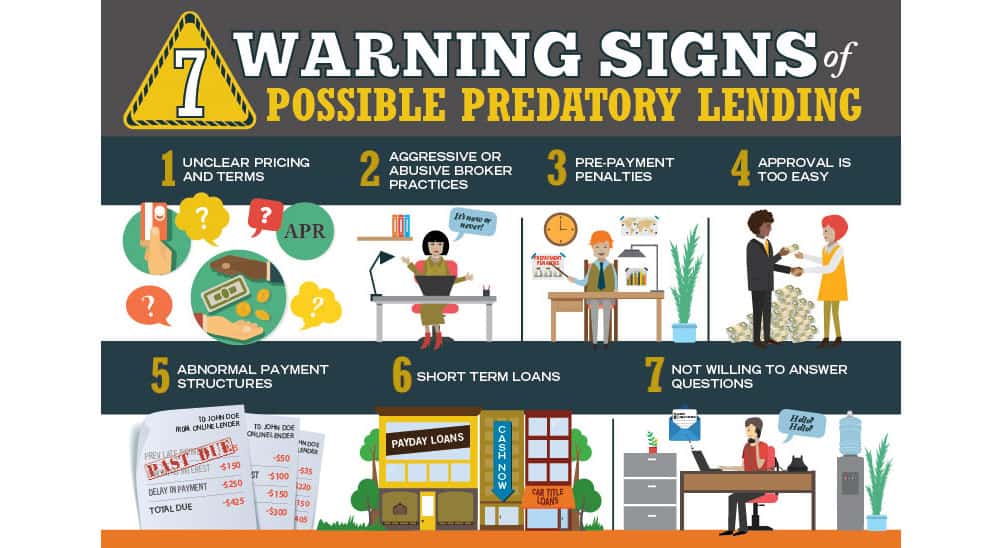

- Definition of Predatory Lending: Provide explicit definitions of what constitutes predatory lending within the context of your institution’s offerings, including specific examples of prohibited actions.

- Prohibited Practices: Detail a list of specific practices that are strictly forbidden, such as:

- Excessive fees or "junk fees."

- Loan flipping (repeated refinancing without tangible benefit to the borrower).

- Aggressive, deceptive, or misleading marketing and advertising.

- Equity stripping (lending based on home equity without regard for repayment ability).

- Single premium credit insurance or other unnecessary add-on products.

- Balloon payments without reasonable ability to repay.

- Steering borrowers into less favorable loan terms.

- Making loans without verifying the borrower’s ability to repay.

- Discrimination based on protected characteristics (fair lending principles).

- Fair Lending and Responsible Underwriting Standards: Outline clear, consistent, and non-discriminatory underwriting criteria, emphasizing the borrower’s capacity to repay and not solely collateral value.

- Disclosure Requirements: Detail all mandatory federal and state disclosure requirements, ensuring transparency of loan terms, fees, interest rates, and all material facts to the borrower before and during the loan agreement process.

- Employee Training and Education: Mandate regular, comprehensive training for all relevant staff on the policy, predatory lending indicators, and ethical conduct.

- Monitoring and Oversight: Establish procedures for ongoing monitoring of lending practices, internal audits, and quality control to ensure adherence to the policy. This includes tracking key metrics related to loan performance and customer complaints.

- Complaint Resolution Process: Outline a clear, accessible, and fair process for customers to report concerns or file complaints related to lending practices, ensuring prompt investigation and resolution.

- Compliance Officer Responsibilities: Define the roles and responsibilities of the compliance team in implementing, maintaining, and enforcing the Anti Predatory Lending Policy Template.

- Record Keeping: Specify requirements for documenting all loan agreements, disclosures, communications, and compliance activities to demonstrate adherence to the policy and regulatory obligations.

- Policy Review and Update: Mandate a schedule for regular review and revision of the policy (e.g., annually, or as regulations change) to ensure it remains current, effective, and compliant.

Design, Usability, and Implementation Tips

Crafting a robust Anti Predatory Lending Policy Template is only half the battle; its effectiveness hinges on thoughtful design, usability, and strategic implementation. The policy should be designed for maximum clarity and accessibility. Use plain language, avoiding overly technical jargon where possible. Employ clear headings, bullet points, and concise paragraphs to break up text, making it easy to read and understand for all employees.

For usability, consider both digital and print formats. Digitally, the policy should be easily searchable and accessible through internal intranets, compliance portals, or dedicated employee resource sites. A well-organized table of contents with hyperlinks can significantly enhance navigation. Ensure it’s mobile-friendly for employees who may access it on various devices. For print, design a professional, legible layout suitable for inclusion in employee handbooks or for distribution to staff who prefer physical documentation. This ensures that every team member, regardless of their preferred method of access, can readily engage with the policy guidelines and understand their obligations.

Implementation requires a multi-faceted approach. Start with a comprehensive launch, communicating the policy’s importance and the institution’s commitment to ethical lending from the top down. Integrate the Anti Predatory Lending Policy Template into your existing new-hire onboarding process and regular compliance training programs. Utilize quizzes or acknowledgment forms to ensure staff have read, understood, and committed to adhering to the guidelines. Regularly solicit feedback from employees on the policy’s clarity and practicality to identify areas for improvement. Ongoing monitoring and enforcement, coupled with a commitment to continuous improvement, will ensure that the Anti Predatory Lending Policy Template remains a living, effective document that underpins your organization’s ethical lending practices and bolsters financial stability.

The journey toward impeccable ethical lending practices is continuous, but with a well-structured Anti Predatory Lending Policy Template, your institution can navigate it with confidence and clarity. This isn’t merely a document to satisfy regulatory requirements; it’s a foundational commitment to your customers and a declaration of your organization’s values. By prioritizing transparency, fairness, and responsible credit provision, you build more than just a successful business; you build lasting trust.

Embracing this template as a dynamic, living framework empowers your teams to make informed, ethical decisions daily, fostering an environment where predatory practices have no place. It’s an investment in your brand’s integrity, your customers’ well-being, and the long-term financial health of your enterprise. Start leveraging the power of a comprehensive Anti Predatory Lending Policy Template today, and set a new standard for responsible lending in the industry.