In the fast-paced world of modern business, managing shared resources efficiently and securely is paramount. Among these resources, company credit cards often present a unique challenge, balancing the need for quick access to funds with the imperative for stringent financial oversight. This is precisely where a robust credit card sign out sheet template emerges as an indispensable tool, offering a simple yet profoundly effective solution for accountability and control.

For businesses, non-profits, educational institutions, or any organization where multiple individuals might need temporary access to corporate credit cards, the question isn’t if a system is needed, but which system provides the best blend of ease-of-use and reliability. A well-designed credit card sign out sheet template acts as a crucial link in your financial control chain, providing a clear record of who has used which card, for what purpose, and when. It’s a proactive step towards mitigating risk, ensuring transparency, and fostering a culture of financial responsibility within your team.

Why a Credit Card Sign Out Sheet Template is Essential in Today’s Business Environment

The landscape of corporate finance is constantly evolving, with increasing scrutiny on internal controls and data security. In this environment, a credit card sign out sheet template isn’t merely a bureaucratic formality; it’s a vital component of a healthy financial ecosystem. The absence of a clear tracking mechanism for shared corporate cards can open the door to numerous issues, from simple misplacement to more serious concerns like unauthorized spending or even fraud.

Implementing a standardized sign-out process provides an immediate audit trail, which is invaluable for both internal reviews and external audits. It helps finance teams quickly identify who was responsible for a specific transaction, streamlining the reconciliation process significantly. Moreover, the very existence of a clear policy and a credit card sign out sheet template acts as a deterrent against misuse, reinforcing the company’s commitment to responsible spending and robust financial accountability. This proactive approach strengthens your risk management framework and safeguards organizational assets.

The Key Benefits of Implementing a Credit Card Sign Out Sheet Template

The advantages of adopting a structured approach to managing corporate credit cards extend far beyond basic tracking. A comprehensive credit card sign out sheet template delivers a range of tangible benefits that contribute to operational efficiency and financial security.

- Enhanced Accountability: By requiring a clear sign-out and sign-in process, every transaction becomes traceable to an individual. This fosters a sense of personal responsibility, as employees know their usage is recorded.

- Improved Expense Tracking and Reconciliation: Finance departments can quickly match transactions to the responsible party and purpose, significantly reducing the time and effort spent on monthly expense reporting and reconciliation. This helps in maintaining accurate financial records.

- Fraud Prevention and Misuse Deterrence: The documented process acts as a powerful deterrent. Individuals are less likely to use a company card for personal or unauthorized expenses when they know there’s a clear record of their usage. It also helps in quickly identifying suspicious activity.

- Streamlined Audits: When auditors need to examine spending patterns or specific transactions, a well-maintained credit card sign out sheet template provides immediate access to critical data. This makes internal and external audits smoother and more efficient, ensuring compliance with corporate financial policy.

- Better Budget Control: By centralizing card usage data, organizations gain deeper insights into spending habits across departments or projects. This information is crucial for informed budget management and forecasting.

- Policy Enforcement: A clear sign-out procedure reinforces the corporate credit card policy, ensuring that all employees understand and adhere to the rules governing card usage, authorization, and receipt submission.

Customizing Your Credit Card Sign Out Sheet Template for Different Needs

No two organizations are exactly alike, and a truly effective credit card sign out sheet template should be flexible enough to adapt to diverse operational structures and specific requirements. The beauty of a template lies in its adaptability, allowing you to tailor it to perfectly fit your company’s unique workflow and internal controls.

Consider the scale of your operations: a small startup with one shared card will have different needs than a large corporation with multiple department-specific cards. You might need to add fields for project codes, client billing information, or specific budgetary allocations depending on your business model. For instance, a marketing department might need a field for campaign IDs, while a travel department might need to track trip dates and destinations.

The choice between a physical print-and-fill template and a digital solution is another customization point. While a physical credit card sign out sheet template is simple and straightforward, a digital version can offer enhanced searchability, automated notifications, and easier integration with existing expense management software. Many organizations opt for a hybrid approach, using a physical sheet for immediate sign-outs and then transferring the data to a digital system for long-term record keeping and analysis, further bolstering data security.

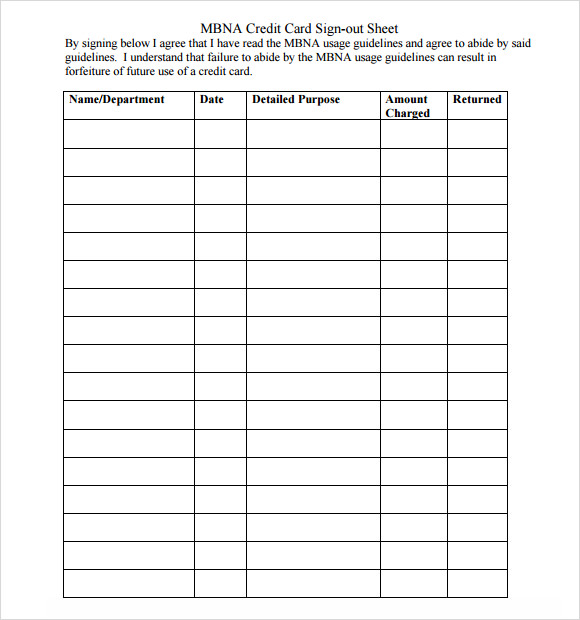

Important Elements to Include in Your Credit Card Sign Out Sheet Template

To be truly effective, a credit card sign out sheet template needs to capture all critical information without being overly cumbersome. The goal is to strike a balance between comprehensive record-keeping and user-friendliness. Here are the essential elements that should be considered for inclusion:

- Card Identification:

- Card Number (Last 4 digits for security and identification)

- Card Type (e.g., Visa, MasterCard, Amex)

- Card Holder Name (if applicable, for individually assigned cards)

- User Information (Sign-Out):

- Employee Name (Full Name)

- Employee Department/Team

- Employee Signature

- Date and Time of Sign-Out

- Purpose of Use:

- Reason for Card Usage (e.g., Office Supplies, Client Dinner, Project X Materials)

- Specific Project Code or Account Number (if relevant for internal billing or tracking)

- Estimated Spend Amount

- Authorization:

- Approver’s Name (if pre-approval is required)

- Approver’s Signature (for verification of authorized use)

- Return Information (Sign-In):

- Date and Time of Sign-In (when the card is returned)

- Actual Spend Amount (for reconciliation purposes)

- Confirmation of Receipts Attached/Submitted (Yes/No checkbox)

- Any Notes or Comments (e.g., "Transaction declined once," "Unexpected extra purchase")

- Employee Signature (confirming return)

- Reviewer’s Signature (confirming receipt of card and documentation)

Design, Usability, and Implementation Tips for Your Credit Card Sign Out Sheet Template

A credit card sign out sheet template is only as good as its usability. A poorly designed or implemented sheet can lead to incomplete records, employee frustration, and ultimately, a breakdown in financial controls. Prioritizing clear design, ease of use, and thoughtful implementation is key to its success.

Design for Clarity and Simplicity

When designing your credit card sign out sheet template, aim for a clean, uncluttered layout. Use clear headings and sufficient white space to make it easy to read and understand. Group related fields together logically (e.g., all sign-out information in one section, all return information in another). Ensure the font is legible and the fields are large enough for comfortable writing, especially for a printed template.

Ensure Usability for All Stakeholders

The template should be intuitive for anyone who needs to use it, from the finance department to the employee making a purchase. Provide brief, clear instructions at the top of the sheet. For digital versions, utilize dropdown menus for common categories (like department or purpose) to reduce errors and standardize input. Test the template with a few employees before full rollout to gather feedback and make necessary adjustments.

Strategic Implementation: Print and Digital

For a **physical credit card sign out sheet template**:

* **Location:** Keep the sheet and the cards in a secure, accessible location (e.g., locked drawer, cabinet).

* **Supplies:** Ensure a dedicated pen is always available. Consider laminating the template if it’s a frequently used master copy that gets photocopied, or using carbon-copy forms for instant duplicates.

* **Training:** Briefly train all employees on the proper procedure for signing cards out and in.

* **Storage:** Establish a clear system for archiving completed sheets for future reference and audit readiness.

For a digital credit card sign out sheet template (e.g., Google Forms, Excel, dedicated software):

- Accessibility: Ensure the digital form is easily accessible to all authorized users, perhaps via a shared drive link or internal portal.

- Automation: Explore features like automatic date/time stamping, required fields to prevent incomplete entries, and email notifications to approvers or finance teams.

- Integration: If possible, integrate the digital template with your existing expense reporting software or accounting system to streamline data flow and reconciliation.

- Security: Ensure the digital platform used adheres to appropriate data security standards to protect sensitive financial information.

Embracing a well-structured credit card sign out sheet template is more than just good practice; it’s a strategic investment in the financial health and integrity of your organization. By providing a clear, traceable record of every corporate card transaction, you foster an environment of trust and accountability, significantly reducing the potential for errors, misuse, and even fraud.

This simple yet powerful tool empowers your finance team with the data they need for efficient reconciliation and robust financial reporting, while giving employees the clarity to confidently use shared resources within established policy guidelines. In an age where financial transparency and rigorous internal controls are non-negotiable, a credit card sign out sheet template stands out as a practical, essential solution for any forward-thinking business. Make it a cornerstone of your operational policy and enjoy the peace of mind that comes with superior financial management.