A corporate credit Card agreement is a legally binding contract between an employer and an employee outlining the terms and conditions governing the use of a company-issued credit card. This document serves as a crucial tool for establishing clear expectations, mitigating financial risks, and ensuring compliance with company policies.

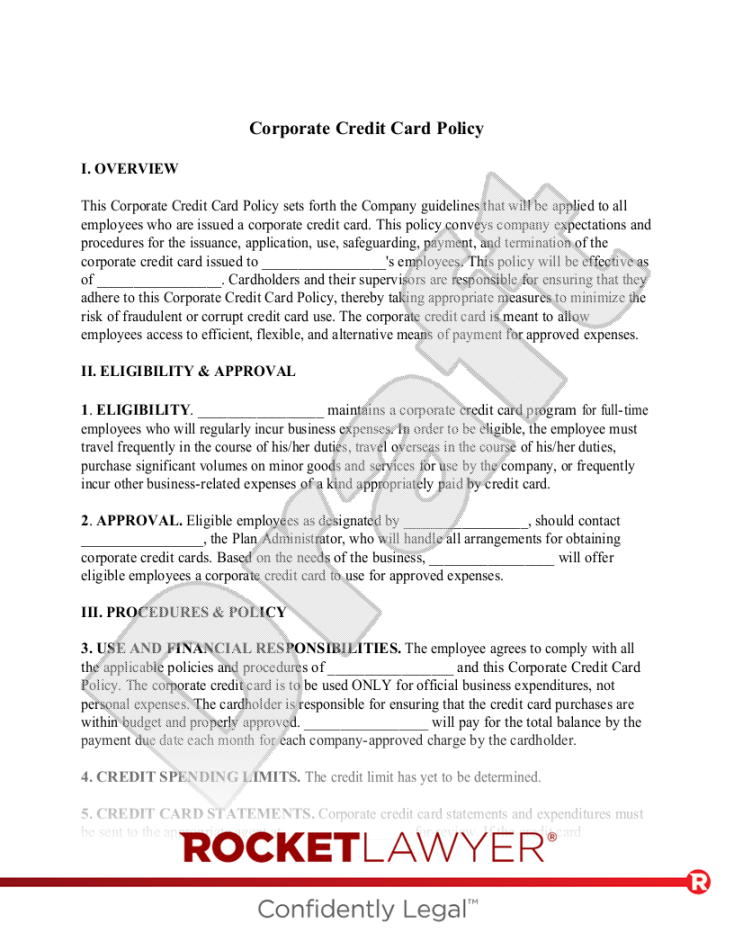

A comprehensive corporate credit card agreement typically encompasses several key elements. Firstly, it explicitly defines the cardholder’s authorized use of the card, strictly limiting it to business-related expenses. Any deviation from this stipulation constitutes a breach of contract. Secondly, the agreement outlines the employee’s responsibility for maintaining accurate records of all transactions, including receipts and supporting documentation. This provision is essential for expense Reporting, auditing, and fraud prevention.

Furthermore, the agreement should clearly delineate the employer’s liability for unauthorized charges. This includes instances of lost, stolen, or fraudulently used cards. To safeguard the company’s interests, the agreement may require employees to report any suspicious activity promptly. Additionally, the document should specify the procedures for card cancellation, replacement, and dispute resolution.

Another critical aspect of a corporate credit card agreement is the establishment of spending limits. These limits are crucial for controlling costs and preventing excessive expenditures. The agreement may also outline specific categories of expenses that are either prohibited or require prior approval.

To ensure compliance and accountability, the agreement should address the frequency of expense reports, the required level of detail, and the consequences of non-compliance. Moreover, it may include provisions regarding the termination of employment and the subsequent return of the corporate credit card.

In conclusion, a well-crafted corporate credit card agreement is indispensable for maintaining financial control, preventing misuse, and protecting the interests of both the employer and the employee. By clearly outlining the terms and conditions, the agreement fosters transparency and accountability, ultimately contributing to the overall financial health of the organization.

FAQs

What is the purpose of a corporate credit card agreement?

A corporate credit card agreement serves to establish clear guidelines for the use of company-issued credit cards, protect the employer from financial liabilities, and ensure compliance with company policies.

Who are the parties involved in a corporate credit card agreement?

The primary parties to a corporate credit card agreement are the employer (the card issuer) and the employee (the cardholder).

What information should be included in a corporate credit card agreement?

A corporate credit card agreement should typically include details about authorized card usage, expense reporting requirements, liability for unauthorized charges, spending limits, dispute resolution procedures, and termination provisions.

Can a corporate credit card agreement be modified?

Yes, a corporate credit card agreement can be modified. However, any changes should be made in writing and signed by both the employer and the employee.

What happens if an employee violates the terms of a corporate credit card agreement?

Consequences for violating a corporate credit card agreement can vary depending on the severity of the violation and the company’s policies. Possible actions may include disciplinary measures, financial penalties, or termination of employment.