In the bustling world of nonprofit organizations, every dollar, every minute, and every document holds significant weight. From grant applications and donor records to volunteer agreements and board minutes, the sheer volume of paperwork, both physical and digital, can be overwhelming. But what happens to these critical documents once their immediate purpose is served? How long should they be kept, and how should they be disposed of safely and legally? This is precisely where a Nonprofit Document Retention Policy Template becomes an indispensable tool, offering a structured approach to managing your organization’s most vital information.

A well-crafted Nonprofit Document Retention Policy Template isn’t just about avoiding clutter; it’s a cornerstone of good governance, legal compliance, and operational efficiency. It provides clear guidelines for staff and board members, ensuring that valuable information is preserved while obsolete or sensitive data is securely discarded. Whether you’re a small community-based charity or a large international aid organization, understanding and implementing such a policy is crucial for protecting your mission, your reputation, and your stakeholders. This article will guide you through the intricacies of creating and utilizing an effective Nonprofit Document Retention Policy Template, offering insights for leaders, administrators, and anyone responsible for organizational oversight.

Why a Nonprofit Document Retention Policy Template is Essential

In today’s increasingly regulated landscape, a robust Nonprofit Document Retention Policy Template isn’t merely a suggestion; it’s a critical component of risk management and legal compliance. Nonprofits face scrutiny from various angles, including the IRS, state charity regulators, grant-making foundations, and the public. Without clear guidelines for record keeping, an organization can quickly find itself in hot water during an audit or, worse, in the midst of litigation. This policy helps demonstrate due diligence and a commitment to transparency and accountability, which are paramount in the charitable sector.

Moreover, the digital age brings with it new challenges, particularly around data security and privacy. A comprehensive Nonprofit Document Retention Policy Template addresses how digital records are stored, accessed, and ultimately destroyed, safeguarding sensitive information like donor contact details, financial data, and beneficiary personal information. It helps organizations navigate complex data privacy regulations, ensuring compliance and preventing potential data breaches that could erode public trust and incur significant penalties. By establishing clear workplace rules for document management, nonprofits can maintain strong internal controls and protect their assets.

Key Benefits of Using a Nonprofit Document Retention Policy Template

Implementing a standardized Nonprofit Document Retention Policy Template offers a multitude of benefits that extend far beyond simple compliance. Firstly, it brings clarity and consistency to your organization’s record-keeping practices. Every staff member, from the executive director to the newest intern, will understand their responsibilities regarding document management, reducing confusion and ensuring uniform application of procedures. This consistency is vital for maintaining an organized and efficient office environment.

Secondly, a well-defined policy protects your nonprofit by ensuring that critical legal and financial documents are always available when needed, such as during an IRS audit or a grant review. Simultaneously, it facilitates the secure and timely destruction of documents that are no longer legally required or operationally useful, mitigating the risk of holding onto unnecessary sensitive data. This proactive approach to data security minimizes the potential for information misuse or loss. Furthermore, having a clear policy demonstrates good governance to donors, funders, and the public, reinforcing your organization’s credibility and commitment to best practices in information governance. It’s a proactive step in managing legal obligations and protecting your organization’s reputation.

Customizing Your Nonprofit Document Retention Policy Template

No two nonprofits are exactly alike, and neither should their document retention policies be. While a Nonprofit Document Retention Policy Template provides an excellent starting point, it’s crucial to customize it to fit the unique needs, size, mission, and operational structure of your specific organization. A small volunteer-run charity, for example, will have different record-keeping requirements and resources than a large nonprofit with multiple programs and hundreds of employees.

When adapting your Nonprofit Document Retention Policy Template, consider the diverse types of documents your organization generates and receives. This includes financial records (e.g., invoices, bank statements, tax returns), HR documents (e.g., employee files, payroll records, volunteer agreements), program-specific documentation, legal contracts and agreements, donor records, and board meeting minutes. Each category may have different statutory retention periods. You’ll also need to factor in specific state and local laws, grant stipulations, and industry best practices relevant to your field of work. Engaging legal counsel during the customization process can ensure that your final policy fully aligns with all applicable compliance requirements and accurately reflects your legal obligations.

Essential Elements of a Nonprofit Document Retention Policy Template

A comprehensive and effective Nonprofit Document Retention Policy Template should include several key components to provide clear guidance and ensure compliance. These elements work together to create a robust framework for managing your organization’s information lifecycle:

- Policy Statement and Purpose: Clearly articulate the policy’s objective, which typically includes ensuring legal compliance, preserving institutional memory, protecting sensitive data, and promoting operational efficiency.

- Scope: Define which documents (both physical and electronic) and which individuals within the organization are covered by the policy. This might include board members, staff, volunteers, and even contractors.

- Roles and Responsibilities: Outline who is responsible for implementing, maintaining, and enforcing the policy. This usually includes specific departmental heads, IT staff, legal counsel, and the board of directors.

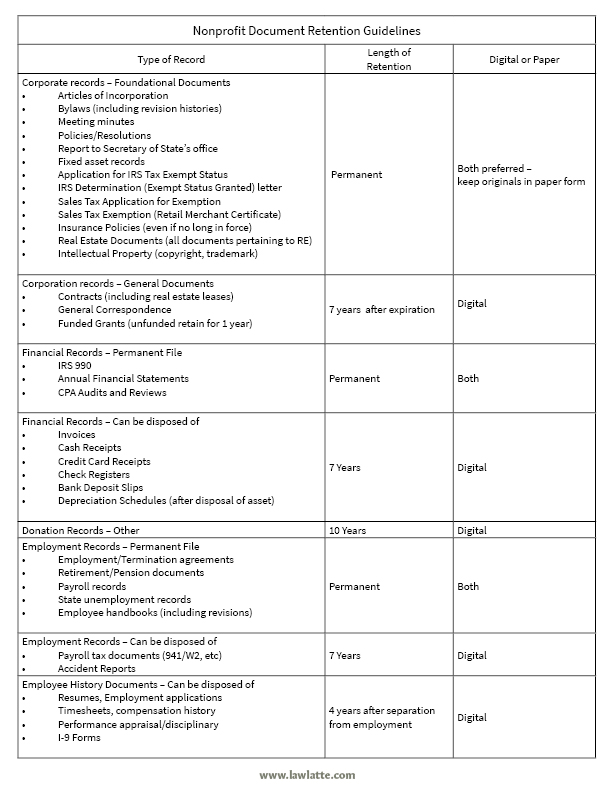

- Document Categorization and Retention Schedules: This is the core of the policy. Categorize documents by type (e.g., financial, HR, legal, program, donor records, board documents) and specify the minimum retention period for each category, citing legal or regulatory requirements where applicable. Include common examples like IRS tax forms (7 years), board minutes (permanently), and HR employee files (varies by state, often 7 years post-termination).

- Document Destruction Procedures: Detail the secure methods for disposing of documents at the end of their retention period. This should differentiate between physical documents (e.g., shredding, secure disposal) and electronic records (e.g., secure deletion, data wiping).

- Legal Holds (Litigation Holds): Include a provision for suspending document destruction when litigation, audits, or investigations are pending or reasonably anticipated. This critical element ensures no relevant documents are destroyed during a legal challenge.

- Electronic Records Management: Address specific guidelines for managing digital documents, including backup procedures, file formats, and storage locations (cloud vs. on-premise).

- Policy Review and Update Process: Establish a schedule for regular review and updates to the policy (e.g., annually or biennially) to ensure it remains current with changing laws, regulations, and organizational needs.

- Training and Communication: Outline how staff and board members will be informed about the policy and trained on its implementation.

Design, Usability, and Implementation Tips

Crafting an excellent Nonprofit Document Retention Policy Template is only half the battle; ensuring it’s used effectively is the other. Design and usability play a crucial role in successful implementation. First and foremost, the policy should be written in clear, concise language, avoiding unnecessary legal jargon. Staff and volunteers are more likely to adhere to guidelines they can easily understand. Consider using plain English and providing practical examples relevant to your organization’s daily operations.

For ease of access and reference, make the policy readily available in both print and digital formats. A digital version should be stored on a shared drive or your internal intranet, ideally as a searchable PDF. Physical copies can be kept in departmental handbooks or common areas. When it comes to implementation, regular training sessions are vital. These sessions should explain the "why" behind the policy, not just the "what," emphasizing its role in compliance, data security, and overall organizational well-being. Integrate the policy into your onboarding process for new employees and volunteers to ensure everyone understands their responsibilities from day one. Consider linking your Nonprofit Document Retention Policy Template to other workplace rules, such as your data privacy or HR policies, to create a cohesive framework for information governance. Regular communication, perhaps via internal newsletters or reminders, can also help keep the policy top of mind.

A well-designed Nonprofit Document Retention Policy Template isn’t just a static document; it’s a living guide that requires ongoing attention. By making it user-friendly and embedding it within your organizational culture, you transform a compliance requirement into a valuable asset. It empowers your team to manage information responsibly, reinforces your commitment to legal obligations, and ultimately strengthens your nonprofit’s ability to achieve its mission.

In a world where information is both an asset and a liability, having a well-defined Nonprofit Document Retention Policy Template is no longer optional—it’s imperative. It serves as your organization’s blueprint for managing the complex lifecycle of its records, protecting you from legal and financial risks while fostering an environment of trust and transparency. By investing the time to develop and implement such a policy, you are not just ticking a compliance box; you are actively fortifying your nonprofit’s resilience, ensuring its longevity, and safeguarding its valuable mission for years to come. Take the initiative today to customize a Nonprofit Document Retention Policy Template that truly serves your organization’s unique needs and supports its continued success.