In the intricate dance of modern business, where innovation meets constant change, organizations face an ever-present companion: risk. From the subtle hum of operational inefficiencies to the disruptive roar of a cyber-attack or a global supply chain breakdown, risks are not just possibilities but inevitable facets of enterprise. Navigating this complex landscape requires more than just reactive measures; it demands a robust, proactive framework for identification, assessment, and mitigation. This is where a well-crafted risk management policy becomes the bedrock of organizational resilience.

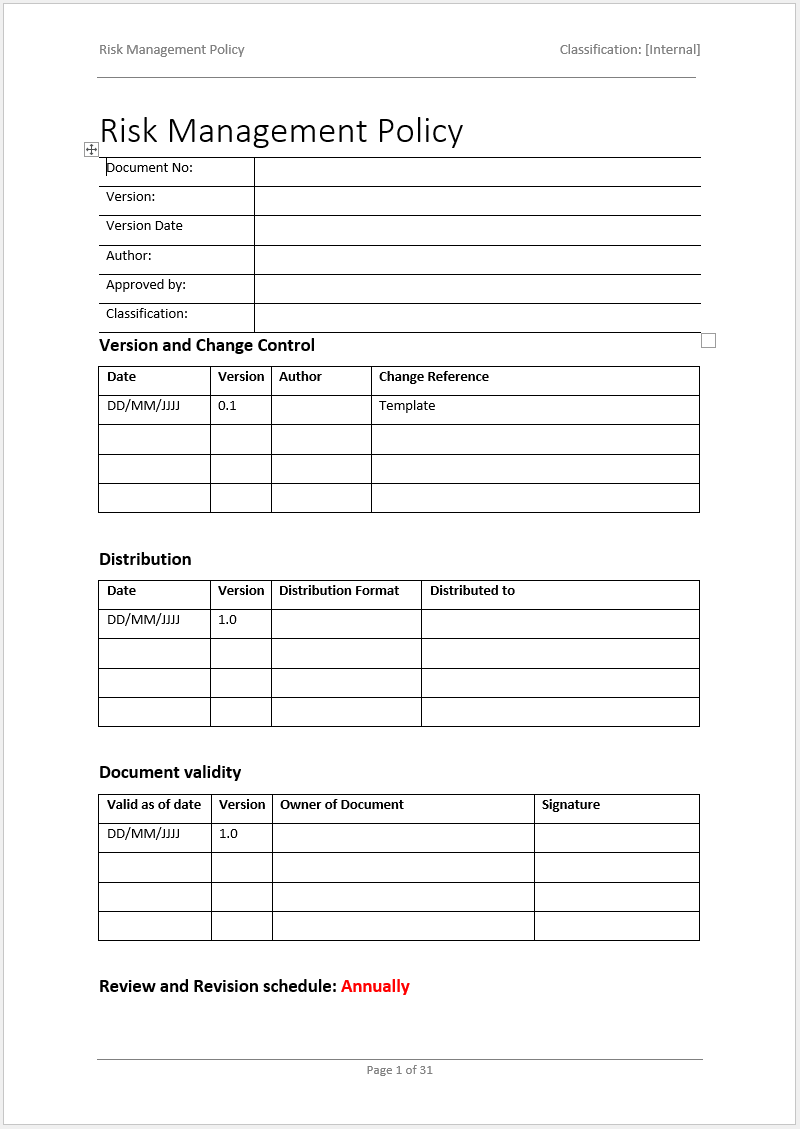

For many businesses, the idea of drafting such a crucial document from scratch can be daunting, consuming valuable time and resources. This challenge highlights the immense value of a structured approach, and specifically, the utility of a Risk Management Policy Template Word. Such a template offers a powerful starting point, providing a clear roadmap for establishing comprehensive risk management protocols. It’s an invaluable asset for compliance officers, legal teams, project managers, and even small business owners who need to formalize their approach to potential threats and opportunities, ensuring consistency and thoroughness across all organizational activities.

Why a Risk Management Policy Template Word is Essential Today

In today’s fast-evolving business environment, the sheer volume and complexity of potential risks have escalated dramatically. Organizations are grappling with everything from sophisticated cybersecurity threats and data security breaches to supply chain vulnerabilities, rapidly changing regulatory landscapes, and increasing geopolitical instability. Without a clear, documented risk management policy, businesses are essentially navigating these turbulent waters without a compass, leaving them vulnerable to significant financial losses, reputational damage, and operational disruptions.

A comprehensive risk management policy, often built upon a robust Risk Management Policy Template Word, is no longer a luxury but a fundamental necessity. It serves as an organization’s blueprint for identifying, evaluating, and responding to potential threats. This proactive stance is crucial for maintaining regulatory compliance, meeting industry standards, and building trust with stakeholders. It demonstrates a commitment to safeguarding assets, ensuring business continuity, and fostering a culture of informed decision-making, which is paramount in a world demanding accountability and resilience.

Key Benefits of Using a Risk Management Policy Template Word

Leveraging a Risk Management Policy Template Word offers a multitude of tangible benefits that extend far beyond simply having a document on file. It streamlines a critical, often complex, organizational task and enhances overall operational efficiency.

Firstly, it provides a significant head start, saving countless hours and resources that would otherwise be spent drafting a policy from the ground up. This efficiency allows teams to focus more on tailoring the content to their specific needs rather than on foundational structuring. Secondly, a template ensures consistency in language, scope, and approach across different departments or projects. This standardization prevents gaps in coverage and ensures that all risks are evaluated against a uniform set of criteria, leading to more reliable risk assessments.

Furthermore, a well-designed Risk Management Policy Template Word acts as a knowledge repository, reminding users of all the critical elements that should be considered in a comprehensive policy. This completeness helps prevent oversight, ensuring that vital areas like legal terms, compliance requirements, and specific operational risks are not inadvertently neglected. It also serves as an excellent training tool, clearly outlining roles, responsibilities, and procedures for employees, thus fostering a shared understanding of risk management principles across the entire organization. Ultimately, adopting such a template improves an organization’s ability to anticipate, respond to, and recover from unforeseen events, bolstering its long-term stability and success.

Customizing Your Risk Management Policy Template Word for Specific Needs

While a Risk Management Policy Template Word provides an excellent foundation, its true power lies in its adaptability. No two organizations are exactly alike, and therefore, no single policy can perfectly fit every context without some degree of customization. The key is to treat the template as a robust framework that requires tailoring to reflect the unique risk profile, operational realities, and strategic objectives of your specific enterprise.

Consider the industry you operate in: a healthcare provider will have distinct data security and privacy compliance needs (like HIPAA) compared to a manufacturing firm dealing with supply chain vulnerabilities or an IT company focused on cyber threats. The size and structure of your organization also play a significant role. A small startup might have a more streamlined policy, while a multinational corporation would require more detailed sections on regional compliance and cross-functional responsibilities. Your company culture, existing HR policies, and even the maturity of your current risk management practices will influence how you adapt the language and scope. This customization might involve adding specific sections for environmental, social, and governance (ESG) risks, incorporating unique project-specific risks, or detailing specific contractual obligations and legal terms relevant to your operations. The goal is to evolve the generic Risk Management Policy Template Word into a living, breathing document that accurately represents your organization’s commitment to resilience and effectively guides its risk management activities.

Important Elements to Include in Your Risk Management Policy Template Word

A truly effective risk management policy, whether built from scratch or adapted from a robust Risk Management Policy Template Word, must be comprehensive and clearly structured. It should leave no ambiguity regarding an organization’s approach to identifying, assessing, and mitigating risks. Here are the critical elements and fields that should be included:

- Policy Statement: A high-level declaration outlining the organization’s overall commitment to effective risk management, its importance, and its integration into business operations.

- Scope and Objectives: Clearly defines what the policy covers (e.g., all departments, projects, external partners) and the specific goals it aims to achieve (e.g., minimize financial loss, ensure compliance, protect reputation).

- Roles and Responsibilities: Delineates who is accountable for what, including the Board of Directors, executive management, risk owners, departmental heads, and all employees. This ensures clear ownership.

- Risk Identification Methodology: Describes the processes and tools used to systematically identify potential risks, such as workshops, brainstorming sessions, incident reporting, or expert interviews.

- Risk Analysis and Evaluation: Outlines how identified risks will be assessed, including criteria for likelihood, impact (financial, operational, reputational), and a risk matrix for prioritization.

- Risk Mitigation and Treatment Strategies: Details the organization’s approach to addressing risks, including options like avoidance, reduction (controls, contingency plans), transfer (insurance, contracts), or acceptance.

- Monitoring and Review: Specifies how risks and the effectiveness of mitigation strategies will be continuously monitored, reviewed, and updated, including frequency and responsible parties.

- Reporting and Communication: Establishes clear channels and formats for reporting risk information to relevant stakeholders, including executive summary for leadership, and ensures transparent communication regarding risk incidents and changes.

- Incident Response and Business Continuity: Provides an overview of the procedures for responding to actual incidents and ensuring the continuation of critical business functions after a disruptive event.

- Training and Awareness: Explains how employees will be educated on the policy, their roles in risk management, and the importance of a risk-aware culture.

- Definitions: A glossary of key terms used throughout the policy to ensure common understanding.

- Compliance and Legal Framework: References relevant regulatory requirements, industry standards, and legal terms that the policy adheres to (e.g., GDPR, Sarbanes-Oxley, industry-specific regulations).

Tips for Design, Usability, and Implementation

Creating a comprehensive risk management policy using a Risk Management Policy Template Word is only half the battle; ensuring it is usable, understood, and effectively implemented is equally crucial. A well-designed policy document is more likely to be read, absorbed, and followed by employees and stakeholders.

Prioritize clarity and readability above all else. Use plain language, avoiding overly technical jargon where possible, or provide clear definitions. Break up dense text with headings, subheadings, and bullet points to improve scannability. Employ ample white space to prevent information overload, making the document visually less intimidating. For both print and digital versions, consider a clean, professional font and consistent formatting. If the Risk Management Policy Template Word is to be distributed digitally (e.g., as a PDF on an intranet), ensure it is accessible, perhaps by including bookmarks or a clickable table of contents for easy navigation.

Crucially, establish robust version control mechanisms. As a living document, the policy will evolve, and it’s vital that everyone is working from the most current version. Implement a clear numbering system and include a revision history section. For implementation, don’t just distribute the document; actively engage employees through training sessions and workshops. Explain the "why" behind the policy, how it affects their daily work, and how they can contribute to effective risk management. Finally, integrate the policy with other corporate documents, such as HR policies, IT security guidelines, and project management frameworks, to ensure a cohesive approach across the organization. Regularly solicit feedback to identify areas for improvement, ensuring your policy remains relevant and effective.

In an era defined by continuous change and uncertainty, a robust risk management framework is not merely a bureaucratic exercise; it is a strategic imperative. The thoughtful development and consistent application of a comprehensive risk management policy can serve as your organization’s shield against unforeseen challenges, transforming potential threats into manageable scenarios. It provides peace of mind, not just for the executive team, but for every individual contributing to the organization’s mission.

Leveraging a well-structured Risk Management Policy Template Word offers an unparalleled advantage, streamlining the policy creation process and ensuring that all critical aspects are addressed. It empowers your business to move beyond reactive damage control, embracing a proactive stance that fosters resilience, protects assets, and nurtures a culture of informed decision-making. By investing in such a template and customizing it to your specific needs, you are not just drafting a document; you are building a foundation for sustainable success and enduring stability in an unpredictable world.