Managing the finances of a church, a vital part of its mission, often involves navigating a complex landscape of donations, expenses, and operational needs. In today’s digital age, credit cards have become an indispensable tool for many organizations, offering convenience for purchases, travel, and various ministry-related expenditures. However, without clear guidelines, this convenience can quickly turn into a source of confusion, potential misuse, or even financial vulnerability. This is precisely where a robust Church Credit Card Policy Template becomes not just helpful, but absolutely essential for any faith-based organization.

A well-crafted Church Credit Card Policy Template serves as a crucial roadmap for anyone authorized to use the church’s credit cards. It provides clarity, sets expectations, and establishes vital internal controls that protect the church’s assets and uphold its commitment to financial stewardship. Whether you’re a pastor, a treasurer, a board member, or an administrative assistant, understanding the parameters of credit card usage is paramount. This template is designed to bring peace of mind, ensuring that every transaction aligns with the church’s values and operational standards, benefiting everyone involved by fostering an environment of transparency and accountability.

Why a Church Credit Card Policy Template is Essential

In an era where financial transparency and accountability are more critical than ever, a Church Credit Card Policy Template stands as a cornerstone of good governance. Churches, like any nonprofit, are entrusted with public funds, and demonstrating responsible financial management is paramount to maintaining donor trust and fulfilling their mission effectively. Without a clear policy, the potential for misunderstandings, unauthorized spending, or even allegations of fraud increases significantly. This document acts as a proactive measure against such risks.

Beyond just preventing misuse, a comprehensive policy helps ensure compliance with various regulatory and legal terms that govern nonprofit organizations. It provides a framework for internal controls, safeguarding the church’s financial integrity and protecting individual staff members from undue scrutiny. By clearly outlining acceptable practices, spending limits, and reporting requirements, the Church Credit Card Policy Template minimizes ambiguity and fosters a culture of diligent financial stewardship. It’s not about distrust; it’s about establishing clear workplace rules that support everyone’s best intentions and protect the organization’s reputation and resources.

Key Benefits of Using a Church Credit Card Policy Template

Implementing a standardized Church Credit Card Policy Template offers a myriad of advantages that extend far beyond simple expense management. Firstly, it provides unparalleled clarity for all cardholders, ensuring everyone understands their obligations and the boundaries of their spending authority. This reduces friction and guesswork, leading to more efficient operations.

Secondly, it significantly enhances financial accountability. By detailing approval processes, receipt requirements, and reconciliation procedures, the template ensures that every expenditure is properly documented and justified. This level of detail is invaluable for budget management and makes audit processes much smoother, as all necessary information is readily available.

Thirdly, a strong policy acts as a powerful deterrent against fraud and unauthorized spending. By establishing strict guidelines and consequences for violations, it protects the church’s assets from misuse. Furthermore, it safeguards the reputation of the church by demonstrating a commitment to ethical financial practices and robust governance. Ultimately, it builds trust among congregants and stakeholders, reinforcing confidence in the church’s ability to manage its resources wisely.

Customizing Your Church Credit Card Policy Template

While the core principles of financial stewardship remain universal, every church is unique in its size, structure, and operational needs. This is why a Church Credit Card Policy Template is designed to be highly adaptable, not a rigid, one-size-fits-all solution. The strength of a template lies in its ability to provide a solid foundation that can be tailored to fit your specific context.

For smaller churches with fewer staff members and a simpler administrative structure, the policy might be more concise, perhaps focusing on primary users and a straightforward approval process involving the pastor and treasurer. Larger organizations, with multiple departments and various ministry initiatives, will likely require a more detailed document, specifying different spending tiers, multiple levels of approval, and perhaps even specific data security protocols for online purchases. Consider your church’s existing financial policies, the experience level of your cardholders, and your typical expense types. By customizing the Church Credit Card Policy Template, you ensure it is practical, enforceable, and truly reflective of your church’s unique operational rhythm and governance structure.

Important Elements for Your Church Credit Card Policy Template

A truly effective Church Credit Card Policy Template must be comprehensive, addressing all critical aspects of credit card usage within the organization. Here are the essential elements and fields that should be included to ensure clarity, compliance, and control:

- Purpose and Scope: Clearly state why the policy exists (e.g., to ensure financial stewardship, prevent fraud) and to whom it applies (e.g., all authorized staff, board members).

- Authorized Cardholders: List who is eligible to possess and use a church credit card, along with their roles and responsibilities.

- Card Issuance and Management: Detail the process for requesting, issuing, and cancelling cards, including who holds the primary account.

- Spending Limits: Specify individual transaction limits, monthly spending caps, and perhaps category-specific limits (e.g., travel, supplies).

- Approved and Prohibited Uses: Clearly define what expenses are appropriate for church credit cards (e.g., ministry supplies, travel, utilities) and what are strictly forbidden (e.g., personal use, cash advances, gifts to employees).

- Pre-Approval Requirements: Outline when and how expenditures require prior authorization, including the approval authority for different spending tiers.

- Receipt and Documentation Requirements: Mandate the submission of detailed receipts for every transaction, explaining what information must be included (vendor, date, amount, purpose).

- Expense Reporting and Reconciliation: Describe the process and timeline for submitting expense reports, reconciling statements, and resolving discrepancies.

- Lost or Stolen Card Procedures: Provide clear instructions on what cardholders must do immediately if a card is lost, stolen, or suspected of unauthorized use, including contact information for the bank and church leadership.

- Data Security and Privacy: Outline guidelines for protecting card information, especially when making online purchases, to prevent data breaches.

- Consequences of Non-Compliance: Clearly state the disciplinary actions for violating the policy, ranging from card suspension to termination of employment, depending on the severity.

- Review and Updates: Include a clause for regular review of the policy (e.g., annually) to ensure it remains current and effective.

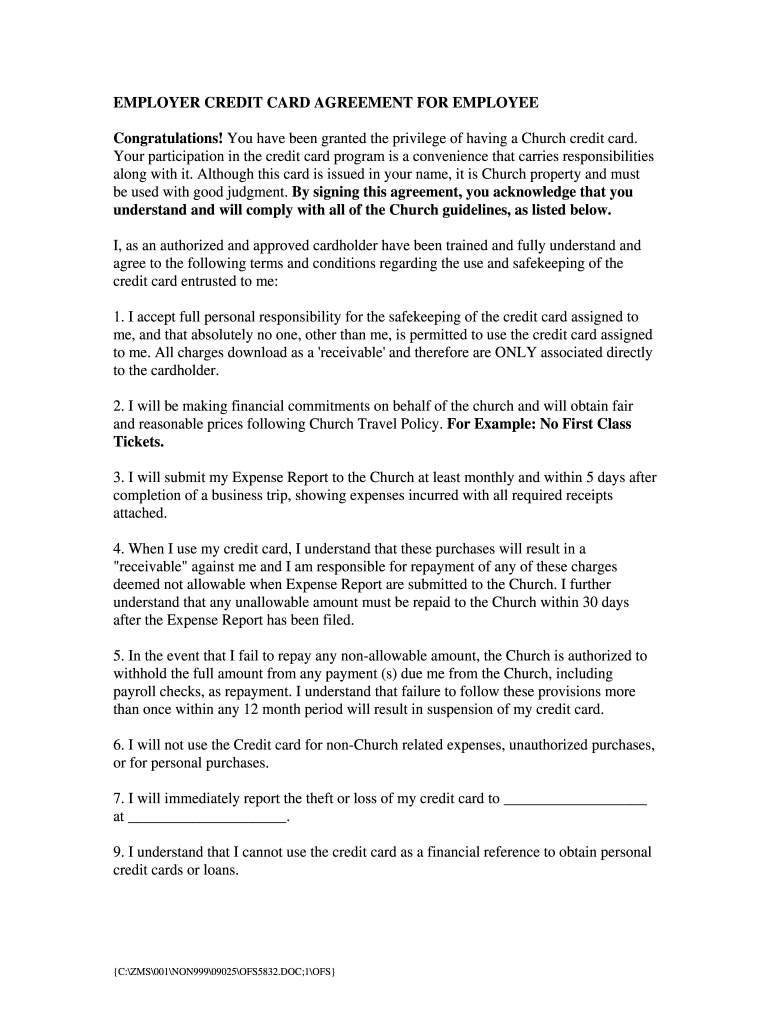

- Acknowledgement of Policy: A section for cardholders to sign, confirming they have read, understood, and agreed to abide by the Church Credit Card Policy Template.

Tips for Design, Usability, and Implementation

Creating a robust Church Credit Card Policy Template is only half the battle; ensuring it’s easily understood, accessible, and actively used is equally vital. When designing and implementing your policy, focus on clarity and user-friendliness.

For usability, consider the language used. Avoid overly technical jargon; aim for plain, concise English that anyone can comprehend. Use clear headings and subheadings to break up text, and bullet points or numbered lists (as demonstrated above) to highlight key rules and procedures. A well-organized document will be far more likely to be read and followed.

In terms of implementation, think about both print and digital accessibility. While a physical copy might be distributed during an orientation or a board meeting for signatures, a digital version should be readily available. Store it on a shared drive, the church’s internal intranet, or a cloud service that all authorized users can access easily. Consider creating a brief training session or a simple FAQ document to accompany the Church Credit Card Policy Template, addressing common questions and scenarios. Regular communication about the policy and its importance, perhaps through staff meetings or newsletters, can reinforce its value and ensure consistent adherence to these crucial workplace rules. Periodically remind staff about the importance of financial controls and best practices.

Implementing a new policy also requires the endorsement of leadership. Ensure the pastor, church board, and finance committee fully understand and support the Church Credit Card Policy Template. Their commitment will set the tone for the entire organization, emphasizing the importance of these guidelines for overall financial health and governance.

Embracing a well-defined Church Credit Card Policy Template is more than just a regulatory formality; it’s a strategic move towards stronger financial stewardship and greater peace of mind. It transforms potential pitfalls into opportunities for clarity, accountability, and streamlined operations. By investing the time to customize and effectively implement such a policy, your church reinforces its commitment to ethical practices and secures its financial future.

Ultimately, a robust Church Credit Card Policy Template empowers your staff while protecting the organization’s valuable resources. It’s a testament to good governance, a safeguard against potential issues, and a clear statement that your church takes its financial responsibilities seriously. Make this template a cornerstone of your church’s administrative toolkit, fostering an environment where every dollar spent aligns with your sacred mission and vision.