In an increasingly digital world, the threat of identity theft looms larger than ever, silently compromising financial stability, personal reputations, and peace of mind. From sophisticated phishing scams and data breaches to old-fashioned dumpster diving, the methods employed by fraudsters are constantly evolving, making a reactive stance simply insufficient. Protecting one’s identity, whether personal or organizational, demands a strategic, proactive defense – precisely what an effective identity theft prevention program offers.

This isn’t just about reacting after the damage is done; it’s about building a robust framework that minimizes vulnerability and equips you with the tools to act swiftly should a breach occur. Understanding and implementing a comprehensive Identity Theft Prevention Program Template provides individuals, families, and businesses with a structured roadmap to navigate the complex landscape of digital security and personal data safeguarding, transforming abstract fears into actionable strategies.

Why a Structured Approach to Identity Protection Matters

The digital footprint we leave daily, whether through online shopping, social media interactions, or even routine financial transactions, generates a wealth of personal information that is highly coveted by cybercriminals. Without a well-thought-out plan, this data becomes an open invitation for misuse. A structured approach to identity protection transcends sporadic vigilance; it embeds security into daily routines and organizational policies, making it a continuous, conscious effort rather than a crisis-driven reaction. It means establishing clear protocols for data handling, monitoring for suspicious activity, and educating all parties involved on best practices.

For individuals, a robust identity protection strategy provides a crucial layer of defense against financial ruin, credit score damage, and the significant emotional toll of identity restoration. For businesses, especially those handling sensitive customer or employee data, such a program is not merely a best practice but often a regulatory necessity, mitigating legal risks, safeguarding reputations, and maintaining customer trust. Investing in a comprehensive fraud prevention framework demonstrates a commitment to security that resonates deeply with stakeholders and clients alike.

The Core Components of an Effective Prevention Program

A truly effective identity theft prevention program isn’t a single solution but a combination of interconnected elements designed to protect, detect, and respond. These components work in concert to create a resilient shield against potential threats, transforming a generic approach into a tailored identity security plan. Understanding these pillars is the first step toward building a formidable defense system against illicit data access and usage.

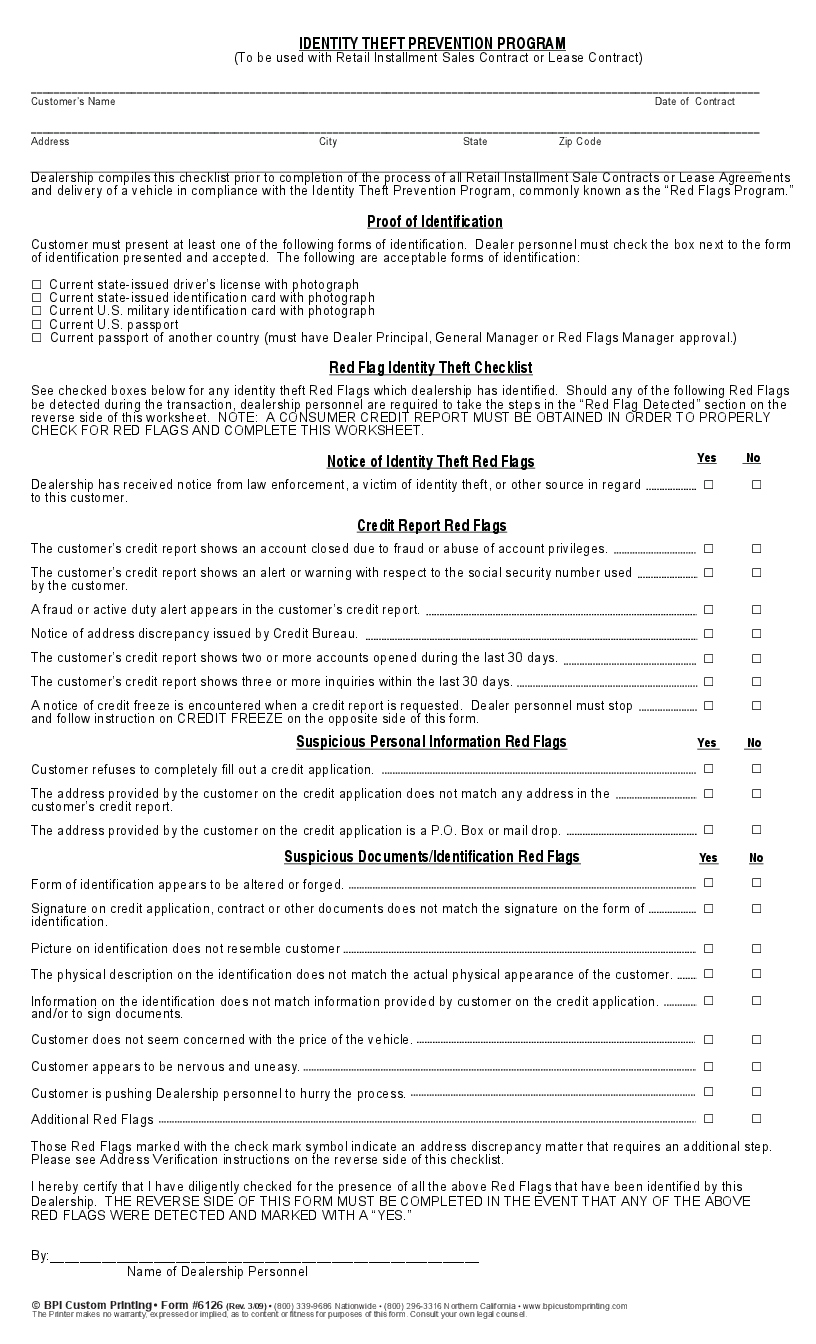

First and foremost is Education and Awareness. This involves teaching individuals about common identity theft schemes, safe online practices, and the importance of strong, unique passwords. For organizations, it extends to mandatory employee training on data privacy policies, recognizing phishing attempts, and proper data disposal. Secondly, Proactive Monitoring is critical. This includes regularly reviewing bank statements, credit reports, and insurance claims for unusual activity. Specialized identity theft monitoring services can also track dark web activity and alert you to potential compromises of your personal information.

Third, robust Data Security Measures are foundational. This means securing physical documents, using encryption for digital data, implementing multi-factor authentication (MFA) on all accounts, and maintaining up-to-date antivirus and anti-malware software. For businesses, it involves secure network architectures, access controls, and regular vulnerability assessments. Finally, a clear Incident Response Plan is non-negotiable. Knowing precisely what steps to take immediately after a suspected breach—contacting credit bureaus, financial institutions, law enforcement, and potentially legal counsel—can significantly limit the damage and expedite recovery.

Building Your Custom Identity Theft Prevention Strategy

While the foundational principles of identity protection remain consistent, the actual implementation must be customized to suit specific needs, whether for an individual, a family, or a sprawling enterprise. A one-size-fits-all approach rarely suffices given the unique data landscapes and risk profiles involved. The beauty of leveraging an existing **Identity Theft Prevention Program Template** lies in its adaptability, allowing you to tailor a sophisticated framework to your particular circumstances.

The customization process begins with a thorough Risk Assessment. For an individual, this might involve evaluating how much personal information is publicly accessible, the number of online accounts held, and the vigilance exercised in daily digital interactions. For businesses, it entails identifying critical data assets, understanding regulatory obligations (like GDPR or CCPA), and assessing potential vulnerabilities within IT systems and employee practices. This initial assessment forms the bedrock for developing targeted security protocols for personal information.

Following the assessment, Policy Creation and Implementation are crucial. This involves drafting clear guidelines for secure data handling, password management, and data sharing. For families, this could be a set of household rules for internet use and document storage. For organizations, it translates into comprehensive internal policies, clear data breach notification procedures, and robust cybersecurity defense strategies. The final, critical step is Continuous Review and Adaptation. Identity theft tactics are always evolving, so your prevention program must evolve with them. Regular audits, policy updates, and ongoing education ensure your proactive defense against identity theft remains effective against emerging threats.

Key Actionable Steps for Individuals and Organizations

Translating a comprehensive identity protection framework into tangible actions is essential for its success. Whether you are safeguarding your personal data or managing the sensitive information of an entire organization, specific steps can significantly bolster your defenses. These practical measures form the bedrock of any successful identity security strategy, moving beyond abstract concepts to concrete safeguards.

For individuals, focusing on consistent, diligent practices is key:

- **Strengthen Passwords and Use MFA:** Create long, complex passwords or passphrases for all accounts and enable **multi-factor authentication** wherever possible.

- **Regularly Monitor Financial Accounts:** Scrutinize bank and credit card statements for unfamiliar transactions and review your credit reports annually from all three major bureaus (Experian, Equifax, TransUnion) via AnnualCreditReport.com.

- **Be Wary of Unsolicited Communications:** Exercise extreme caution with emails, calls, or texts requesting personal information. Assume such requests are fraudulent until verified through an **independent source**.

- **Shred Sensitive Documents:** Securely dispose of financial statements, expired IDs, and other documents containing personal data before discarding them.

- **Control Your Digital Footprint:** Be mindful of what you share on social media and ensure your privacy settings are configured for maximum protection. Consider a **credit freeze** as a strong preventative measure.

For organizations, protecting stakeholder data requires a more expansive and systematic approach:

- **Implement Robust Employee Training Programs:** Regularly educate staff on cybersecurity best practices, **phishing detection**, and data handling protocols.

- **Utilize Data Encryption and Access Controls:** Encrypt sensitive data both in transit and at rest, and implement **least privilege access** to limit who can view or modify critical information.

- **Develop and Test an Incident Response Plan:** Establish clear procedures for identifying, containing, eradicating, recovering from, and learning from security incidents. Conduct **regular drills**.

- **Conduct Regular Security Audits and Vulnerability Scans:** Proactively identify and address weaknesses in your IT infrastructure and applications.

- **Stay Compliant with Data Privacy Regulations:** Understand and adhere to relevant laws like HIPAA, CCPA, or GDPR to avoid penalties and protect customer trust through a robust privacy protection framework.

Maintaining Vigilance and Adapting to New Threats

The landscape of identity theft is dynamic, with new threats and sophisticated tactics emerging constantly. Therefore, an identity theft prevention program cannot be a static document; it must be a living, evolving strategy. Maintaining vigilance means staying informed about the latest scams, data breaches, and technological advancements used by fraudsters. It requires a commitment to continuous learning and proactive adjustment to one’s security posture.

This ongoing commitment involves regularly reviewing your personal data safeguarding plan or organizational security template. Are your passwords still strong enough? Have new accounts been opened that require monitoring? Are your employees up-to-date on the latest phishing techniques? Routine audits, whether personal or corporate, provide an opportunity to assess the effectiveness of current measures and identify areas for improvement. Embracing this mindset ensures that your defense remains robust against the ever-changing tides of digital identity threats, safeguarding your future.

In an era where personal information is a valuable commodity, protecting your identity is not merely an option but an absolute necessity. The journey to comprehensive identity security begins with a structured, thoughtful approach, guided by a robust framework. By embracing the principles outlined in an Identity Theft Prevention Program Template, individuals and organizations alike can construct formidable defenses against an evolving threat landscape.

Taking the initiative to establish and maintain a personalized identity security plan offers more than just protection; it provides the invaluable peace of mind that comes from knowing you’ve taken decisive steps to safeguard your financial well-being and personal reputation. Start building your proactive defense today, ensuring your digital and financial identity remains securely yours.