In today’s complex and interconnected business world, organizations are increasingly under scrutiny regarding their ethical practices, governance standards, and transparency. One area that frequently attracts attention, both from regulators and stakeholders, is related party transactions. These dealings, while often legitimate and beneficial, carry inherent risks of conflicts of interest, perceived unfairness, and even outright fraud if not managed with meticulous care. This is precisely where a robust Related Party Transaction Policy Template becomes an indispensable tool for any entity aiming to uphold the highest standards of corporate integrity and build enduring trust.

A thoughtfully designed Related Party Transaction Policy Template serves as the cornerstone for ethical conduct, providing clear guidelines and procedures for identifying, reviewing, and approving transactions involving individuals or entities with a close relationship to the organization. Whether you’re a publicly traded corporation, a growing private company, a non-profit organization, or even a sophisticated family office, establishing such a framework is not merely a matter of compliance; it’s a strategic imperative that protects reputation, mitigates legal risks, and fosters a culture of transparency. It helps everyone, from the board of directors to the newest employee, understand the boundaries and expectations for fair dealing.

Why a Related Party Transaction Policy Template is Essential

The landscape of corporate governance has evolved significantly, placing a heightened emphasis on transparency and accountability. A comprehensive Related Party Transaction Policy Template is no longer a “nice-to-have” but an absolute necessity for several critical reasons. Firstly, regulatory bodies across the US, from the Securities and Exchange Commission (SEC) for public companies to state charity commissions for non-profits, impose strict requirements for the disclosure and oversight of related party transactions. Non-compliance can lead to severe penalties, reputational damage, and costly litigation, making a strong policy a crucial aspect of overall compliance efforts.

Beyond regulatory mandates, the integrity of an organization hinges on its ability to manage potential conflicts of interest. Related party transactions, by their very nature, introduce the possibility of such conflicts, where the personal interests of an individual might unduly influence a business decision. A well-defined Related Party Transaction Policy Template provides the necessary internal controls to identify, evaluate, and mitigate these risks, ensuring that all transactions are conducted on an arm’s-length basis and are in the best interest of the organization and its shareholders or beneficiaries. This proactive approach safeguards assets, promotes ethical decision-making, and significantly bolsters stakeholder confidence in the organization’s governance.

Key Benefits of Using a Related Party Transaction Policy Template

Adopting and implementing a Related Party Transaction Policy Template offers a multitude of benefits that extend far beyond mere compliance. One of the primary advantages is enhanced transparency. By establishing clear procedures for disclosure and approval, the policy ensures that all relevant information about related party dealings is brought to light, allowing for informed decision-making and preventing hidden agendas. This openness fosters greater trust among investors, donors, employees, and the public, bolstering the organization’s reputation as an ethical and well-governed entity.

Another significant benefit is robust risk mitigation. Related party transactions are a common source of legal and financial exposure if not properly managed. The structured approach provided by a Related Party Transaction Policy Template helps to identify potential risks early, implement safeguards, and document the decision-making process. This due diligence can be invaluable in defending against accusations of impropriety or unfair dealing, offering a layer of legal protection. Furthermore, it streamlines the review process, ensuring consistency and efficiency in how these transactions are handled. This reduces administrative burdens and allows management to focus on core strategic objectives, knowing that a clear framework is in place for these potentially sensitive dealings, ultimately contributing to better internal controls and organizational integrity.

Customizing Your Related Party Transaction Policy Template

While a Related Party Transaction Policy Template provides an excellent starting point, its true value is unlocked through careful customization to fit the unique context of your organization. No two businesses are exactly alike, and what works for a large public corporation may not be suitable for a small, privately held family business or a non-profit with a focused mission. The first step in customization involves understanding your organizational structure, including ownership, governance model, and specific operational needs. For example, a publicly traded company will need to rigorously adhere to SEC requirements and potentially stock exchange rules, which might necessitate more detailed disclosure and approval processes than a private company.

Industry specifics also play a crucial role. Financial institutions, for instance, might face different related party transaction regulations and expectations compared to a tech startup or a healthcare provider. Consider the typical nature and frequency of transactions your organization engages in. Do you regularly transact with subsidiaries, joint ventures, or entities controlled by board members? Your Related Party Transaction Policy Template should be tailored to address these common scenarios. Finally, assess your risk tolerance and the size and complexity of your typical transactions. Smaller, less material transactions might warrant a simplified review process, while larger, more significant dealings will undoubtedly require robust independent oversight. The goal is to create a policy that is effective, enforceable, and proportionate to your organization’s specific environment, not a one-size-fits-all document.

Important Elements for Your Related Party Transaction Policy Template

A comprehensive and effective Related Party Transaction Policy Template must include several key elements to ensure clarity, enforceability, and compliance. These components form the backbone of a strong governance framework, guiding employees and leadership alike.

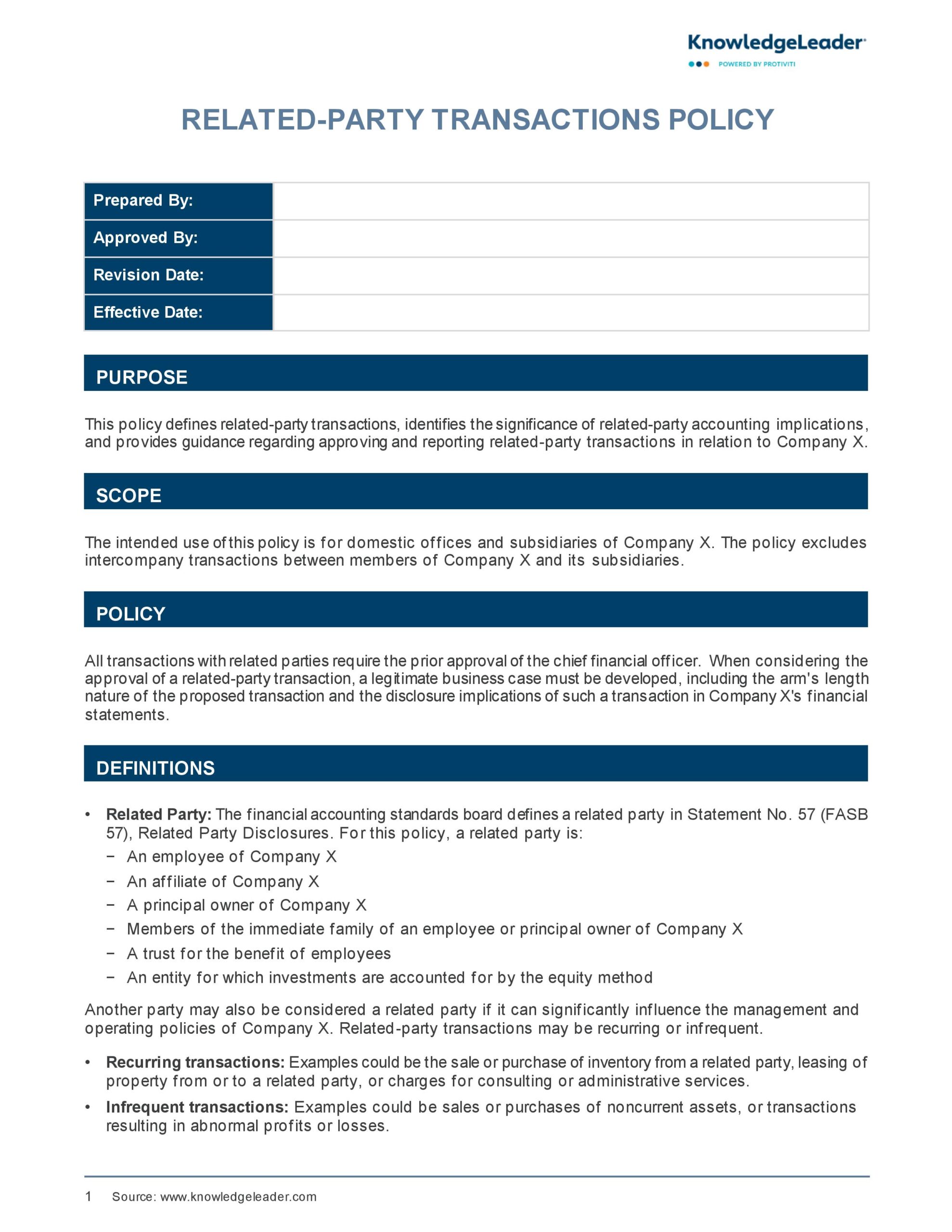

- Definition of Related Party: Clearly define who constitutes a “related party,” typically including directors, officers, principal shareholders, their immediate family members, and entities in which they have a material interest or significant influence.

- Definition of Related Party Transaction: Outline what types of transactions fall under the policy’s scope. This should be broad, covering any financial or material transaction, including sales, purchases, services, leases, loans, guarantees, and asset transfers.

- Scope and Applicability: Specify to whom the policy applies (e.g., all employees, officers, directors, and potentially significant contractors) and which types of transactions (e.g., all transactions, or those exceeding certain materiality thresholds).

- Identification and Disclosure Procedures: Detail the process for identifying potential related parties and for disclosing proposed related party transactions. This often involves annual questionnaires for directors and officers, as well as a requirement for real-time disclosure of new potential transactions.

- Review and Approval Process: Establish a clear, multi-layered review and approval hierarchy. This typically involves review by management, potentially independent legal counsel, and ultimately approval by an independent committee of the board of directors (e.g., audit committee) or the full board, excluding any interested parties.

- Materiality Thresholds: Define what constitutes a “material” related party transaction, which may trigger more rigorous review and disclosure requirements. These thresholds can be quantitative (e.g., dollar amounts) or qualitative (e.g., impact on reputation).

- Documentation Requirements: Mandate thorough documentation for all related party transactions, including the rationale, the review process, independent valuations (if applicable), and the final approval.

- Arm’s-Length Principle: Explicitly state that all related party transactions must be conducted on terms no less favorable to the organization than those obtainable from an unrelated third party through arm’s-length negotiations.

- Conflict of Interest Avoidance: Include provisions that reiterate the organization’s broader commitment to avoiding conflicts of interest and how this policy supports that objective.

- Confidentiality: Address the treatment of sensitive information related to related party transactions.

- Training and Communication: Outline plans for educating relevant personnel on the policy’s requirements.

- Annual Review and Update: Specify that the Related Party Transaction Policy Template itself will be reviewed and updated periodically to reflect changes in regulations, best practices, or the organization’s structure.

- Enforcement and Consequences: Detail the consequences of non-compliance with the policy, reinforcing its importance and enforceability.

Design, Usability, and Implementation Tips

Once you have meticulously crafted the content of your Related Party Transaction Policy Template, its effectiveness largely hinges on its design, usability, and thoughtful implementation. A policy, no matter how comprehensive, is only useful if it’s accessible and understood by those who need to follow it. For design, focus on clarity and readability. Use clear, concise language, avoiding excessive legal jargon where possible. Employ headings, subheadings, bullet points, and short paragraphs to break up text and make it easy to digest. A well-organized table of contents and an index can significantly improve navigation, especially for longer documents.

When considering usability, think about both print and digital formats. For digital, ensure the document is easily searchable (e.g., a PDF with optical character recognition) and can be hosted on an intranet or secure cloud platform. Version control is paramount; clearly mark the effective date and version number to prevent confusion. If printed, ensure it’s in a binder or easily locatable in a policy manual. More importantly, implementation involves more than just distributing the document. Develop a comprehensive communication plan to announce the policy, explain its importance, and highlight key changes if it’s an update. Regular training sessions for directors, officers, and key employees are crucial to ensure everyone understands their obligations under the Related Party Transaction Policy Template. Consider integrating this policy with other corporate policies and internal guidelines, such as codes of conduct and ethics policies, to create a cohesive framework for organizational integrity. Providing real-world examples in training can also help illustrate how the policy applies in practical situations.

A well-crafted Related Party Transaction Policy Template is far more than just a bureaucratic obligation; it is a vital strategic asset that underpins an organization’s ethical foundation and long-term success. By providing clear guidelines, fostering transparency, and mitigating risks associated with complex dealings, it safeguards against potential conflicts of interest and reinforces a commitment to fair business practices. Embracing such a policy isn’t just about avoiding legal pitfalls; it’s about actively building and maintaining the trust of all stakeholders, from investors and employees to customers and the wider community.

Ultimately, investing the time and resources into developing and implementing a robust Related Party Transaction Policy Template demonstrates an unwavering dedication to sound corporate governance. It equips your organization with the tools necessary to navigate intricate business relationships with confidence and integrity, ensuring that every decision serves the best interests of the entity. Consider this template not as a burden, but as an essential element in cultivating a resilient, ethical, and highly reputable organization in today’s demanding business environment.