Navigating the intricate world of life insurance can often feel like deciphering a complex legal manuscript written in a foreign language. From understanding different policy types like term, whole, or universal life, to grasping the nuances of riders, beneficiaries, and payout structures, the learning curve is steep. This complexity often deters individuals from adequately exploring their options, leaving them less prepared for critical financial decisions. What if there was a way to explore these concepts in a safe, risk-free environment, allowing for hands-on learning without the pressure of real-world commitments?

Enter the Fake Life Insurance Policy Template. This isn’t a tool for deception, but rather a robust, adaptable framework designed for educational purposes, conceptual modeling, and training. It serves as a mock-up, a sample document that mirrors the structure and typical content of a genuine policy, but without any legal binding or financial implications. This template is an invaluable resource for students, financial educators, insurance agents in training, fraud prevention specialists, and even those simply wishing to better understand the mechanics of life insurance before making a real-world purchase.

Why a Fake Life Insurance Policy Template is Essential in Today’s Context

In an age where financial literacy is paramount, and the digital landscape often blurs the lines between legitimate and fraudulent information, tools that clarify complex subjects are more important than ever. A Fake Life Insurance Policy Template addresses this need directly by offering a tangible, yet harmless, representation of a critical financial instrument. It serves as a pedagogical instrument, allowing users to engage with policy language and structure in a controlled environment.

This type of template is particularly useful for fraud awareness initiatives. By familiarizing individuals with the typical appearance and components of a legitimate policy, they become better equipped to spot red flags in potentially fraudulent schemes. It provides a baseline understanding, making it harder for scam artists to pass off fake documents as real. Furthermore, for financial advisors and insurance educators, a conceptual model like this enhances training programs, providing practical examples that resonate more deeply than abstract theoretical discussions.

Key Benefits of Using a Fake Life Insurance Policy Template

The advantages of utilizing a Fake Life Insurance Policy Template are numerous, extending across various fields from education to professional development. One primary benefit is its utility as an educational aid. It allows students and learners to dissect and understand the components of a life insurance policy without the commitment or complexity of a real financial product. They can see how beneficiaries are designated, how coverage amounts are stipulated, and the typical clauses included in such agreements.

Moreover, this template offers a risk-free experimentation ground. Financial professionals in training can practice filling out policy details, calculating hypothetical premiums, or simulating claims processes without any real-world consequences. This hands-on experience builds confidence and competence. For software developers, it acts as valuable test data, enabling them to build and refine systems that process policy information, ensuring their applications can handle the diverse elements of real-world documents effectively. It also serves as a consistent sample document for internal demonstrations or for illustrating different hypothetical scenarios.

How a Fake Life Insurance Policy Template Can Be Customized or Adapted to Different Needs

The power of a well-designed Fake Life Insurance Policy Template lies in its adaptability. It’s not a one-size-fits-all solution but a flexible framework that can be tailored to meet a myriad of specific requirements. For instance, an educator might adapt it to create different hypothetical scenarios for a class, varying the insured’s age, health status, or occupation to demonstrate how these factors influence premiums and coverage. This allows for a dynamic learning experience, exploring various policy types like term life, whole life, or universal life with fictional details.

Fraud prevention specialists could customize the template to highlight common characteristics of fraudulent policies, using it as a training aid to teach people how to identify inconsistencies or red flags. A software company developing an insurance management system might adapt it to create extensive test data sets, ensuring their platform can robustly handle diverse policy structures and data inputs. The template can be modified to reflect different hypothetical state regulations or specific policy riders, offering a comprehensive and versatile tool for understanding structural analysis within the insurance sector.

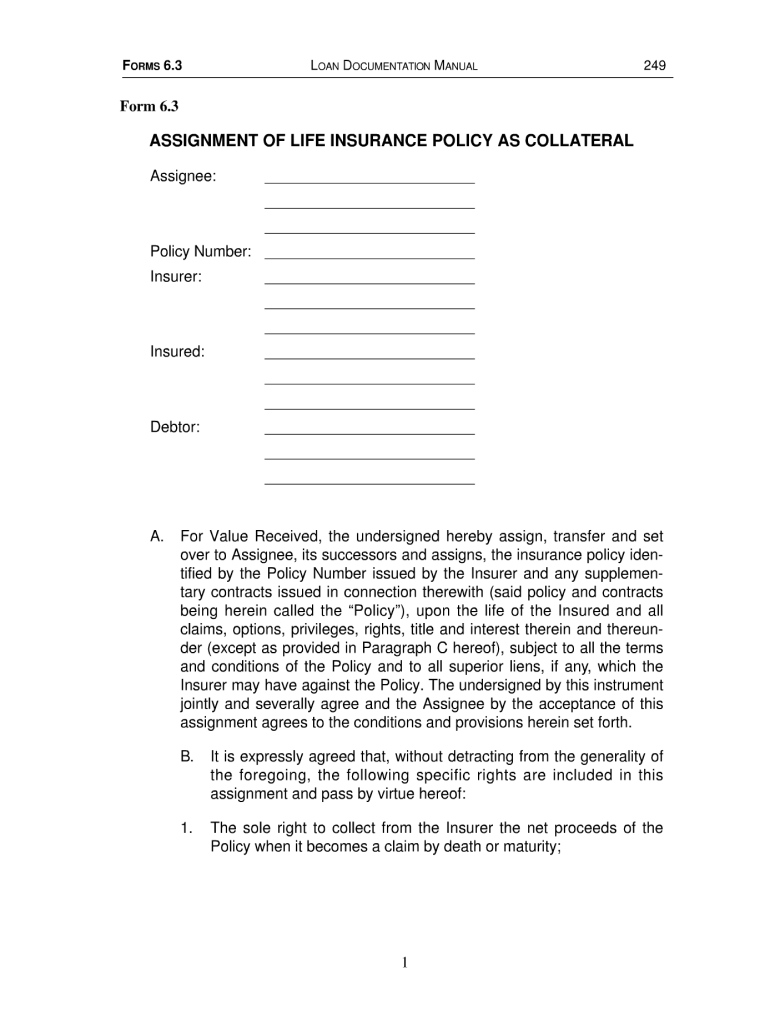

Important Elements or Fields That Should Be Included in a Fake Life Insurance Policy Template

To ensure maximum utility and realism, a Fake Life Insurance Policy Template should incorporate a comprehensive set of elements typically found in a genuine life insurance contract. These fictional details are crucial for building an effective educational or training tool. The more complete and structured the mock-up, the better it serves its purpose as a learning resource or demonstration.

Key elements to include are:

- Policy Number: A unique, hypothetical identifier for the policy.

- Insured’s Fictional Details: Placeholder names, dates of birth, addresses, and other personal information for the "insured" individual.

- Beneficiary Fictional Details: Placeholder names, relationships, and allocation percentages for the primary and contingent "beneficiaries."

- Coverage Amount (Death Benefit): A hypothetical sum representing the financial payout upon the insured’s "death."

- Policy Type: Clearly state whether it’s a "fictional term life," "mock whole life," or "sample universal life" policy.

- Policy Effective Date & Expiration Date (if term): Hypothetical dates indicating the policy’s theoretical start and end.

- Premium Schedule & Amount: Fictional premium figures and payment frequency (e.g., monthly, annually).

- Riders/Endorsements: Sections for hypothetical additional benefits or modifications, such as "mock accidental death rider" or "sample waiver of premium."

- Policy Provisions & Clauses: Include sections for general conditions, exclusions (e.g., "hypothetical suicide clause"), contestability period, and grace period, using simplified language where appropriate.

- Cash Value (if applicable): A section demonstrating how "cash value" might accrue in a hypothetical permanent policy.

- Policy Owner Details: If different from the insured, include fictional details for the policy owner.

- Insurance Company Fictional Information: A placeholder name and address for the "issuing company."

- Signatures & Dates: Placeholder lines for hypothetical signatures of the insured, policy owner, and a "company representative," with fictional dates.

- Hypothetical Claims Process: A brief outline of how a "claim" would theoretically be filed.

Tips on Design, Usability, or Implementation

Designing a Fake Life Insurance Policy Template for optimal usability, whether in print or digital format, is key to its effectiveness as a learning resource. The goal is to make it look professional and authoritative, mirroring real documents without being misleading. For print versions, clarity and readability are paramount. Use clear, legible fonts and ample white space to avoid a cluttered appearance. Organize sections logically with clear headings and subheadings, making it easy for users to navigate the document and quickly locate specific information.

When implementing the template digitally, consider creating interactive fields where users can input hypothetical data. This transforms the template into a dynamic training aid, allowing for immediate feedback or calculation demonstrations. Ensure the digital version is accessible across various devices and platforms. For both print and digital iterations, incorporate branding that clearly identifies it as a "sample," "mock-up," or "for educational purposes only" document. This reinforces its role as a demonstration and prevents any misinterpretation. Consistent formatting, professional aesthetics, and a user-friendly layout will significantly enhance the value of your Fake Life Insurance Policy Template, making it a powerful tool for conceptual modeling and risk assessment training.

The Fake Life Insurance Policy Template stands out as an exceptionally versatile and practical resource in a world increasingly demanding clear, accessible financial education. It demystifies a crucial financial product, transforming complex legal jargon into understandable components for learners of all levels. From its utility in academic settings to its role in enhancing fraud awareness training, this template empowers individuals with knowledge without the inherent risks of real-world transactions.

By providing a safe, adaptable sandbox for understanding policy structure, coverage details, and beneficiary designations, the Fake Life Insurance Policy Template offers tangible benefits for anyone looking to gain a deeper insight into life insurance. It’s more than just a document; it’s a powerful educational tool that fosters informed decision-making and builds confidence. Embrace this innovative approach to learning and training, and unlock a clearer understanding of life insurance today.