In today’s interconnected world, where digital transformation is the norm and data is a paramount asset, the specter of cyber threats looms larger than ever. Businesses of all sizes, from bustling startups to multinational corporations, face a relentless barrage of sophisticated attacks, ranging from ransomware and data breaches to denial-of-service assaults. The financial fallout from such incidents can be catastrophic, encompassing not only direct costs like incident response and data recovery but also significant expenses related to legal fees, regulatory fines, reputational damage, and business interruption. This complex and evolving risk landscape has made cyber security insurance an indispensable component of a comprehensive risk management strategy.

However, navigating the intricacies of cyber insurance policies can be a daunting task. Policy language is often dense, full of jargon, and the scope of coverage can vary wildly between providers. This is where a well-structured Cyber Security Insurance Policy Template becomes an invaluable tool. It serves as a foundational blueprint, simplifying the process of understanding, evaluating, and negotiating these critical contracts. For risk managers, legal teams, CFOs, and business owners, this template provides clarity, ensures all essential bases are covered, and ultimately helps secure robust protection against the escalating costs of cyber incidents.

Why a Cyber Security Insurance Policy Template is Essential

The digital age presents unique challenges, making a proactive approach to risk mitigation crucial. A comprehensive Cyber Security Insurance Policy Template is more than just a document; it’s a strategic asset in an organization’s defense against modern threats. It addresses the inherent complexities and ambiguities often found in standard insurance contracts, offering a framework that promotes transparency and understanding.

One of the primary reasons for its importance lies in the rapidly evolving nature of cyber threats. As attack methods become more sophisticated, so too must the protective measures and, consequently, the insurance coverage. A template helps organizations stay abreast of current risks, ensuring that their policy language reflects the most relevant and necessary protections, from ransomware payments to post-breach legal defense. Moreover, the increasing regulatory pressure, such as that stemming from GDPR, CCPA, and various state-specific data breach notification laws, imposes significant financial penalties for non-compliance. A strong Cyber Security Insurance Policy Template can help ensure that coverage extends to these regulatory fines and legal obligations, mitigating potential financial ruin.

By providing a clear, pre-defined structure, the template empowers businesses to compare offerings from different insurers more effectively. It highlights critical clauses, exclusions, and definitions, allowing for a side-by-side analysis that would otherwise be extremely difficult. This reduces the time and effort required for due diligence and allows for more informed decision-making regarding these vital financial instruments.

Key Benefits of Using a Cyber Security Insurance Policy Template

Leveraging a well-designed Cyber Security Insurance Policy Template offers a multitude of advantages that extend beyond mere document organization. It’s a strategic tool that enhances an organization’s ability to manage cyber risk effectively and efficiently.

Firstly, it significantly streamlines the policy evaluation and negotiation process. Instead of starting from scratch or deciphering a brand new, complex document with each insurer, a template provides a consistent baseline. This consistency allows businesses to quickly identify gaps in coverage, compare terms, and negotiate more favorable contract terms with insurers. This often translates into substantial cost savings by avoiding unnecessary premiums for redundant coverage or ensuring essential coverages aren’t overlooked.

Secondly, a robust Cyber Security Insurance Policy Template enhances clarity and understanding for all stakeholders. The dense legal language of insurance policies can be a barrier, even for seasoned professionals. By using clear, accessible language and a logical structure, the template makes it easier for internal teams – from IT and legal to HR and executive leadership – to comprehend the policy’s scope, obligations, and limitations. This improved understanding facilitates better internal compliance with the policy’s requirements, reducing the risk of a claim being denied due to a technicality.

Finally, it acts as a powerful risk management and mitigation tool. By outlining the types of incidents covered, the response actions expected, and the financial protections available, the template reinforces an organization’s overall data security posture. It encourages a proactive review of existing workplace rules related to data handling and incident response protocols, ensuring alignment between insurance coverage and internal operational realities. This holistic approach helps to build resilience against cyber threats, turning a potential disaster into a manageable incident.

How a Cyber Security Insurance Policy Template Can Be Customized

No two businesses are exactly alike, and neither are their cyber risk profiles. A truly effective Cyber Security Insurance Policy Template is not a rigid, one-size-fits-all solution but rather a flexible framework designed for extensive customization. This adaptability ensures that the resulting policy accurately reflects the unique needs, operational complexities, and industry-specific regulations of any given organization.

Customization begins with tailoring the scope of coverage to match the specific threats a business faces. For instance, a healthcare provider might prioritize coverage for HIPAA violation fines and patient notification costs, while a financial institution would focus on wire fraud and systemic attack protection. The Cyber Security Insurance Policy Template allows for the insertion of clauses addressing these industry-specific risks, ensuring that the scope of protection is precise and relevant. Businesses can also adjust limits and deductibles to align with their risk appetite and budget constraints, finding the right balance between premium costs and potential out-of-pocket expenses.

Furthermore, the template can be adapted to reflect a company’s internal compliance requirements and existing data security measures. If a company has robust internal controls or adheres to specific certifications (like ISO 27001 or SOC 2), these can be referenced within the policy template to potentially influence underwriting and premium rates. This level of detail helps align the insurance policy with broader corporate governance and risk management strategies. It also allows for the inclusion of specific clauses regarding the handling of sensitive customer or employee data, ensuring that the policy aligns with internal workplace rules and data security protocols. By defining key legal terms within the policy, the template minimizes ambiguity and ensures that all parties understand their respective obligations under the contract.

Important Elements for a Cyber Security Insurance Policy Template

A comprehensive Cyber Security Insurance Policy Template should be meticulously structured to include all critical components that define the coverage, responsibilities, and operational aspects of the agreement. Omitting even minor details can lead to significant issues during a claim. Here are the essential elements that should be incorporated:

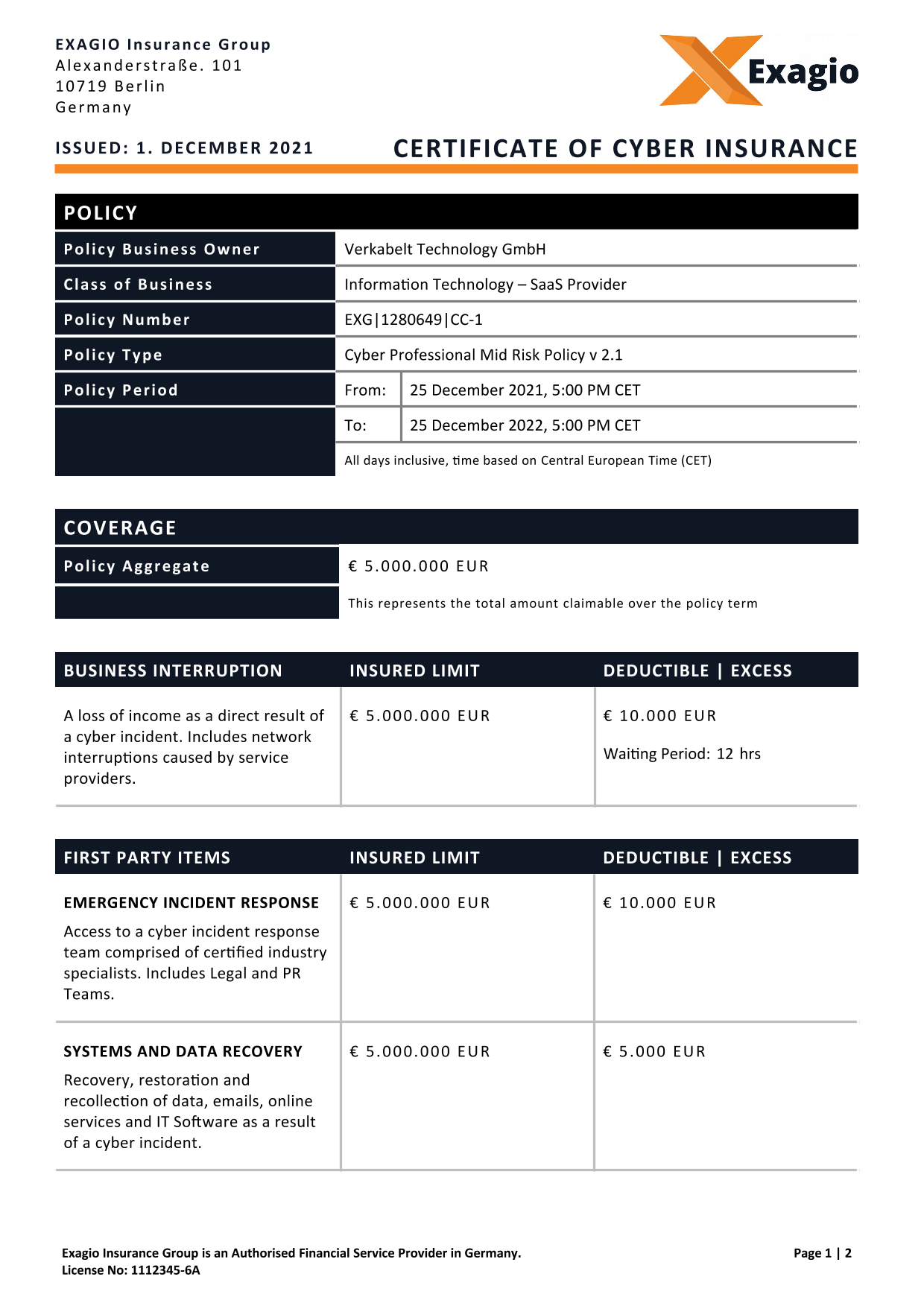

- Policyholder and Insurer Information: Clear identification of both parties, including legal names, addresses, and contact details.

- Policy Period: The effective start and end dates of the insurance coverage.

- Definitions of Key Terms: A glossary of all specialized terms (e.g., "cyber incident," "personally identifiable information," "network security event," "ransomware," "data breach") to ensure clear understanding and avoid ambiguity.

- Insuring Agreements (Coverage Sections): Detailed descriptions of what is covered, typically broken down into:

- First-Party Coverage: Covers direct costs to the insured (e.g., business interruption, data recovery, forensic investigation costs, ransomware payments, crisis management expenses, notification costs).

- Third-Party Coverage: Covers costs related to claims made by others against the insured (e.g., legal defense costs, regulatory fines and penalties, privacy liability, media liability, payment card industry (PCI) fines and assessments).

- Exclusions: Clearly stated events or circumstances that are NOT covered by the policy (e.g., acts of war, pre-existing conditions, intentional wrongful acts, bodily injury, property damage not caused by cyber events).

- Limits of Liability and Deductibles/Self-Insured Retentions: The maximum amount the insurer will pay for a claim or series of claims, and the amount the policyholder must pay before coverage kicks in.

- Conditions and Obligations of the Insured: Requirements the policyholder must meet (e.g., maintain specific security controls, promptly report incidents, cooperate with the insurer’s investigation).

- Incident Response Requirements: Outlines the steps the insured must take immediately following a cyber incident, often including notification procedures to the insurer and use of approved vendors.

- Subrogation Rights: The insurer’s right to pursue a third party that caused the loss, after paying a claim to the insured.

- Claims Reporting Procedures: Step-by-step instructions on how and when to report a claim.

- Dispute Resolution: Mechanisms for resolving disagreements between the insured and the insurer, such as arbitration or mediation.

- Governing Law: The jurisdiction whose laws will apply to the policy contract.

- Endorsements and Riders: Specific additions or modifications to the standard policy language that customize coverage for unique situations.

Tips on Design, Usability, and Implementation

While the content of a Cyber Security Insurance Policy Template is paramount, its design, usability, and thoughtful implementation are equally crucial for its effectiveness. A well-designed template enhances clarity, promotes engagement, and ensures that the information is easily digestible by diverse audiences, from legal professionals to business executives.

For optimal usability, prioritize a clean, uncluttered layout. Use clear headings and subheadings (even <h3> for very detailed sub-sections) to break up dense text, making it easy to navigate and find specific information. Employ bullet points and numbered lists, as demonstrated above, to present complex details in an easy-to-read format. Consistent font styles and sizes, along with appropriate line spacing, contribute significantly to readability. For digital versions, ensure the Cyber Security Insurance Policy Template is searchable and potentially hyperlinked to definitions or related sections for quick reference. Consider including an executive summary at the beginning, providing a high-level overview of the policy’s key coverage and benefits, particularly for those who need a quick grasp of its scope and deliverables.

Implementation also involves thoughtful version control, especially for an evolving document like a policy template. Maintain a clear naming convention and date stamp for each iteration. For both print and digital versions, consider creating a user-friendly guide or FAQ that accompanies the template, explaining common questions or ambiguities in simpler terms. This proactive approach helps in setting clear expectations and understanding the obligations outlined within the contract. When sharing the template or derived policies, ensure secure digital distribution channels are used, especially given the sensitive financial and operational details it contains. This attention to detail in design and implementation transforms a mere document into an accessible and powerful tool for managing cyber risks.

The digital landscape will only grow more complex, and with it, the necessity for robust cyber risk management. A comprehensive Cyber Security Insurance Policy Template is not just a reactive measure; it’s a proactive investment in your organization’s future resilience. By providing a clear, structured framework, it demystifies the often-opaque world of cyber insurance, allowing businesses to secure the right protection with confidence and clarity.

Embracing such a template empowers organizations to make informed decisions, negotiate effectively, and ensure that their hard-earned assets are safeguarded against the unpredictable nature of cyber threats. It’s a foundational step towards building a more secure and sustainable business in an increasingly digital world, turning the complexity of cyber insurance into a manageable and strategic advantage.