Navigating the world of insurance can sometimes feel like a labyrinth, and while obtaining coverage is often straightforward, the process of cancellation can introduce unexpected complexities. Whether you’re switching providers, selling an insured asset, or simply no longer require a specific type of coverage, ensuring a smooth and legally sound policy termination is paramount. This is precisely where a well-crafted Cancellation Of Insurance Policy Template becomes an invaluable asset, transforming a potentially confusing procedure into a clear, professional, and compliant action.

For individuals and businesses alike, having a standardized approach to ending an insurance agreement isn’t just about formality; it’s about protecting your financial interests and preventing future disputes. A robust Cancellation Of Insurance Policy Template provides the framework necessary to communicate your intentions clearly, document the cessation of coverage accurately, and facilitate any necessary refund processes without unnecessary delays or misunderstandings. It’s a critical tool for maintaining order and peace of mind in your personal and commercial financial management.

Why a Cancellation Of Insurance Policy Template is Essential

In today’s fast-paced environment, the need for clear and legally sound documentation cannot be overstated, especially when it comes to financial commitments like insurance policies. A Cancellation Of Insurance Policy Template serves as a critical safeguard, ensuring that all parties understand the terms under which coverage is being terminated. This is essential for maintaining regulatory compliance across various insurance types, from auto and home policies to complex commercial liability and health insurance plans.

Without a standardized process, policyholders risk leaving themselves vulnerable to continued premium charges, unresolved claims, or even legal complications arising from ambiguous termination dates. A comprehensive Cancellation Of Insurance Policy Template helps mitigate these risks by providing a definitive record of the intent to cancel, the effective date of cancellation, and any specific terms or conditions that apply. It acts as a shield against potential disputes and misunderstandings with insurers, ensuring that your legal obligations are met and your rights are protected.

Furthermore, proper documentation is vital for accurate financial record-keeping and tax purposes, especially for businesses. An official Cancellation Of Insurance Policy Template ensures that your accounts reflect the true status of your coverage, preventing discrepancies that could arise during audits or financial reviews. It streamlines the administrative burden associated with policy changes, allowing you to focus on other critical aspects of your personal or business operations.

Key Benefits of Using a Cancellation Of Insurance Policy Template

The advantages of employing a dedicated Cancellation Of Insurance Policy Template extend far beyond mere administrative convenience. One of the primary benefits is the standardization it brings to an otherwise fragmented process. By using a consistent format, you ensure that all necessary information is captured every time, reducing the chance of oversight or forgotten details that could complicate the cancellation.

Such a template also offers significant legal protection. A well-structured Cancellation Of Insurance Policy Template provides clear, documented proof of your request to terminate coverage, which can be invaluable in the event of a dispute over premiums, claims, or the effective date of cancellation. It clearly outlines the policyholder’s intent and the details of the policy being cancelled, forming a strong part of your contractual agreements.

Moreover, a standardized template drastically improves administrative efficiency. Instead of drafting a new letter for each cancellation, individuals and businesses can simply fill in the specific details, saving valuable time and resources. This efficiency is particularly beneficial for HR departments or operations managers who frequently manage multiple insurance policies for employees or various company assets.

Finally, using a professional Cancellation Of Insurance Policy Template projects an image of diligence and competence. It demonstrates that you approach your financial and contractual obligations seriously, fostering better communication and a more respectful relationship with your insurance provider. It also helps in preventing future claims or liabilities from policies you no longer intend to hold.

Customizing Your Cancellation Of Insurance Policy Template

While a Cancellation Of Insurance Policy Template provides a solid foundation, its true power lies in its adaptability. Not all insurance policies are created equal, and neither are the reasons for their cancellation. Therefore, the ability to customize the template to fit specific scenarios is crucial for its effectiveness.

For instance, canceling an auto insurance policy might require different information or specific state-mandated disclosures compared to terminating a life insurance policy, which could involve discussions about cash value or surrender charges. A homeowner’s policy cancellation, perhaps due to the sale of a property, will also have unique elements related to the property’s transfer of ownership. A flexible Cancellation Of Insurance Policy Template should allow for these variations.

Businesses, too, will find immense value in tailoring their template for different types of commercial coverage. Canceling a general liability policy might involve different legal considerations than ending a workers’ compensation policy, which often has strict regulatory requirements. The template can be adapted to include specific clauses relevant to the nature of the business or the type of commercial insurance.

Customization can involve adding fields for specific policy riders, detailing reasons for cancellation (e.g., policy replacement, asset sold, financial changes), or incorporating any insurer-specific requirements for policy changes. The goal is to ensure the Cancellation Of Insurance Policy Template remains relevant and comprehensive, no matter the underlying insurance agreement or the particular circumstances driving the termination request.

Important Elements of a Cancellation Of Insurance Policy Template

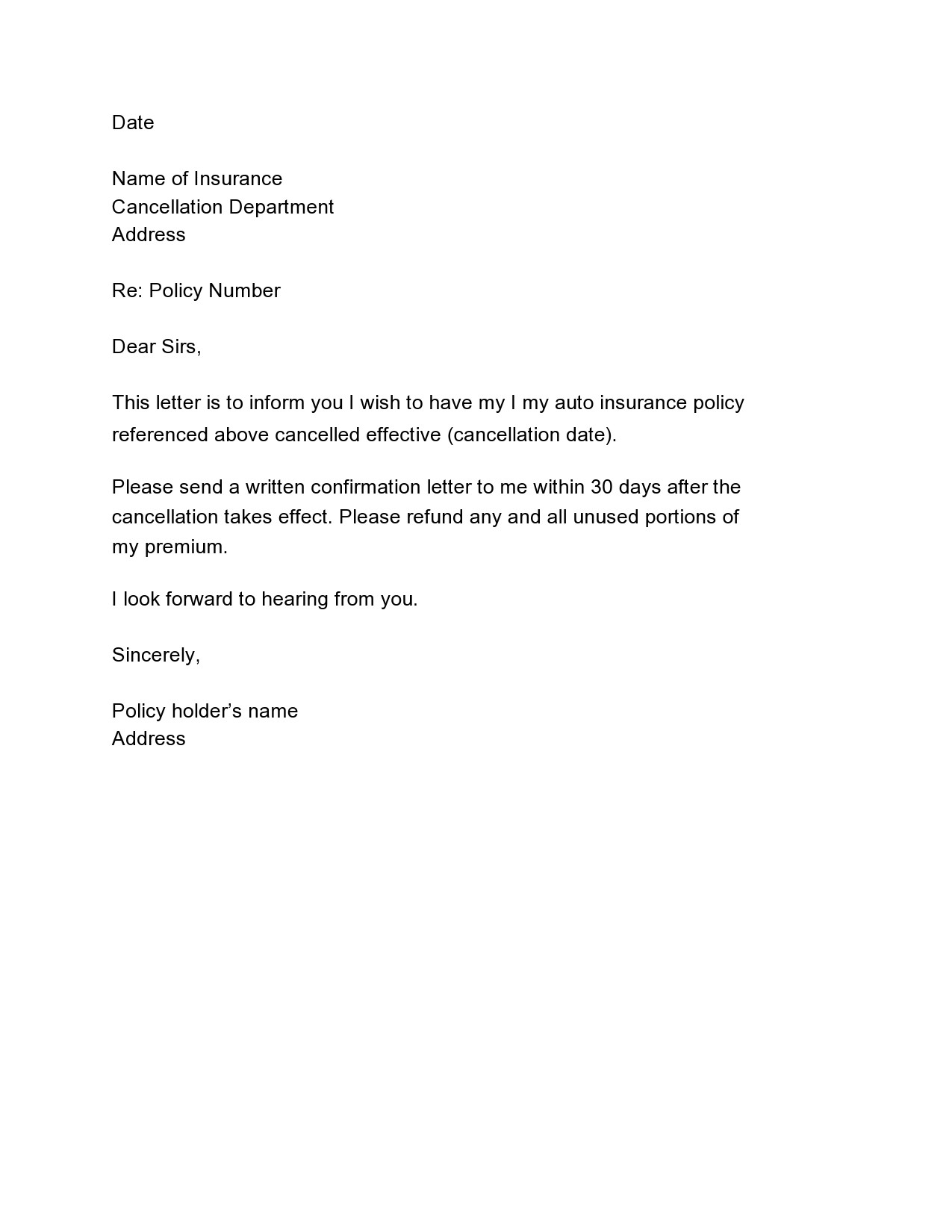

To be truly effective and legally sound, a Cancellation Of Insurance Policy Template must include several key pieces of information. These elements ensure clarity, facilitate processing, and provide a comprehensive record for all parties involved. A template lacking these details can lead to delays or, worse, unintended continued coverage and premium charges.

Here are the critical elements that should be included:

- Policyholder Information: Full legal name, current address, contact phone number, and email address of the individual or entity requesting the cancellation.

- Insurer Information: Complete name and address of the insurance company, along with the department or agent’s name if applicable.

- Policy Details: The exact policy number, type of insurance (e.g., Auto, Home, Life, General Liability), and the period of coverage.

- Effective Date of Cancellation: A clear, unambiguous date on which the policyholder wishes the coverage to cease. This is a critical field for legal and financial implications.

- Reason for Cancellation: A brief but clear explanation (e.g., "Sold insured vehicle," "Switching to a new provider," "No longer require coverage," "Policy replaced").

- Request for Refund: A clear statement requesting any unearned premium refund, along with instructions on how it should be processed (e.g., mailed check, direct deposit).

- Acknowledgment of Coverage Cessation: A statement confirming understanding that coverage will cease on the effective date and that the policyholder will be responsible for any incidents thereafter.

- Signature and Date: The policyholder’s legal signature and the date the cancellation request is being submitted.

- Contact Information for Follow-up: Any additional preferred contact methods for the insurer to use if clarification is needed.

- State-Specific Disclosures: Any clauses or information required by state insurance regulations, especially for certain types of policies.

Including these elements in your Cancellation Of Insurance Policy Template ensures that your cancellation request is professional, comprehensive, and legally robust, leaving no room for ambiguity.

Tips for Design, Usability, and Implementation

The effectiveness of a Cancellation Of Insurance Policy Template isn’t solely dependent on its content; its design, usability, and how it’s implemented also play a significant role. A well-designed template enhances readability, reduces errors, and ensures a smoother process for both the policyholder and the insurer.

Clarity and Conciseness: The template should be designed with a clean, uncluttered layout. Use clear headings and simple language, avoiding jargon where possible. Paragraphs should be short and to the point, making the document easy to scan and understand. This is crucial for ensuring that insurance termination letter is taken seriously and processed quickly.

Fillable Fields: For digital implementation, utilize fillable PDF forms or editable document formats. This allows users to easily input their specific information without altering the template’s structure. Clearly label each field so there’s no confusion about what information is required.

Instructions and Guidance: Include brief, clear instructions on how to complete the Cancellation Of Insurance Policy Template, where to send it, and what, if any, supporting documentation might be needed. This guidance reduces user error and streamlines the submission process, aiding in overall policy management.

Print and Digital Accessibility: Ensure the Cancellation Of Insurance Policy Template is optimized for both print and digital use. For print, use appropriate margins and font sizes. For digital, ensure it’s accessible across different devices and operating systems. Consider offering it in multiple formats (e.g., PDF, Word document).

Version Control: If you are a business or an agency managing multiple policies, implement a version control system for your Cancellation Of Insurance Policy Template. This ensures that you are always using the most current and compliant version, especially as regulations or internal processes evolve. Regular reviews of the template for accuracy and relevance are also advised.

Branding (for businesses): If used by a company, incorporate your organizational branding, such as a logo and consistent font styles. This adds a layer of professionalism and reinforces the credibility of the document.

By paying attention to these design and implementation tips, you can transform a simple document into a highly effective tool for managing policy changes and ensuring proper documentation for all your insurance agreements.

In an era where personal and business finances are increasingly complex, the importance of meticulous documentation cannot be overstated. A thoughtfully developed and consistently utilized Cancellation Of Insurance Policy Template stands out as an indispensable tool, offering clarity, legal protection, and administrative ease. It transforms what could be a source of confusion and potential financial liability into a streamlined, confident process, ensuring that your intent to cease coverage is unambiguously understood and acted upon.

Embracing a standardized Cancellation Of Insurance Policy Template isn’t merely about ticking a box; it’s about smart financial management and proactive risk mitigation. By simplifying the process of policy termination, you gain peace of mind, knowing that your insurance coverage aligns precisely with your current needs and that your financial records are accurate and robust. Consider integrating a comprehensive Cancellation Of Insurance Policy Template into your personal or business operational toolkit—it’s a small effort for a significant return in security and efficiency.