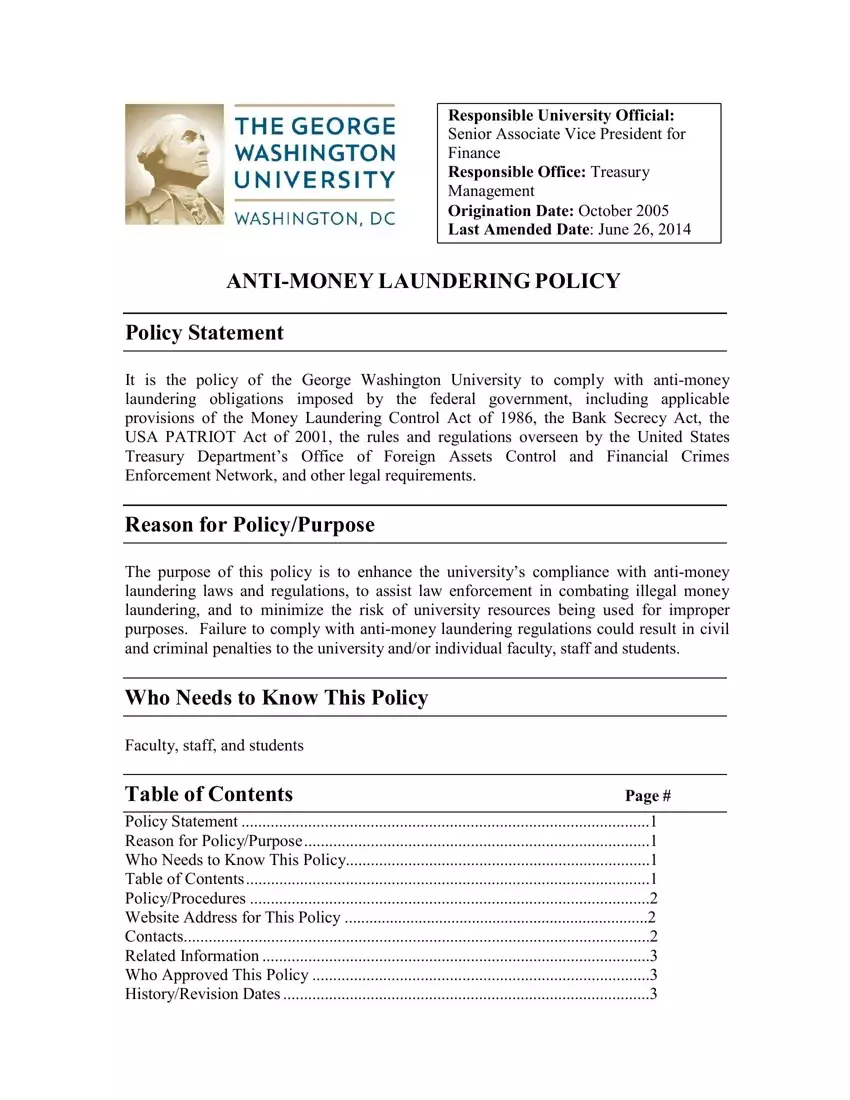

In today’s interconnected financial landscape, the fight against illicit finance is more critical than ever. Money laundering, a sophisticated process used to disguise the origins of illegally obtained funds, poses a significant threat to global economic stability, national security, and the integrity of financial systems. For businesses operating within the United States, navigating the complex web of anti-money laundering (AML) regulations isn’t just a best practice; it’s a non-negotiable legal obligation, primarily enforced by agencies like the Financial Crimes Enforcement Network (FinCEN) under the Bank Secrecy Act (BSA).

Developing a comprehensive and effective AML compliance program is a cornerstone of responsible business operations. It’s a proactive defense mechanism that protects an organization from becoming an unwitting conduit for criminal activity, safeguarding its reputation, financial health, and legal standing. While the core principles of AML are universal, their application requires careful tailoring to a business’s specific risks, services, and customer base. This necessity often leads businesses to seek a structured approach, a foundational blueprint that guides them in building a robust defense against financial crime.

The Imperative of AML Compliance in the Modern Age

The sheer volume and velocity of financial transactions in the digital age have created fertile ground for money launderers. From drug trafficking and terrorism financing to fraud and cybercrime, illicit funds seek pathways through legitimate financial channels. Businesses, whether large banks, fintech startups, or money service businesses, are on the front lines, tasked with identifying and reporting suspicious activities. The consequences of failing to meet these obligations are severe, ranging from hefty fines and asset seizures to criminal charges, reputational damage, and loss of trust from customers and partners.

For US entities, the regulatory framework is stringent, rooted in the Bank Secrecy Act and supplemented by specific regulations and guidance from FinCEN. This mandates a risk-based approach to anti-money laundering, requiring institutions to assess their unique vulnerabilities and implement controls proportionate to those risks. Simply put, understanding your obligations and having a clearly defined strategy to meet them is not merely about avoiding penalties; it’s about contributing to a safer, more transparent financial ecosystem.

What Constitutes a Robust AML Compliance Framework?

A truly effective anti-money laundering framework is more than a set of rules; it’s an integrated system designed to detect, prevent, and report illicit financial activities. It reflects an organization’s commitment to ethical conduct and its understanding of the evolving threats posed by financial crime. At its core, such a framework must be dynamic, capable of adapting to new risks, regulatory changes, and technological advancements. It requires a continuous cycle of assessment, implementation, monitoring, and review.

The foundation of any strong anti-money laundering program is built upon several critical pillars, as outlined by regulatory bodies. These pillars ensure that an organization has the necessary infrastructure, policies, and personnel to effectively combat money laundering. Without these foundational elements, even the most well-intentioned efforts can fall short, leaving an organization exposed to compliance gaps and regulatory scrutiny. Adopting a structured methodology is crucial for consistency and thoroughness.

Leveraging an Effective Compliance Program Blueprint

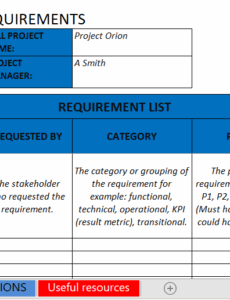

For many organizations, particularly those new to the complexity of financial regulations or those seeking to enhance existing protocols, developing an AML program from scratch can be daunting. This is where an Anti Money Laundering Compliance Program Template becomes invaluable. It provides a pre-structured, comprehensive document that outlines the essential components and considerations required for a compliant and effective program. Think of it as a sophisticated starting point, designed to accelerate the development process and ensure no critical elements are overlooked.

A well-crafted compliance blueprint doesn’t just list requirements; it offers guidance on how to implement them, often providing sample language, procedures, and best practices. It helps bridge the gap between abstract regulatory requirements and concrete, actionable internal policies. Utilizing such a structured document allows institutions to focus their efforts on tailoring the framework to their specific operational realities, rather than spending valuable time on basic structure and wording. It’s a strategic tool for efficiency and robust risk management.

Key Elements of a Comprehensive AML Program Structure

An effective anti-money laundering compliance program must address several core components. These elements are non-negotiable under US regulations and form the backbone of an organization’s defense against financial crime. Leveraging a comprehensive program structure helps ensure that each of these critical areas is thoroughly developed and documented.

Here are the essential components that should be clearly defined and implemented within any robust AML compliance structure:

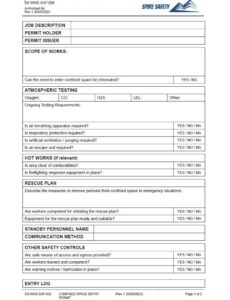

- Designation of a Compliance Officer: A dedicated individual with sufficient authority and resources to oversee the day-to-day operations of the anti-money laundering program. This officer is responsible for implementing policies, training staff, and acting as the primary contact for regulatory inquiries.

- Internal Controls: Policies, procedures, and systems designed to mitigate the risks of money laundering and terrorist financing. This includes robust customer identification procedures (CIP), enhanced due diligence (EDD) for high-risk clients, and transaction monitoring systems.

- Ongoing Employee Training: Regular and mandatory training programs for all relevant employees. This ensures that staff at all levels understand their role in identifying and reporting suspicious activities, recognizing red flags, and adhering to established policies.

- Independent Review/Audit: Periodic, independent testing of the anti-money laundering program’s effectiveness. This review, often conducted by internal audit or an external firm, assesses compliance with regulatory requirements and internal policies, identifying areas for improvement.

- Customer Identification Program (CIP): Detailed procedures for verifying the identity of new customers. This typically involves collecting specific identifying information, verifying it through reliable independent sources, and maintaining records of the verification process.

- Enhanced Due Diligence (EDD): Protocols for conducting more intensive scrutiny on customers identified as high-risk, such as politically exposed persons (PEPs), those from high-risk jurisdictions, or those involved in certain high-risk industries.

- Suspicious Activity Reporting (SAR): Clear procedures for identifying, investigating, and reporting suspicious transactions to FinCEN. This includes criteria for what constitutes suspicious activity, documentation requirements, and timely filing protocols.

- Currency Transaction Reporting (CTR): Procedures for reporting cash transactions exceeding $10,000 to FinCEN, in accordance with BSA requirements.

- Record Keeping: Policies for retaining all necessary documents related to customer identification, transactions, and AML compliance for the required regulatory periods.

- Risk Assessment: A documented process for identifying, measuring, monitoring, and controlling the money laundering and terrorist financing risks specific to the institution’s products, services, customers, and geographic locations. This assessment should be updated regularly.

- Sanctions Compliance: Integration of protocols to comply with sanctions programs administered by the Office of Foreign Assets Control (OFAC), including screening customers and transactions against OFAC’s Specially Designated Nationals (SDN) list.

Customization and Continuous Improvement: Making It Your Own

While an Anti Money Laundering Compliance Program Template provides an excellent framework, it is crucial to understand that it is a starting point, not a final solution. Each business operates with unique risk profiles, customer bases, service offerings, and technological capabilities. Therefore, customization is not just recommended; it is essential for the program to be genuinely effective and compliant. Generic policies rarely address specific vulnerabilities, leaving potential gaps that can be exploited by illicit actors.

The process of adapting a blueprint involves a thorough risk assessment tailored to your organization. This assessment should identify the specific money laundering and terrorist financing risks your business faces, considering factors like geographic locations, types of customers, products and services offered, and delivery channels. Based on this, you can then fine-tune policies, adjust due diligence procedures, and develop relevant training materials. Furthermore, the fight against financial crime is ever-evolving. This necessitates a commitment to continuous improvement, regularly reviewing and updating your compliance structure to respond to new threats, regulatory changes, and internal operational shifts.

Establishing a robust anti-money laundering compliance framework is an ongoing journey, not a destination. It requires vigilance, commitment, and a proactive approach to risk management. By leveraging a structured template, organizations can efficiently lay a strong foundation, but the true strength of their defense lies in the diligent customization, consistent implementation, and perpetual refinement of their anti-money laundering program.

Ultimately, investing in a comprehensive and well-adapted compliance program is an investment in your organization’s future. It safeguards against significant financial penalties and reputational damage while fostering a culture of integrity and responsibility. In an era where financial transparency is paramount, a meticulously designed and executed anti-money laundering program isn’t just a regulatory checkbox; it’s a strategic asset that contributes to a safer and more secure financial ecosystem for everyone.