Navigating the landscape of insurance policies can often feel like a maze, especially when it comes to making changes or, more critically, terminating coverage. Whether you’ve found a better deal, no longer need the coverage, or are simply streamlining your expenses, the act of canceling an insurance policy requires clear, precise communication. A misstep here can lead to continued charges, unaddressed liabilities, or even gaps in essential protection.

This is precisely where a well-structured Letter To Cancel Insurance Policy Template becomes an indispensable tool. It provides a formal, documented way to communicate your intent to your insurance provider, ensuring that your request is handled efficiently and accurately. From individual policyholders to small businesses managing multiple types of coverage, having a reliable framework for this crucial communication can save time, prevent misunderstandings, and safeguard your financial interests.

Why a Letter To Cancel Insurance Policy Template is Essential

In today’s fast-paced world, where automatic renewals and complex contractual obligations are common, a clear, written declaration of your intent to terminate coverage is more important than ever. Relying solely on a phone call or a casual email might seem convenient, but it leaves room for misinterpretation and lacks the formal documentation often required by insurance providers. A professionally crafted Letter To Cancel Insurance Policy Template serves as an official notice, leaving no ambiguity about your intentions.

This official notice is vital for several reasons. Firstly, it helps prevent unwanted charges from auto-renewals or continued billing, ensuring that you stop paying for a service you no longer require. Secondly, it provides a clear record of your request, which can be invaluable in resolving any disputes that might arise later regarding the cancellation date or premium refunds. Finally, it demonstrates your adherence to any policy termination clauses, maintaining compliance with the terms you initially agreed upon and ensuring a smooth exit from the agreement.

Key Benefits of Using a Letter To Cancel Insurance Policy Template

Leveraging a robust Letter To Cancel Insurance Policy Template offers a multitude of advantages, transforming a potentially confusing process into a straightforward task. One of the primary benefits is the inherent clarity and professionalism it brings to your communication. A well-formatted letter ensures that all necessary information is presented logically and concisely, making it easy for the insurance company to process your request without delay.

Moreover, a template significantly reduces the risk of errors or omissions. It acts as a checklist, guiding you to include all critical details such as your policy number, desired cancellation date, and contact information. This minimizes the back-and-forth communication that often occurs when incomplete information is provided. It also creates a definitive paper trail or digital record of your cancellation request, offering peace of mind and protection should any issues arise. Ultimately, using a Letter To Cancel Insurance Policy Template saves valuable time and effort, streamlining the entire cancellation process for both the policyholder and the insurance provider. It stands as a testament to diligent record-keeping and responsible management of contractual obligations.

Customizing Your Letter To Cancel Insurance Policy Template

While a core Letter To Cancel Insurance Policy Template provides a solid foundation, its true strength lies in its adaptability. It’s not a one-size-fits-all solution, and rightly so, as insurance policies vary widely. The template can and should be customized to suit the specific type of insurance you’re canceling, whether it’s auto, home, health, life, or a specialized business liability policy.

For instance, when canceling an auto insurance policy, you might need to specify the vehicle’s make, model, and VIN. A health insurance cancellation, on the other hand, might require details about your coverage group or reason for termination (e.g., new employment coverage). Businesses may need to include additional identifiers for commercial policies and potentially address outstanding balances or unique contractual terms. The template can be adjusted to include sections for specific refund requests, details about returning physical policy documents, or even a brief, optional explanation for your decision to cancel. This flexibility ensures that your Letter To Cancel Insurance Policy Template remains relevant and effective across different scenarios, providing the precise information needed for a smooth transition out of your current agreement.

Important Elements to Include in Your Letter To Cancel Insurance Policy Template

To ensure your cancellation request is clear, comprehensive, and processed without hitches, your Letter To Cancel Insurance Policy Template must incorporate several vital pieces of information. These elements are non-negotiable for proper documentation and communication. Each point contributes to the official nature of your notice and aids the insurance company in identifying your policy and acting upon your instructions promptly.

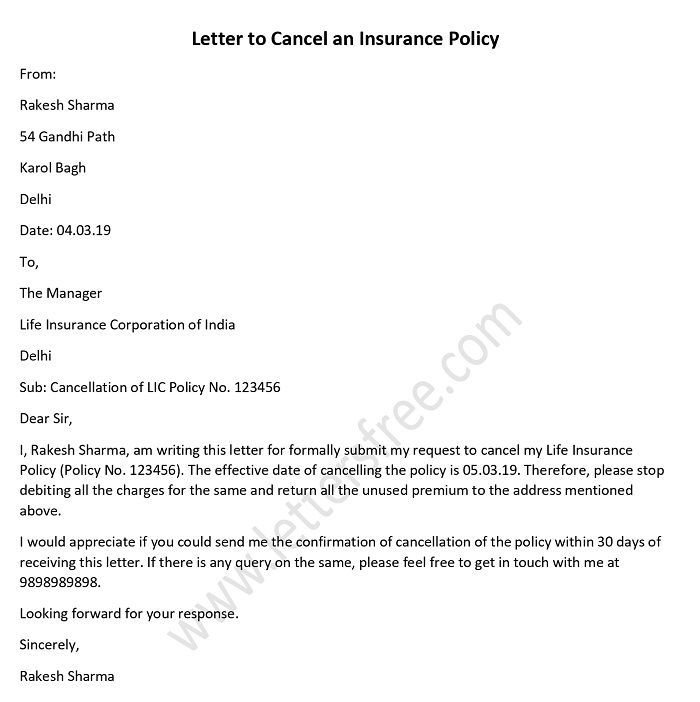

Here are the critical components that should be part of any effective Letter To Cancel Insurance Policy Template:

- Your Full Name and Address: This identifies you as the policyholder and provides your current contact details for any follow-up correspondence.

- Your Policy Number(s): Crucial for the insurance provider to locate your specific policy among their records. If you are canceling multiple policies, list each one clearly.

- The Insurance Company’s Full Name and Address: Ensures the letter is directed to the correct entity and department for processing cancellations.

- Effective Cancellation Date: State the precise date on which you wish your coverage to cease. Be mindful of any notice periods required by your policy.

- Clear Statement of Intent: Explicitly state that you wish to cancel the specified insurance policy. Ambiguity here can lead to delays.

- Reason for Cancellation (Optional but Recommended): While not always required, a brief, professional reason (e.g., "obtained new coverage," "sold insured asset") can sometimes facilitate the process.

- Request for Confirmation of Cancellation: Ask for written confirmation that your policy has been canceled and the effective date of termination. This is your proof of action.

- Request for Refund of Unearned Premium (If Applicable): If you’ve paid premiums in advance beyond the cancellation date, explicitly request a refund for the prorated amount.

- Your Signature and Date: A handwritten signature (for mailed letters) or a digital signature (for electronic submissions) authenticates your request.

- Your Contact Information (Phone Number and Email): Provide additional ways for the insurance company to reach you if they have questions or need to send confirmation.

Tips for Design, Usability, and Implementation

Creating an effective Letter To Cancel Insurance Policy Template goes beyond just its content; its design, usability, and how it’s implemented also play a significant role in its success. Whether you opt for a print or digital format, clarity and professionalism should be paramount. For a printed letter, consider using a standard, professional font like Times New Roman or Arial in a readable size (10-12 points). A clean layout with appropriate margins and line spacing enhances readability. If you have personal or business letterhead, using it adds an extra layer of professionalism and authenticity. When mailing, always send it via certified mail with a return receipt requested; this provides indisputable proof of delivery.

For digital implementation, such as sending via email, convert your Letter To Cancel Insurance Policy Template into a PDF document. This preserves formatting and prevents unintended alterations. Use a clear and concise subject line for your email, such as "Insurance Policy Cancellation Request – [Your Name] – Policy # [Your Policy Number]." Ensure any attachments are clearly labeled. Always keep digital copies of your sent emails and the attached cancellation letter. Regardless of the medium, double-check all details for accuracy before sending. Proofreading for typos or grammatical errors is crucial, as is making sure all policy numbers and dates are correct. Maintaining meticulous records of all correspondence, including a copy of the final Letter To Cancel Insurance Policy Template you sent, is a best practice for managing your contractual obligations effectively.

In an era where personal and financial security are paramount, having a reliable mechanism for managing your insurance policies is essential. A meticulously prepared Letter To Cancel Insurance Policy Template is far more than just a formality; it’s a critical tool for clear communication, robust documentation, and ultimate peace of mind. It ensures that your decision to terminate coverage is handled professionally and without unintended consequences, allowing you to move forward with confidence.

By utilizing a customizable Letter To Cancel Insurance Policy Template, you empower yourself with the ability to manage your insurance portfolio effectively, safeguard your finances from unwanted charges, and maintain clear records of your contractual obligations. Take control of your insurance journey by adopting this practical solution, ensuring that every transition is as smooth and stress-free as possible.