In today’s fast-paced and interconnected business environment, organizations face an unprecedented array of challenges. From supply chain disruptions and cybersecurity threats to regulatory changes and human error, the landscape of potential pitfalls is vast and ever-evolving. Navigating this complexity requires more than just reactive measures; it demands a proactive, systematic approach to understanding, assessing, and mitigating risks that could derail operations, harm reputation, or impact the bottom line.

This is precisely where a robust Operational Risk Management Policy Template becomes indispensable. It’s not merely a document; it’s a foundational blueprint that guides an organization in embedding risk awareness into its culture and daily activities. Whether you’re a burgeoning startup establishing your governance framework, a mid-sized firm looking to standardize compliance, or a large enterprise aiming to refine your risk posture, leveraging an effective Operational Risk Management Policy Template can provide the structure and clarity needed to manage operational uncertainties with confidence.

Why an Operational Risk Management Policy Template is Essential Today

The modern business world is characterized by constant change and increasing volatility. Global events, technological advancements, and shifts in consumer behavior can rapidly introduce new operational risks. Without a clear and documented approach, businesses can find themselves scrambling to address issues, often after significant damage has occurred. An Operational Risk Management Policy Template provides the necessary framework to anticipate and prepare for these challenges.

Regulatory bodies are also placing greater emphasis on robust risk management practices. Industries from finance and healthcare to manufacturing are subject to stringent compliance requirements, which often necessitate a documented and auditable operational risk framework. An Operational Risk Management Policy Template serves as a cornerstone for demonstrating due diligence and adherence to these critical obligations. It helps organizations not only meet legal terms and obligations but also to proactively build resilience.

Furthermore, stakeholder expectations regarding corporate governance and transparency are higher than ever. Investors, customers, and employees expect organizations to operate responsibly and sustainably. Implementing an Operational Risk Management Policy Template signals a commitment to sound governance, protecting assets, and fostering a secure and reliable operational environment, which includes critical aspects like data security and workplace rules.

Key Benefits of Using an Operational Risk Management Policy Template

Adopting a well-structured Operational Risk Management Policy Template offers a multitude of strategic and operational advantages. First and foremost, it provides standardization and consistency across all departments and business units. This ensures that every part of the organization approaches risk identification, assessment, and mitigation using a common language and methodology, eliminating fragmented efforts and enhancing overall effectiveness.

Secondly, an Operational Risk Management Policy Template is a significant time-saver. Instead of starting from scratch, organizations can adapt a pre-designed framework, allowing them to allocate more resources to content development and customization rather than basic structural design. This accelerated implementation means that the benefits of a formalized risk management program can be realized much sooner.

Thirdly, it helps ensure comprehensive coverage of potential risks. A well-designed Operational Risk Management Policy Template typically includes sections that prompt consideration of a broad spectrum of risks, from process failures and system outages to human error and external events. This systematic approach reduces the likelihood of overlooking critical areas that might otherwise be neglected.

Moreover, having a clear policy improves decision-making. When risks are identified, assessed, and understood within a defined framework, management can make more informed choices about resource allocation, strategic planning, and crisis response. It also facilitates effective training and awareness programs, ensuring that all employees understand their roles in maintaining a strong risk culture.

Finally, an effective Operational Risk Management Policy Template significantly bolsters regulatory compliance efforts. By providing a clear record of an organization’s approach to operational risk, it simplifies audits, demonstrates commitment to best practices, and helps avoid potential penalties or reputational damage associated with non-compliance.

Customizing Your Operational Risk Management Policy Template

While an Operational Risk Management Policy Template provides a robust foundation, its true value comes from its adaptability. No two organizations are identical; they operate in different industries, vary in size and complexity, and face unique risk profiles. Therefore, customization is not just an option, but a necessity for the policy to be truly effective.

Organizations should tailor their Operational Risk Management Policy Template to reflect their specific risk appetite and strategic objectives. This involves adjusting the scope and depth of various sections to align with the company’s operational footprint. For instance, a tech company might place a heavier emphasis on cybersecurity and data security risks, while a manufacturing firm might focus more on supply chain disruptions and plant safety.

Consider the industry-specific regulations and standards that apply to your business. A healthcare provider, for example, will need to incorporate HIPAA compliance requirements, while a financial institution will need to address regulations like SOX or Dodd-Frank. The Operational Risk Management Policy Template should be updated to explicitly reference these critical external obligations.

Furthermore, the template should be adapted to the organizational structure and culture. Clearly define roles and responsibilities that match your existing hierarchy, whether it’s a centralized risk function or a distributed model with risk owners in each department. Ensure the language used resonates with your employees, making the policy accessible and understandable rather than a complex legal document.

Important Elements of an Operational Risk Management Policy Template

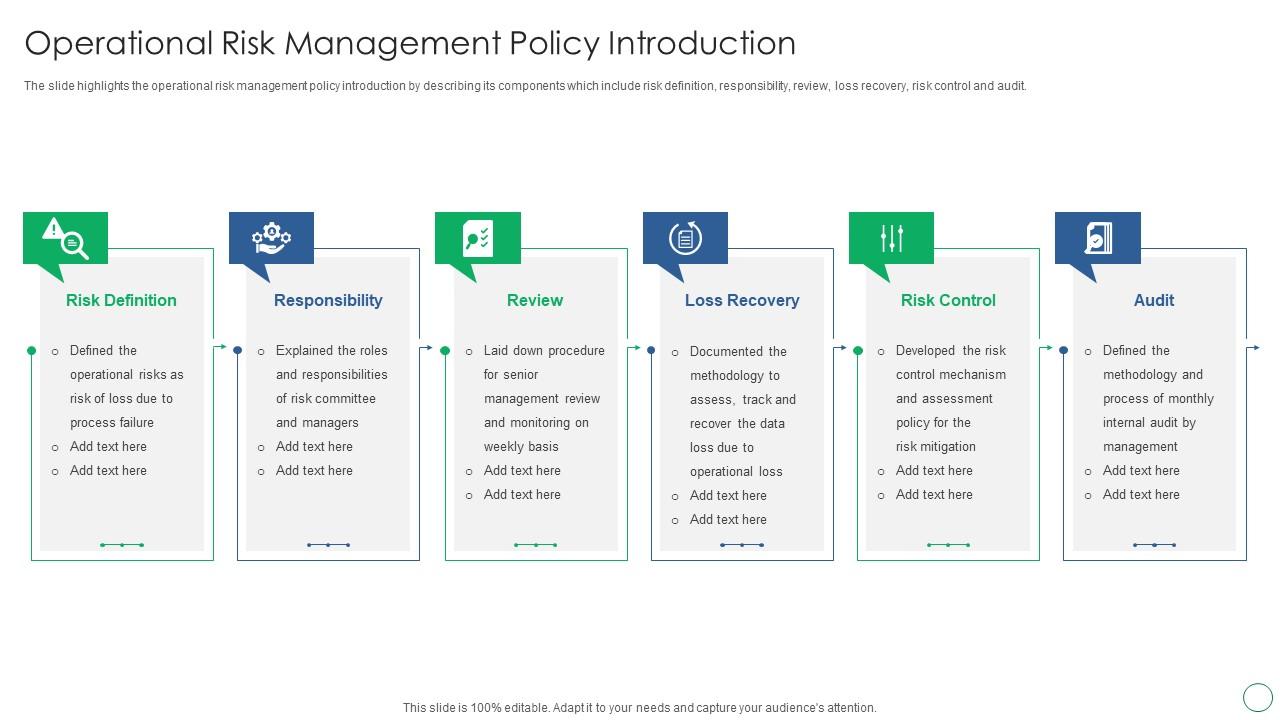

A comprehensive Operational Risk Management Policy Template should include several key elements to ensure it covers all essential aspects of managing operational risk effectively. These sections provide the structure and content necessary for a robust framework:

- Policy Statement: A clear, concise statement outlining the organization’s commitment to operational risk management, its objectives, and its overall risk appetite. This sets the tone for the entire document.

- Scope: Defines which entities, processes, systems, and activities within the organization are covered by the policy. It also specifies any exclusions, ensuring clarity on its applicability.

- Definitions: A glossary of key terms (e.g., operational risk, risk event, control, mitigation, risk appetite) to ensure a common understanding across the organization.

- Roles and Responsibilities: Clearly delineates who is accountable for what in the operational risk management process, from the Board of Directors and senior management to department heads and individual employees. This includes responsibilities for risk identification, assessment, and reporting.

- Risk Identification: Outlines the methodologies and tools used to identify potential operational risks. This might include workshops, incident data analysis, process mapping, and external threat intelligence.

- Risk Assessment and Analysis: Describes the process for evaluating identified risks, including qualitative and quantitative techniques for assessing likelihood and impact. It also covers the classification of risks (e.g., high, medium, low).

- Risk Mitigation and Control: Details the strategies and control frameworks employed to reduce or eliminate identified risks. This includes preventative controls, detective controls, and corrective actions, along with defining residual risk.

- Risk Monitoring and Review: Explains how operational risks and the effectiveness of controls will be continuously monitored, reviewed, and reported. This section often includes requirements for periodic policy reviews and updates.

- Reporting and Communication: Specifies the channels, frequency, and content of operational risk reports to various stakeholders, including management, the board, and regulatory bodies.

- Incident Management and Business Continuity: Addresses the procedures for responding to and recovering from operational risk events, including incident reporting, investigation, and the activation of business continuity plans.

- Training and Awareness: Outlines the requirements for educating employees on their role in operational risk management and ensuring a strong risk culture.

- Documentation and Record-Keeping: Specifies the requirements for documenting all aspects of the operational risk management process, including risk registers, assessment reports, and control effectiveness reviews.

Tips for Design, Usability, and Implementation

An Operational Risk Management Policy Template is only effective if it’s usable and understandable by its intended audience. When designing and implementing your policy, prioritize clarity and accessibility. Use clear, concise language, avoiding jargon where possible, or defining it thoroughly in your definitions section. Short paragraphs (2-4 sentences) and bullet points enhance readability significantly.

For usability, consider how employees will access and interact with the policy. A digital format, hosted on an internal intranet or a dedicated Governance, Risk, and Compliance (GRC) platform, allows for easy searchability and updates. Ensure proper version control is in place, so users always access the most current iteration of the Operational Risk Management Policy Template. If a print version is necessary for specific contexts (e.g., on-site manuals for certain operational areas), ensure it is well-formatted and includes version numbers.

Implementation extends beyond merely publishing the document. It requires a comprehensive rollout strategy. Conduct thorough training sessions for relevant stakeholders, explaining the policy’s purpose, key elements, and individual responsibilities. Link the policy to existing operational procedures and integrate it into performance management where appropriate. This includes weaving aspects of data security protocols and workplace rules directly into daily operations.

Seek feedback regularly. An Operational Risk Management Policy Template is a living document that should evolve with your organization and the external risk landscape. Establish a review cycle, perhaps annually or semi-annually, to assess its effectiveness and make necessary adjustments. Engage employees from various levels in this review process to gain diverse perspectives and foster buy-in.

Embracing an Operational Risk Management Policy Template isn’t just about ticking a compliance box; it’s about building a resilient, forward-thinking organization. By systematically identifying, assessing, and mitigating operational risks, businesses can safeguard their assets, protect their reputation, and ensure continuity in the face of uncertainty. The structured approach offered by such a template provides the clarity and direction needed to navigate the complexities of today’s business environment, transforming potential vulnerabilities into managed challenges.

So, whether you’re starting fresh or refining existing frameworks, consider how a well-crafted Operational Risk Management Policy Template can serve as your strategic partner. It’s an investment in stability, a commitment to sound governance, and a proactive step towards securing your organization’s future. Utilize this powerful tool to strengthen your operational foundation and empower your teams to manage risk with confidence and clarity.