In an increasingly digital world, where personal and financial information flows freely across countless platforms, the concept of privacy has taken on unprecedented importance. For consumers, the security of their sensitive data is paramount, especially when engaging with services that delve deep into their financial lives. This heightened awareness places a significant responsibility on businesses, particularly those in the financial sector like mortgage brokers, to clearly articulate how they collect, use, and protect client information.

This is precisely where a robust Mortgage Broker Privacy Policy Template becomes an invaluable asset. It’s not merely a legal formality; it’s a foundational document that builds trust, ensures compliance with a complex web of regulations, and provides a clear framework for data handling. Whether you’re a seasoned independent broker, a growing firm, or just starting out, understanding and implementing such a template is crucial for safeguarding your clients’ data and, by extension, your business’s reputation and long-term viability.

Why a Mortgage Broker Privacy Policy Template is Essential

In today’s fast-paced financial landscape, operating without a comprehensive privacy policy is akin to navigating a complex legal and ethical minefield blindfolded. The sheer volume and sensitivity of the data handled by mortgage brokers – credit scores, income statements, asset details, and personal identifiers – necessitate stringent data protection measures. A well-structured Mortgage Broker Privacy Policy Template serves as your primary defense and declaration of commitment to consumer data protection.

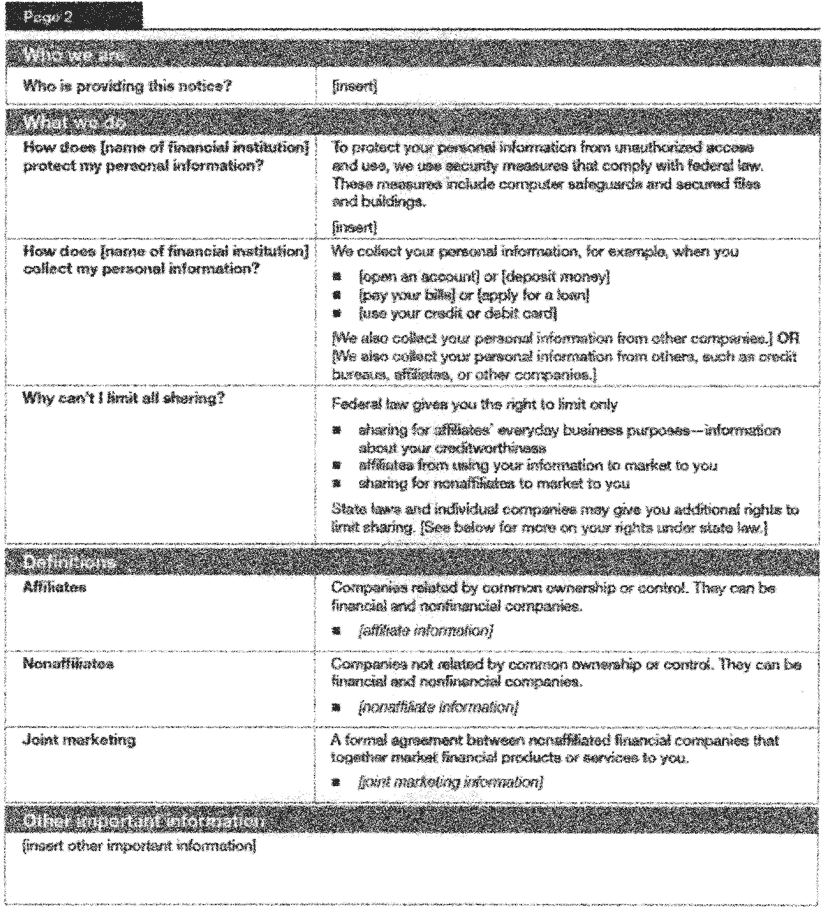

Federal laws like the Gramm-Leach-Bliley Act (GLBA) specifically mandate that financial institutions, including mortgage brokers, protect their customers’ nonpublic personal information and provide clear privacy notices. Non-compliance can lead to hefty fines, legal challenges, and severe reputational damage. Beyond federal mandates, a patchwork of state-specific privacy regulations, such as the California Consumer Privacy Act (CCPA), adds layers of complexity, requiring businesses to be adaptable and comprehensive in their privacy practices. A standardized template helps navigate these varied legal obligations, offering a structured approach to regulatory adherence.

Moreover, in an era marked by frequent data breaches, clients are more discerning than ever about who they trust with their financial details. A transparent privacy policy demonstrates professionalism and a proactive stance on data security, fostering confidence and loyalty among your clientele. It signals that your business prioritizes their privacy rights, thereby mitigating risks associated with mistrust and potential legal disputes arising from perceived negligence in data handling.

Key Benefits of Using a Mortgage Broker Privacy Policy Template

Adopting a specialized Mortgage Broker Privacy Policy Template offers a multitude of advantages that extend beyond mere legal checkboxes. For busy professionals, time is money, and starting from a professionally drafted template significantly reduces the effort and resources required to create a bespoke policy from scratch. This efficiency is a huge benefit, allowing brokers to focus on their core business of helping clients secure mortgages.

Financially, relying on a template can be far more cost-effective than engaging legal counsel to draft a policy from the ground up. While legal review is always recommended for the final document, the template provides a robust framework, ensuring that all essential components related to financial data privacy and information sharing are covered. This structured approach helps ensure comprehensiveness, preventing critical omissions that could lead to compliance issues down the line.

Furthermore, a well-implemented Mortgage Broker Privacy Policy Template elevates your professional image. It communicates to clients, partners, and regulators that your firm operates with integrity, foresight, and a deep understanding of its legal and ethical responsibilities regarding consumer data. It instills a sense of security, which is invaluable in a service-oriented industry where trust is currency. This systematic approach to privacy management also facilitates easier updates and revisions as privacy regulations evolve, ensuring ongoing compliance without repeated, costly overhauls.

Customizing Your Mortgage Broker Privacy Policy Template

While a Mortgage Broker Privacy Policy Template provides an excellent starting point, it’s crucial to understand that it serves as a foundation, not a final, static document. Every mortgage brokerage operates with unique practices, technology stacks, and third-party relationships, making customization an absolute necessity. The template acts as a comprehensive checklist, guiding you to fill in the specifics of your operations.

Begin by detailing your precise data collection methods. Do you use online application forms, collect documents via secure portals, or primarily conduct in-person consultations? Your policy must accurately reflect these channels. Similarly, identify all third parties with whom you share client information – this could include lenders, credit reporting agencies, appraisal companies, title companies, and marketing partners. Explicitly naming these entities or categorizing them appropriately ensures transparency.

Consider also any unique services or technologies your firm employs. If you utilize advanced analytics, automated communication tools, or specific customer relationship management (CRM) systems, their implications for data handling should be addressed. Remember to tailor the language to reflect your brand’s voice while maintaining a professional and clear tone. After customizing your Mortgage Broker Privacy Policy Template to mirror your specific business practices, it is highly advisable to seek legal review. An attorney specializing in financial services and data privacy can ensure your tailored policy fully complies with all applicable federal and state laws, particularly the nuances of GLBA and local privacy statutes relevant to your operational footprint.

Important Elements to Include in Your Mortgage Broker Privacy Policy Template

A truly effective Mortgage Broker Privacy Policy Template must be comprehensive, addressing every facet of data handling from collection to destruction. The following key elements should be robustly detailed to ensure full transparency and compliance:

- Information Collected: Clearly list the types of personal, nonpublic, and financial information you gather. This includes names, addresses, Social Security numbers, income details, employment history, credit scores, bank account numbers, and property details.

- Methods of Collection: Explain how this information is obtained, whether through direct client input (applications, forms), third-party sources (credit bureaus, employers, financial institutions), or technological means (website cookies, analytics).

- Purpose of Collection: Articulate the specific reasons for collecting data, such as processing loan applications, verifying eligibility, fulfilling regulatory requirements, preventing fraud, providing customer service, and marketing relevant services.

- Use and Sharing of Information: Detail how the collected information is used internally and, critically, with whom it is shared externally. This section must explicitly name or categorize third parties like lenders, credit reporting agencies, service providers, and governmental authorities. It should also specify the purposes for such sharing.

- Data Security Measures: Describe the technical, administrative, and physical safeguards implemented to protect client data from unauthorized access, disclosure, alteration, and destruction. Mention encryption, access controls, secure storage, and staff training.

- Consumer Rights: Inform clients of their rights regarding their personal information. Depending on applicable laws (like CCPA or future federal privacy legislation), these might include rights to access, correct, delete, or opt-out of the sale or sharing of their data.

- Cookies and Tracking Technologies: Disclose the use of cookies, web beacons, and similar technologies on your website, explaining their purpose (e.g., website functionality, analytics, targeted advertising) and how users can manage their preferences.

- Changes to the Policy: Outline your procedure for updating the privacy policy and how clients will be notified of significant changes.

- Contact Information: Provide clear contact details for clients to ask questions, exercise their privacy rights, or raise concerns regarding the policy or their data.

- Effective Date: Include the date the policy was last updated, demonstrating a commitment to currency.

- GLBA Disclosure: Explicitly state compliance with the Gramm-Leach-Bliley Act and provide the mandated GLBA privacy notices regarding opt-out rights for information sharing.

Design, Usability, and Implementation Tips

Having a robust Mortgage Broker Privacy Policy Template is one thing; making it accessible and understandable is another. Its utility is significantly diminished if clients cannot easily find or comprehend its contents. Thoughtful design and strategic implementation are crucial for ensuring the policy effectively serves its purpose.

For digital implementation, ensure your privacy policy is prominently linked from your website’s footer. It should be easily discoverable from any page. The digital version must be mobile-friendly, rendering clearly on various devices and screen sizes. Employ clear headings, short paragraphs, and bullet points to break up text and enhance readability. Avoid legal jargon where simpler language suffices, explaining complex terms in an accessible manner. Consider a “summary” section at the top, offering a concise overview of key points before delving into the detailed legal text. This improves user experience significantly.

For print, ensure the policy is available upon request at your physical office locations. Maintain consistent formatting between digital and print versions for clarity. Staff should be well-versed in the policy’s contents and able to direct clients to it, whether online or in hard copy. Furthermore, it’s vital to establish a clear internal process for version control. Every time the Mortgage Broker Privacy Policy Template is updated, document the changes, effective date, and ensure all platforms (website, internal documents, printed copies) reflect the latest version. Implement regular staff training sessions to reinforce understanding and adherence to the privacy policy, turning it into a living document rather than a mere theoretical obligation.

In essence, a Mortgage Broker Privacy Policy Template is more than a regulatory hurdle; it’s a cornerstone of modern business practice in the financial sector. It represents a tangible commitment to protecting sensitive client information, adhering to complex legal frameworks like the Gramm-Leach-Bliley Act, and building an unshakeable foundation of trust. Proactively developing and maintaining a transparent privacy policy not only mitigates legal risks but also significantly enhances your firm’s credibility and reputation.

By leveraging a comprehensive Mortgage Broker Privacy Policy Template, customizing it to your unique operations, and ensuring its clear communication, you are making a vital investment in your business’s future. This practical solution empowers you to confidently navigate the intricacies of data protection, demonstrate ethical stewardship of client data, and foster lasting relationships built on transparency and confidence. Don’t view it as a burden, but as an opportunity to solidify your position as a trusted advisor in the mortgage industry.