In the intricate world of healthcare, where patient care rightly takes center stage, the administrative and financial aspects often become complex undercurrents. Navigating insurance claims, patient deductibles, co-payments, and the myriad of billing nuances can be a significant challenge for any medical practice, regardless of its size or specialty. Without clear guidelines, these financial interactions can lead to confusion, frustration, and even significant revenue loss.

This is where a robust Medical Office Financial Policy Template becomes not just a helpful tool, but an indispensable asset. It serves as the bedrock for transparent financial communication between your practice and your patients, ensuring that everyone understands their responsibilities and expectations upfront. Whether you’re a new practice setting up foundational systems, an established clinic looking to streamline your revenue cycle, or an office manager seeking to improve patient relations and staff efficiency, understanding and implementing a comprehensive financial policy is key to a healthy practice.

Why a Medical Office Financial Policy Template is Essential Today

In today’s evolving healthcare landscape, the importance of a well-crafted Medical Office Financial Policy Template cannot be overstated. High-deductible health plans have shifted a greater financial burden onto patients, making clear communication about costs and payment expectations more critical than ever before. Practices are increasingly finding themselves in the position of needing to educate patients not just about their health, but also about their financial obligations.

A clear financial policy protects both the patient and the practice. For patients, it eliminates ambiguity, fostering trust and reducing anxiety about unexpected bills. For the practice, it is a crucial component of sound revenue cycle management, minimizing billing disputes, reducing accounts receivable days, and improving overall cash flow. It also helps ensure compliance with various regulations by standardizing procedures and clearly outlining terms and conditions regarding patient agreements and obligations.

Key Benefits of Using a Medical Office Financial Policy Template

Implementing a standardized Medical Office Financial Policy Template offers a multitude of benefits that extend far beyond simply getting paid. It creates a more stable, predictable, and professional environment for everyone involved.

Firstly, it significantly improves cash flow. By clearly outlining when payments are due (e.g., co-pays at the time of service, deductibles before elective procedures), practices can reduce the amount of outstanding debt and decrease collection efforts. This proactive approach ensures a steady stream of income vital for operational stability.

Secondly, a well-defined policy minimizes billing errors and disputes. When patients sign an acknowledgement of the financial terms, there’s less room for misunderstanding about what services are covered, what their out-of-pocket expenses will be, and how insurance claims are handled. This clarity reduces the time staff spend on clarifying bills or resolving complaints.

Thirdly, it enhances patient satisfaction and trust. Patients appreciate transparency. Presenting them with a comprehensive Medical Office Financial Policy Template from the outset demonstrates professionalism and a commitment to clear communication. When patients understand their financial obligations, they are more likely to feel respected and empowered, leading to a better overall patient experience.

Finally, such a policy provides a layer of legal protection for your practice. It acts as a formal agreement, outlining the terms of service and payment. In the event of a dispute, this documented policy can be crucial evidence, establishing clear workplace rules regarding patient financial obligations and staff procedures. It supports ethical billing practices and helps safeguard your practice against potential legal challenges related to collections or misunderstandings.

Customizing Your Medical Office Financial Policy Template

While a Medical Office Financial Policy Template provides an excellent starting point, its true power lies in its adaptability. Every medical practice is unique, with its own specialty, patient demographic, and operational nuances. Therefore, customization is not just an option, but a necessity to ensure the policy truly reflects your specific needs and values.

Consider the nature of your practice. A cosmetic surgery center, for example, might have a stronger focus on self-pay patients and require detailed payment plan agreements for high-cost procedures. A pediatric practice might need specific provisions for divorced parents or guardians regarding billing responsibilities. An urgent care clinic will emphasize immediate payment for services, whereas a chronic care management practice might focus more on recurring billing cycles and ongoing patient responsibility for long-term care.

You should tailor specific sections, such as accepted payment methods, the details of your payment plan options, or your specific policy for missed appointments. For instance, if your practice serves a diverse community, consider translating the policy into common languages spoken by your patient population to ensure better understanding and compliance. Thinking about different scenarios and adapting the core template allows you to create a document that is both comprehensive and highly relevant to your patient base and administrative workflow. This adaptability ensures your financial policy serves as a practical, living document rather than a rigid, one-size-fits-all solution.

Important Elements to Include in Your Medical Office Financial Policy Template

To create a truly effective and comprehensive Medical Office Financial Policy Template, several key elements must be thoroughly addressed. These components ensure clarity, mitigate risk, and streamline financial interactions.

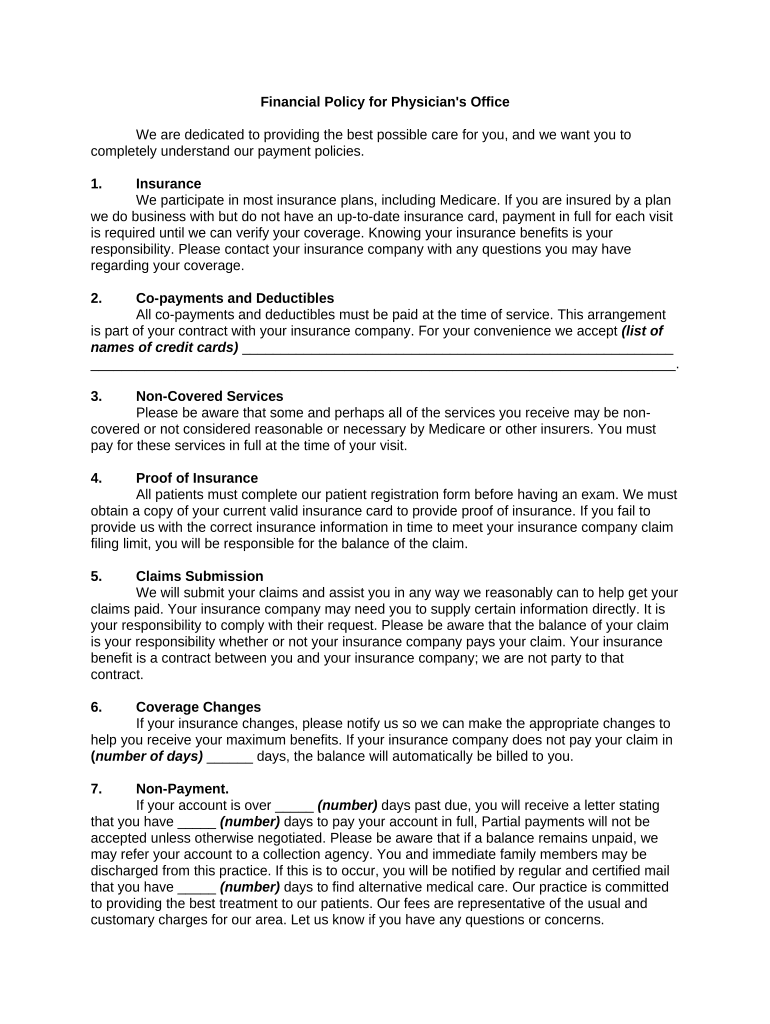

- Patient Responsibility for Co-payments, Deductibles, and Co-insurance: Clearly state that these amounts are due at the time of service, or by a specified deadline. Explain what these terms mean in simple language.

- Insurance Filing and Verification: Outline your practice’s policy regarding insurance claims – whether you file primary and secondary claims, the patient’s responsibility to provide accurate insurance information, and what happens if a claim is denied. Specify that patients are ultimately responsible for charges, regardless of insurance coverage.

- Accepted Payment Methods: List all forms of payment your practice accepts, such as credit cards, debit cards, checks, cash, and online payment portals.

- Payment Plans and Financial Hardship: Detail any available payment arrangements for larger balances, including eligibility criteria, required down payments, and interest policies. Include a compassionate but firm approach for patients experiencing genuine financial hardship, perhaps outlining a process for special consideration.

- Missed Appointment and Cancellation Policy: Clearly state the required notice for cancellations and the fees associated with no-shows or late cancellations. Explain how these charges are handled and that they are typically not covered by insurance.

- Collection Procedures for Past Due Accounts: Explain the steps your practice takes for overdue balances, including reminder notices, collection calls, potential use of collection agencies, and how this might affect future appointments. Be transparent about late fees or interest charges.

- Self-Pay Patients and Discounts: If your practice offers discounts for prompt payment by self-pay patients, outline the terms and conditions explicitly.

- Refund Policy: Clearly state the conditions under which refunds are issued, the process for requesting one, and the typical timeframe for processing.

- Required Forms and Signatures: Include a section for the patient or legal guardian to sign and date, acknowledging they have read, understood, and agree to the terms of the financial policy. This creates a binding agreement.

- HIPAA and Patient Data Security: Briefly mention how your financial policy aligns with patient privacy regarding billing information, reassuring patients about the security of their financial data and compliance with relevant regulations.

Tips for Design, Usability, and Implementation

A well-crafted Medical Office Financial Policy Template is only effective if it’s easy to understand and consistently implemented. Attention to design, usability, and strategic deployment can significantly impact its success.

Firstly, focus on clarity and conciseness in your language. Avoid jargon where possible, or provide simple explanations for complex terms. Use clear headings, bullet points, and short paragraphs to break up the text, making it less intimidating and easier to digest. Consider creating a simplified “Highlights” sheet for quick reference alongside the full, detailed policy.

Secondly, ensure accessibility. For print versions, use a legible font size (at least 11-12 points) and ample white space. For digital versions, ensure it’s mobile-friendly and easily downloadable from your website or patient portal. If your patient demographic includes non-English speakers, providing translated versions of your Medical Office Financial Policy Template can greatly improve understanding and compliance.

Thirdly, implement the policy consistently and uniformly across your practice. All staff members, especially those involved in front desk operations, billing, and patient intake, must be thoroughly trained on the policy’s contents and how to communicate it to patients. Regular training sessions can ensure everyone is on the same page and can confidently answer patient questions.

Fourthly, make the policy readily available. Display it prominently in your waiting area, have physical copies available at the front desk, and upload it to your practice website and patient portal. Patients should receive a copy at their initial visit and whenever the policy is updated. Utilizing digital signature options can streamline the acknowledgement process, especially for tech-savvy patients.

Finally, review and update your Medical Office Financial Policy Template regularly. Healthcare regulations, insurance contracts, and economic conditions can change, requiring adjustments to your policy. A periodic review (e.g., annually) ensures the policy remains current, compliant, and reflective of your practice’s operational realities.

Embracing a comprehensive Medical Office Financial Policy Template is more than just a procedural necessity; it’s a strategic investment in the long-term health and stability of your practice. By laying out clear expectations and procedures, you foster an environment of transparency, trust, and mutual respect with your patients. This proactive approach minimizes misunderstandings, reduces administrative burdens, and ensures a healthier financial outlook for your medical office.

Don’t let financial ambiguities overshadow the exceptional care you provide. Take the initiative to develop, customize, and implement a robust financial policy today. It’s a foundational step towards building a more efficient, compliant, and patient-friendly practice, ultimately allowing your team to focus more on what truly matters: delivering outstanding healthcare.