In today’s intricate regulatory landscape, managing consumer information isn’t just a best practice; it’s a legal imperative. Businesses across various sectors routinely handle sensitive personal data, especially when making decisions related to employment, credit, housing, or other transactions. This is where the Fair Credit Reporting Act (FCRA) comes into play, a pivotal federal law designed to ensure accuracy, fairness, and privacy of consumer information contained in the files of consumer reporting agencies. Navigating the nuances of FCRA can be a complex endeavor, making a comprehensive and well-structured Fair Credit Reporting Act Policy Template an indispensable tool for any organization.

Imagine having a clear, actionable guide that not only outlines your obligations under FCRA but also provides step-by-step procedures for handling consumer reports ethically and legally. That’s precisely the power of a robust Fair Credit Reporting Act Policy Template. It serves as a foundational document, enabling businesses – from small landlords to large financial institutions and HR departments – to maintain compliance, mitigate risks, and foster trust with applicants and customers. For HR professionals, compliance officers, legal teams, and operational managers, this template offers peace of mind and a streamlined approach to an otherwise challenging area of regulatory adherence.

Why a Fair Credit Reporting Act Policy Template is Essential

The importance of a well-defined Fair Credit Reporting Act Policy Template cannot be overstated in the current environment. FCRA regulations are far-reaching, impacting how organizations obtain, use, and share consumer credit and background information. Non-compliance isn’t merely an administrative oversight; it can lead to significant legal penalties, hefty fines, costly litigation, and irreparable damage to an organization’s reputation.

A standardized Fair Credit Reporting Act Policy Template acts as your organization’s internal compass, guiding every action related to consumer reports. It ensures that all employees involved in hiring, lending, or tenant screening understand their obligations and the stringent requirements of the FCRA. This proactive approach to compliance management not only safeguards your business from potential legal challenges but also demonstrates a clear commitment to ethical data handling and consumer privacy, crucial elements for building and maintaining public trust.

Key Benefits of Using a Fair Credit Reporting Act Policy Template

Implementing a comprehensive Fair Credit Reporting Act Policy Template offers a multitude of advantages beyond mere regulatory compliance. It brings clarity, efficiency, and a robust framework to your operational procedures, ultimately enhancing your business’s integrity and resilience.

Firstly, it provides standardization across all departments and decision-makers. Everyone understands the consistent workplace rules for obtaining and using consumer reports, minimizing variations that could lead to non-compliance. Secondly, it serves as an excellent training resource, educating employees on the intricacies of FCRA and their specific responsibilities regarding data security and consumer rights. This reduces the likelihood of costly errors.

Furthermore, a well-drafted Fair Credit Reporting Act Policy Template acts as demonstrable evidence of due diligence to regulatory bodies and auditors. Should questions arise, having documented procedures showcases your commitment to following legal terms and obligations. It also streamlines internal processes, allowing HR and legal teams to execute tasks more efficiently, saving valuable time and resources that might otherwise be spent navigating legal ambiguities or responding to compliance inquiries. Ultimately, it fosters an environment of transparency and fairness, both internally and externally.

Customizing and Adapting Your Fair Credit Reporting Act Policy Template

While a Fair Credit Reporting Act Policy Template provides a solid foundation, its true value lies in its adaptability. No two organizations are exactly alike, and therefore, a "one-size-fits-all" approach seldom works perfectly for regulatory compliance. Successfully leveraging this template requires thoughtful customization to align with your specific industry, business operations, and geographic footprint.

Consider the nature of your business: are you a financial institution, a landlord, an employer conducting pre-employment background checks, or a company involved in tenant screening? Each context will have unique requirements and permissible purposes for obtaining consumer reports. Your Fair Credit Reporting Act Policy Template must reflect these specific scenarios. Furthermore, state and local laws often impose additional requirements beyond federal FCRA regulations. For instance, some states have stricter rules regarding adverse action notices or the use of credit reports in employment decisions.

Therefore, it’s crucial to review and integrate these local nuances into your Fair Credit Reporting Act Policy Template. Engage legal counsel to ensure that the adapted policy not only meets federal standards but also satisfies all applicable state-specific requirements. Regularly review and update your customized policy to account for legislative changes, evolving best practices, and shifts in your business operations, ensuring it remains a dynamic and effective compliance tool.

Important Elements to Include in Your Fair Credit Reporting Act Policy Template

A robust Fair Credit Reporting Act Policy Template should be comprehensive, covering all critical aspects of FCRA compliance. While the exact structure may vary based on your organization’s needs, several core elements are indispensable.

Here are the key fields and sections your Fair Credit Reporting Act Policy Template should encompass:

- Scope and Applicability: Clearly define who the policy applies to (e.g., employees, contractors, third-party vendors) and the types of consumer reports it covers.

- Definitions: Provide clear definitions for key terms such as "consumer report," "investigative consumer report," "consumer reporting agency (CRA)," "permissible purpose," and "adverse action."

- Permissible Purpose for Obtaining Consumer Reports: Detail the specific legal grounds under which your organization will obtain consumer reports (e.g., employment, credit, tenancy, insurance).

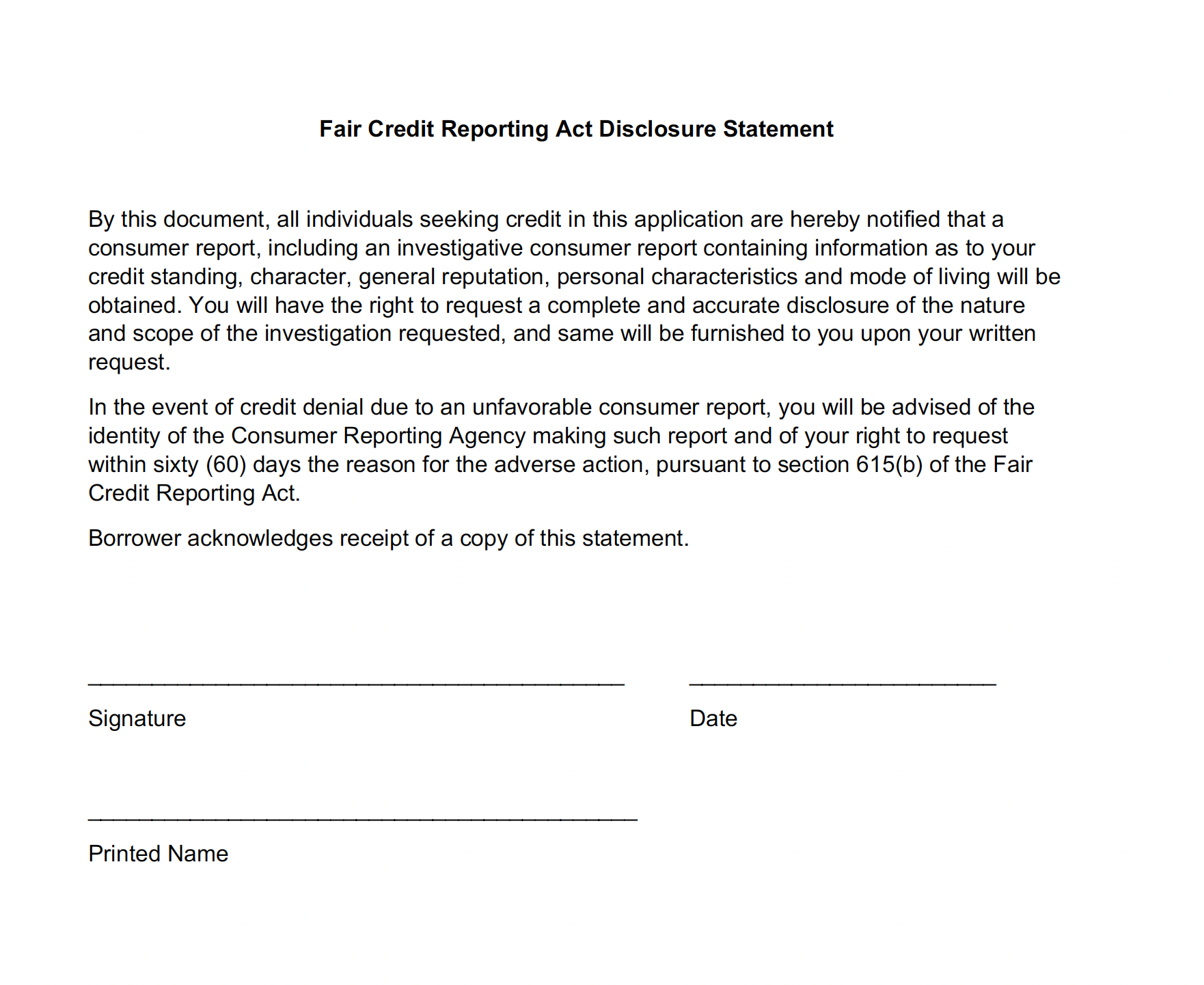

- Disclosure and Authorization Requirements: Outline the precise procedures for obtaining written consent from consumers, including the "standalone disclosure" requirement and the summary of consumer rights.

- Pre-Adverse Action Procedures: Describe the steps to be taken when considering an adverse action based on information in a consumer report, including providing the consumer with a copy of the report and a "Summary of Your Rights Under the FCRA."

- Adverse Action Notices: Detail the content and timing of the final adverse action notice, explaining the consumer’s right to dispute the accuracy or completeness of the report and to obtain additional free reports.

- Resale of Consumer Report Information: If applicable, specify policies regarding the resale or sharing of consumer report information, ensuring compliance with FCRA provisions.

- Data Security and Retention: Establish protocols for protecting the confidentiality and security of consumer report information, including secure storage, access controls, and retention schedules.

- Dispute Resolution: Outline procedures for handling consumer disputes regarding the accuracy of information obtained from a CRA.

- Employee Training and Accountability: Mandate training for all personnel involved in handling consumer reports and define consequences for non-compliance.

- Record-Keeping: Specify requirements for documenting all FCRA-related activities, including disclosures, authorizations, adverse action notices, and related communications.

- Compliance Officer/Designated Contact: Identify the individual or department responsible for overseeing FCRA compliance and addressing inquiries.

Design, Usability, and Implementation Tips for Your Fair Credit Reporting Act Policy Template

Developing a strong Fair Credit Reporting Act Policy Template is only half the battle; ensuring its effective implementation and usability is equally crucial. The design and presentation of your policy can significantly impact its adoption and adherence within your organization.

Prioritize clarity and conciseness in language. Avoid overly legalistic jargon where possible, or provide clear explanations for complex legal terms. The goal is for all employees, not just legal professionals, to understand their responsibilities. For usability, consider both digital and print formats. A digital version integrated into your HR or compliance portal allows for easy access, searchability, and version control. Ensure it’s mobile-friendly for on-the-go access. If printed copies are distributed, ensure they are clearly labeled with version numbers and effective dates.

Implementation should be accompanied by comprehensive employee training. Don’t just publish the Fair Credit Reporting Act Policy Template; actively educate your team on its contents, importance, and practical application. Integrate it into new employee onboarding and provide regular refreshers. Furthermore, establish a clear process for reviewing and updating the policy annually or whenever there are changes in regulations or business practices. Assign responsibility for this review to a dedicated compliance team or legal counsel, ensuring that your organization’s obligations remain current and effectively managed.

A well-crafted and diligently implemented Fair Credit Reporting Act Policy Template is more than just a document; it’s a strategic asset for your organization. It forms the bedrock of ethical data handling, risk management, and regulatory compliance, fostering an environment of trust and integrity. By outlining clear procedures for obtaining, using, and protecting consumer report information, it empowers your teams to make informed decisions while upholding the rights of individuals.

Embracing a robust Fair Credit Reporting Act Policy Template is a proactive step towards safeguarding your business from legal pitfalls and enhancing its reputation as a responsible entity. It demonstrates a profound commitment to fairness, accuracy, and privacy in all consumer interactions. Consider it an investment in your organization’s long-term stability and ethical standing, ensuring that your practices align with the highest standards of consumer protection.