Every ambitious project, whether a groundbreaking tech startup, a community development initiative, or an internal corporate overhaul, hinges on one critical resource: funding. Without a clear understanding of what’s needed and why, securing that essential capital can feel like navigating a maze blindfolded. This is precisely where a robust framework for articulating financial needs becomes not just helpful, but indispensable. It transforms abstract ideas into concrete financial asks, laying the groundwork for successful investor pitches, grant applications, or internal budget allocations.

Creating a compelling case for investment goes beyond simply listing numbers; it requires a strategic narrative that communicates value, manages risk, and builds confidence. A well-structured Project Funding Requirements Template empowers project leaders and teams to articulate their financial needs with precision and clarity. It serves as the definitive document that bridges the gap between your project’s vision and its financial reality, ensuring all stakeholders—from potential investors to internal finance departments—understand the scope, scale, and financial viability of your endeavor.

Why a Solid Funding Requirements Document is Your Project’s Lifeline

In the complex world of project management and financial acquisition, a comprehensive funding requirements document is more than just paperwork; it’s a strategic asset. It acts as the backbone of your financial planning, providing a detailed breakdown of all anticipated costs necessary to bring your project to fruition. This meticulous approach reduces uncertainties, minimizes the risk of budget overruns, and ensures that no critical expense is overlooked in the planning stages.

Beyond internal planning, a carefully prepared financial requirements for projects document is your most powerful advocacy tool. It speaks volumes about your team’s preparedness, professionalism, and understanding of the project’s true scope. When seeking external investment or internal budget approval, presenting a clear, coherent, and justifiable request significantly boosts your credibility and increases the likelihood of securing the necessary capital. It demonstrates due diligence and a commitment to fiscal responsibility, which are qualities highly valued by any funding source.

Key Elements of an Effective Funding Proposal

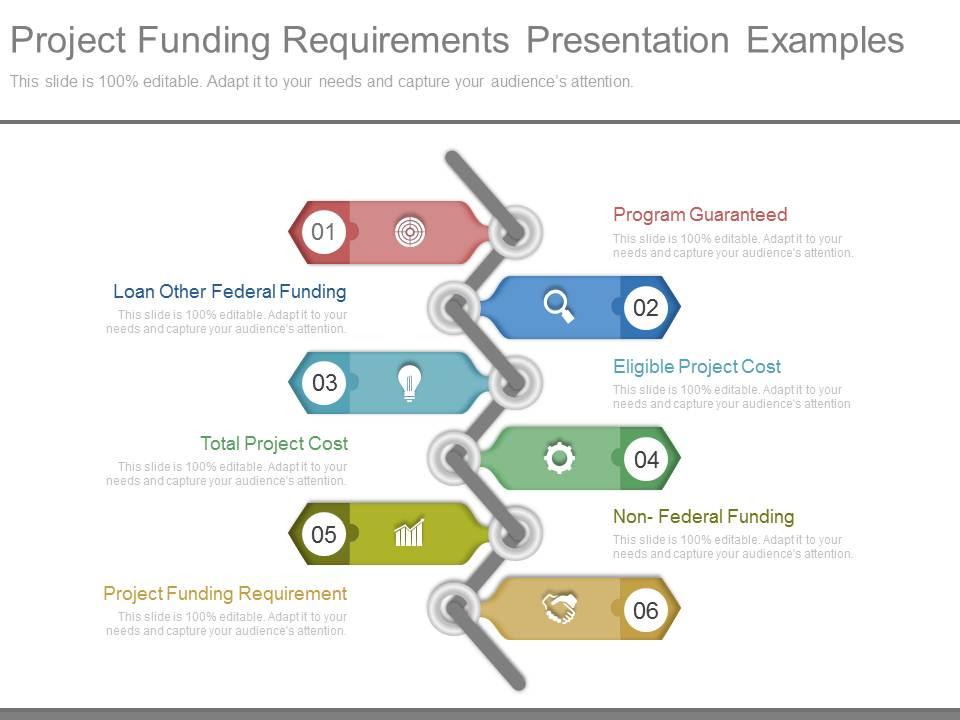

Crafting a document that truly resonates with funders requires more than just listing expenses. It demands a thoughtful presentation of your project’s financial architecture. An effective Project Funding Requirements Template typically integrates several critical components, each designed to answer a specific question a potential funder might have. This holistic view ensures that every aspect of the project’s financial needs is covered, from inception to completion.

Here are the essential elements typically found within a comprehensive project financing needs template:

- Executive Summary: A concise overview of the project, its goals, the total funding requested, and the expected outcomes or ROI. This is often the first, and sometimes only, part a busy decision-maker reads initially.

- Project Description and Scope: Detailed explanation of what the project entails, its objectives, deliverables, and the problem it aims to solve. This sets the stage for why the investment is needed.

- Detailed Budget Breakdown: An itemized list of all anticipated costs, categorized by phase, type (e.g., personnel, equipment, software, marketing), and timeline. This section should be exhaustive and transparent.

- Cost Justification: Explanation for each significant cost item, demonstrating why it’s necessary and how it contributes to the project’s success. This moves beyond simply listing figures to justifying their existence.

- Funding Schedule and Milestones: A timeline indicating when funding will be required and tied to specific project milestones or deliverables. This shows a clear path for funds utilization.

- Expected Outcomes and Benefits: Articulation of the tangible and intangible benefits the project will yield, including financial returns, market impact, social good, or strategic advantage.

- Risk Assessment and Mitigation: Identification of potential financial and operational risks, along with strategies to mitigate them. This demonstrates foresight and preparedness for challenges.

- Exit Strategy or Sustainability Plan: For external funders, outlining how their investment will be repaid or how the project will sustain itself beyond the initial funding period.

How to Leverage Your Funding Request Blueprint for Success

Having a well-documented capital allocation plan is only half the battle; knowing how to strategically deploy it is key to securing funding. Your project budget proposal isn’t just a static document; it’s a dynamic tool for communication, negotiation, and transparency. Utilizing it effectively can significantly strengthen your position when engaging with stakeholders.

When presenting your financial resource planning document, focus on clarity and conviction. Be prepared to walk through each section, explaining the rationale behind your figures and demonstrating your understanding of potential challenges. Use it as a conversation starter, inviting questions and feedback, which can further refine your approach. For internal projects, this document facilitates robust discussions with finance teams, ensuring alignment with organizational financial goals and resource availability. Externally, it serves as the cornerstone of your investment pitch, offering tangible proof of your project’s financial planning rigor.

Customizing Your Template: Best Practices

While a universal Project Funding Requirements Template provides a solid foundation, its true power lies in its adaptability. Every project is unique, and a one-size-fits-all approach rarely yields optimal results. Tailoring your funding requirements document to the specific nuances of your project and the expectations of your target funders is crucial for success. This customization process makes your proposal more relevant, compelling, and ultimately, more likely to secure approval.

Start by clearly defining your project’s objectives and deliverables, as these will dictate the scope of your financial needs. Research your potential funders – whether they are venture capitalists, government grant agencies, or internal department heads – to understand their specific priorities, preferred formats, and evaluation criteria. A grant application, for example, will likely require different language and emphasis than an investment pitch document for private equity. Adjust your budget categories to reflect industry standards or internal accounting practices. Furthermore, highlight elements that directly address the funder’s mission or investment thesis, demonstrating strong alignment. This thoughtful customization shows you’ve done your homework and respect their guidelines, significantly enhancing your chances of success.

Benefits Beyond the Bottom Line

The advantages of meticulously preparing an investment needs document extend far beyond merely securing capital. The process of developing a comprehensive cost projection template inherently leads to a deeper understanding of your project’s intricacies. It forces teams to think critically about every resource required, anticipate potential roadblocks, and plan contingencies, thereby improving overall project planning and execution.

This rigorous financial planning document also fosters greater internal alignment. When all team members contribute to or understand the financial requirements, it creates shared accountability and a common vision for resource utilization. It acts as a reference point throughout the project lifecycle, helping to monitor expenses, track budget adherence, and make informed adjustments as circumstances evolve. Ultimately, a well-crafted funding request blueprint isn’t just about money; it’s about establishing a foundation of clarity, confidence, and control for your entire project.

Frequently Asked Questions

What is the primary purpose of a project funding requirements document?

The primary purpose is to clearly articulate and justify all the financial resources needed to successfully complete a project, making a compelling case to secure the necessary capital from investors, grantors, or internal stakeholders.

Who typically uses a project funding requirements template?

Project managers, entrepreneurs, non-profit organizations, startup founders, and business development teams commonly use such a template to streamline their financial planning and funding acquisition processes.

How often should project funding requirements be updated?

It should be updated whenever there are significant changes to the project scope, timeline, or anticipated costs. Regular reviews (e.g., quarterly or at major project milestones) are also good practice to ensure accuracy and relevance.

Is this template only for external funding requests?

No, while it is excellent for external funding, it is equally valuable for internal projects. It helps departments justify budget requests to senior management or the finance team, ensuring efficient allocation of company resources.

Can a small project benefit from developing a detailed funding requirements document?

Absolutely. Even small projects can encounter unexpected costs or resource needs. A detailed document helps in thorough planning, risk mitigation, and ensures that even minor projects are adequately funded and managed.

Developing a robust plan for your project’s financial future is a foundational step toward achieving its goals. By systematically outlining every projected cost, justifying each expense, and anticipating potential financial hurdles, you not only make a strong case for investment but also instill confidence in your project’s leadership and viability. This proactive approach minimizes financial surprises and paves the way for a smoother execution phase, free from the constant scramble for resources.

Embrace the power of thorough financial planning. Utilize a structured approach to articulate your project’s financial needs, transforming uncertainty into a clear, actionable strategy. A well-crafted and effectively presented funding requirements document is your unwavering advocate, ensuring that your vision is not only heard but also properly resourced, allowing your project to move from concept to impactful reality.