In the complex and often high-stakes world of real estate, the flow of large sums of money can, unfortunately, attract illicit activities. Estate agents, whether they realize it or not, often find themselves on the front lines in the global fight against financial crime. The vast sums involved in property transactions make the sector particularly vulnerable to money laundering, where criminals attempt to legitimize illegally obtained funds by integrating them into the legitimate financial system. Without robust safeguards, real estate businesses can unwittingly become conduits for dirty money, facing severe legal, financial, and reputational repercussions.

This growing threat underscores the critical need for every estate agency to have a comprehensive and actionable anti-money laundering (AML) strategy. A well-crafted Anti Money Laundering Policy Template For Estate Agents serves as the foundational blueprint for this strategy. It’s not just a document; it’s a living guide designed to protect your firm, your clients, and the integrity of the broader financial system. This template provides a structured approach, helping real estate professionals navigate the intricate regulatory landscape, implement essential due diligence, and ultimately, safeguard their business against the insidious reach of financial criminals.

Why an Anti Money Laundering Policy Template For Estate Agents Is Essential Today

The landscape of financial regulation is constantly evolving, with increased scrutiny on sectors historically perceived as less regulated than traditional banking. Real estate is now firmly in the crosshairs of global and domestic anti-money laundering efforts. In the US, while direct federal AML regulations for all real estate brokers and agents are still being solidified, the Bank Secrecy Act (BSA) and advisories from FinCEN (Financial Crimes Enforcement Network) highlight the industry’s vulnerability and the expectation for firms to exercise vigilance. State-level regulations and professional body guidelines also often mandate a level of due diligence that aligns with AML principles.

Beyond explicit legal mandates, the importance of a robust Anti Money Laundering Policy Template For Estate Agents stems from several critical factors. Firstly, it mitigates significant legal and financial risks. Failure to identify and report suspicious activities can lead to hefty fines, criminal charges, and even imprisonment for individuals and businesses alike. Secondly, it protects your firm’s reputation. Being associated with money laundering, even inadvertently, can destroy trust, deter legitimate clients, and cause irreparable damage to your brand.

Furthermore, adopting an Anti Money Laundering Policy Template For Estate Agents demonstrates a commitment to ethical business practices and corporate social responsibility. It signals to clients, partners, and regulators that your firm takes its role seriously in preventing financial crime. In an increasingly interconnected world, where illicit funds move swiftly across borders, estate agents are crucial gatekeepers, and having a clear compliance framework is no longer optional but a fundamental requirement for responsible operation.

Key Benefits of Using an Anti Money Laundering Policy Template For Estate Agents

Implementing a well-structured Anti Money Laundering Policy Template For Estate Agents offers a multitude of advantages that extend far beyond mere regulatory compliance. It transforms a complex, daunting task into a manageable and systematic process, providing clarity and efficiency where there might otherwise be confusion.

One primary benefit is streamlined compliance. The template provides a ready-made framework, ensuring that all necessary components of an effective AML program are considered and documented. This reduces the time and effort required to develop policies from scratch, allowing firms to focus on core business operations while still meeting their legal obligations. It helps establish consistent procedures across all transactions and employees.

Secondly, it leads to enhanced risk management. By clearly outlining procedures for customer due diligence (CDD), transaction monitoring, and suspicious activity reporting, the template empowers staff to identify and mitigate potential money laundering risks proactively. This protection safeguards the firm from financial losses, legal penalties, and reputational damage.

Moreover, an Anti Money Laundering Policy Template For Estate Agents fosters improved operational efficiency and clarity. When employees understand their roles and responsibilities regarding AML, processes become smoother. The clear guidelines minimize ambiguity, reduce errors, and ensure a unified approach to compliance, creating a more professional and accountable workplace environment. It also serves as an excellent training tool, helping to onboard new staff quickly on your firm’s compliance standards.

Finally, having a comprehensive and customized Anti Money Laundering Policy Template For Estate Agents builds trust and credibility with clients and regulatory bodies. It signals a proactive stance against financial crime, differentiating your firm as a responsible and ethical player in the competitive real estate market. This can lead to stronger client relationships and a more robust business standing.

Customizing and Adapting the Anti Money Laundering Policy Template For Estate Agents

While an Anti Money Laundering Policy Template For Estate Agents provides an excellent starting point, it’s crucial to understand that it is not a one-size-fits-all solution. Each estate agency has unique characteristics—its size, geographical reach, the types of properties it handles (residential, commercial, luxury), its client base, and its specific risk profile. Therefore, successful implementation hinges on careful customization and adaptation.

Begin by conducting a thorough risk assessment specific to your business. This involves identifying the particular vulnerabilities your firm faces, considering factors such as the average transaction value, the prevalence of foreign clients, the use of corporate entities, and the jurisdictions involved in property deals. The template should then be tailored to address these identified risks, outlining specific mitigation strategies. For instance, an agency dealing predominantly with high-value international properties will require more stringent enhanced due diligence (EDD) procedures than one focusing on local, lower-value residential sales.

Consider your firm’s existing internal controls and operational structure. The Anti Money Laundering Policy Template For Estate Agents should integrate seamlessly with your current workflows and departmental responsibilities. It might require defining new roles, such as appointing a dedicated compliance officer, or assigning AML responsibilities to existing management or HR personnel. The language used within the policy should also resonate with your company culture and be easily understood by all employees.

Furthermore, state-specific regulations and professional association guidelines must be incorporated. While federal guidance provides a broad framework, individual states or real estate boards may have additional requirements or best practices that your policy needs to reflect. Regularly reviewing and updating the Anti Money Laundering Policy Template For Estate Agents to account for changes in laws, industry standards, and your firm’s own business model is paramount to maintaining its effectiveness and relevance. Think of it as a living document that evolves with your business and the regulatory landscape.

Important Elements to Include in Your Anti Money Laundering Policy Template For Estate Agents

A truly effective Anti Money Laundering Policy Template For Estate Agents must be comprehensive, covering all critical aspects of AML compliance. While specific details will be customized, certain core elements are non-negotiable for a robust framework. Here are the essential components that should be clearly articulated:

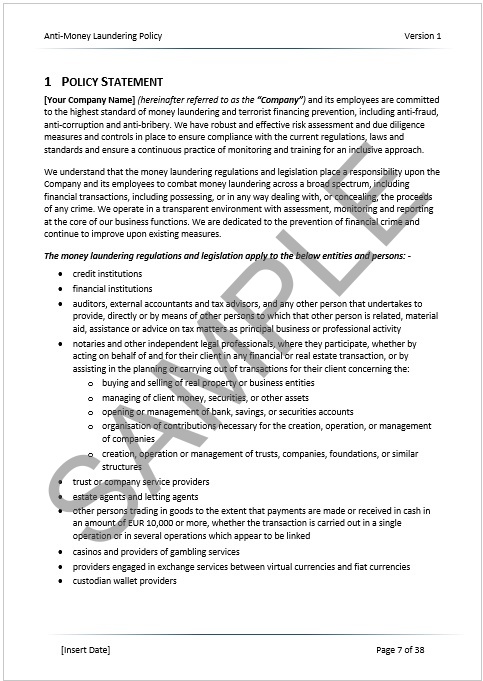

- Policy Statement and Scope: A clear declaration of the firm’s commitment to preventing money laundering and terrorist financing. This section should define the policy’s applicability to all employees, services, and transactions.

- Risk Assessment Methodology: Detail how the firm identifies, assesses, and understands its money laundering and terrorist financing risks. This includes defining risk factors related to customers, geographic locations, products/services, and delivery channels.

- Customer Due Diligence (CDD) / Know Your Customer (KYC) Procedures: Outline the process for verifying the identity of clients (individuals and entities), including beneficial ownership. This should specify required documents, information to be collected, and methods for verification.

- Enhanced Due Diligence (EDD) Triggers: Define the circumstances under which EDD is required, such as dealings with politically exposed persons (PEPs), high-risk jurisdictions, complex ownership structures, or unusually large transactions. Specify the additional information and verification steps needed.

- Transaction Monitoring: Describe the procedures for monitoring transactions for unusual patterns or suspicious activities. This includes setting thresholds, flagging anomalies, and reviewing ongoing client relationships for changes in behavior.

- Reporting Suspicious Activities (SARs): Clearly explain the process for identifying, documenting, and reporting suspicious transactions or activities to FinCEN (or other relevant authorities) through a Suspicious Activity Report (SAR). This must emphasize the prohibition against "tipping off" clients.

- Record-Keeping Requirements: Detail what records must be kept, for how long, and how they should be stored (e.g., client identification, transaction records, internal reports, training logs). Compliance with data security and privacy regulations is also crucial here.

- Employee Training and Awareness: Specify the frequency and content of AML training for all relevant employees, ensuring they understand their responsibilities, how to identify red flags, and the internal reporting process. New hires should receive immediate training.

- Appointment of a Compliance Officer: Designate a specific individual or team responsible for overseeing the firm’s AML program, including policy implementation, training, monitoring, and reporting. This person should have sufficient authority and resources.

- Internal Controls and Auditing: Describe the internal checks and balances designed to ensure compliance, including independent audits or reviews of the AML program’s effectiveness at regular intervals.

- Consequences of Non-Compliance: Clearly state the internal disciplinary actions for employees who fail to adhere to the Anti Money Laundering Policy Template For Estate Agents, in addition to outlining the external legal and regulatory penalties.

- Policy Review and Updates: Establish a schedule for regular review and revision of the Anti Money Laundering Policy Template For Estate Agents to ensure it remains current with regulatory changes, industry best practices, and the firm’s evolving business model.

Tips on Design, Usability, and Implementation of Your Anti Money Laundering Policy Template For Estate Agents

Beyond the comprehensive content, the effectiveness of your Anti Money Laundering Policy Template For Estate Agents also heavily relies on its design, usability, and how it is implemented within your organization. A policy that is difficult to understand or access will quickly become ignored, rendering it useless in practice.

Clarity and Simplicity: Design the document with clarity as a paramount goal. Use plain language, avoiding excessive legal jargon where possible. Employ headings, subheadings, bullet points, and numbered lists to break up dense text and make information easily digestible. A clear table of contents at the beginning is also invaluable for quick navigation. The goal is to make it easy for any employee, from a junior agent to a senior broker, to find the information they need quickly.

Accessibility and Format: Consider both digital and print formats. A digital version, ideally a searchable PDF or an internal webpage, ensures easy access and allows for quick updates and version control. Ensure it’s stored on an easily accessible internal network drive or compliance portal. For reference, some firms may also opt for printed copies, perhaps in a binder, particularly for certain roles or when conducting physical training. Whatever the format, ensure it’s legible and professional.

Integration with Workflow: The Anti Money Laundering Policy Template For Estate Agents shouldn’t be a standalone, rarely-touched document. Integrate its principles and procedures directly into your daily operational workflow. This might involve creating checklists for client onboarding that reference the policy, building automated reminders for due diligence reviews, or embedding key policy points into your client relationship management (CRM) software.

Training and Communication: A beautifully designed policy is only effective if employees know it exists and understand its content. Roll out the customized policy with comprehensive training sessions for all relevant staff. These sessions should be interactive, using real-world scenarios relevant to estate agents, and offer opportunities for questions and clarification. Reinforce key messages through internal communications, regular refreshers, and accessible FAQs. Ensure all staff acknowledge they have read and understood the policy.

Version Control and Updates: Establish a clear system for version control. Every time the Anti Money Laundering Policy Template For Estate Agents is updated, ensure the old version is archived, and the new version is clearly marked with a date and version number. Communicate changes effectively to all staff, highlighting what has been altered and why. This meticulous approach ensures everyone is working from the most current and compliant guidelines.

Embracing an Anti Money Laundering Policy Template For Estate Agents is more than just fulfilling a regulatory obligation; it’s a strategic investment in the future and integrity of your real estate business. In an era where financial transparency is increasingly demanded, and the real estate sector is under heightened scrutiny, proactive compliance is not just good practice—it’s essential for survival and prosperity.

By adopting, customizing, and rigorously implementing a comprehensive Anti Money Laundering Policy Template For Estate Agents, your firm demonstrates a clear commitment to ethical operations and the global fight against financial crime. This dedication safeguards your business from devastating penalties and reputational damage, while also fostering a culture of integrity that attracts and retains legitimate clients. Take the proactive step today to secure your firm’s standing and contribute to a cleaner, more trustworthy financial ecosystem in real estate.