In the passionate world of nonprofits, where every dollar and every hour of effort is dedicated to a vital cause, the focus is almost always on impact. Organizations pour their energy into serving communities, advocating for change, and providing essential services. However, even the noblest missions can be derailed by unforeseen challenges if a robust framework isn’t in place to identify and mitigate potential pitfalls. This is precisely where a well-structured Risk Management Policy Template Nonprofit becomes not just a useful tool, but an indispensable safeguard.

For board members, executive directors, and dedicated staff, the idea of “risk management” might conjure images of complex corporate jargon or daunting legal documents. But at its core, it’s about foresight – anticipating what could go wrong and planning how to prevent it or respond effectively. A tailored Risk Management Policy Template Nonprofit simplifies this crucial process, offering a clear roadmap to protect your organization’s assets, reputation, and, most importantly, its ability to fulfill its mission. It transforms abstract concerns into actionable steps, ensuring continuity and resilience in an unpredictable world.

Why a Risk Management Policy Template Nonprofit is Essential in Today’s Context

The operational landscape for nonprofits has never been more complex. Increased regulatory scrutiny, heightened donor expectations regarding transparency and accountability, and a rapidly evolving digital environment all contribute to a myriad of potential risks. A comprehensive Risk Management Policy Template Nonprofit serves as your organization’s compass through these turbulent waters, preventing potential crises from becoming mission-critical failures.

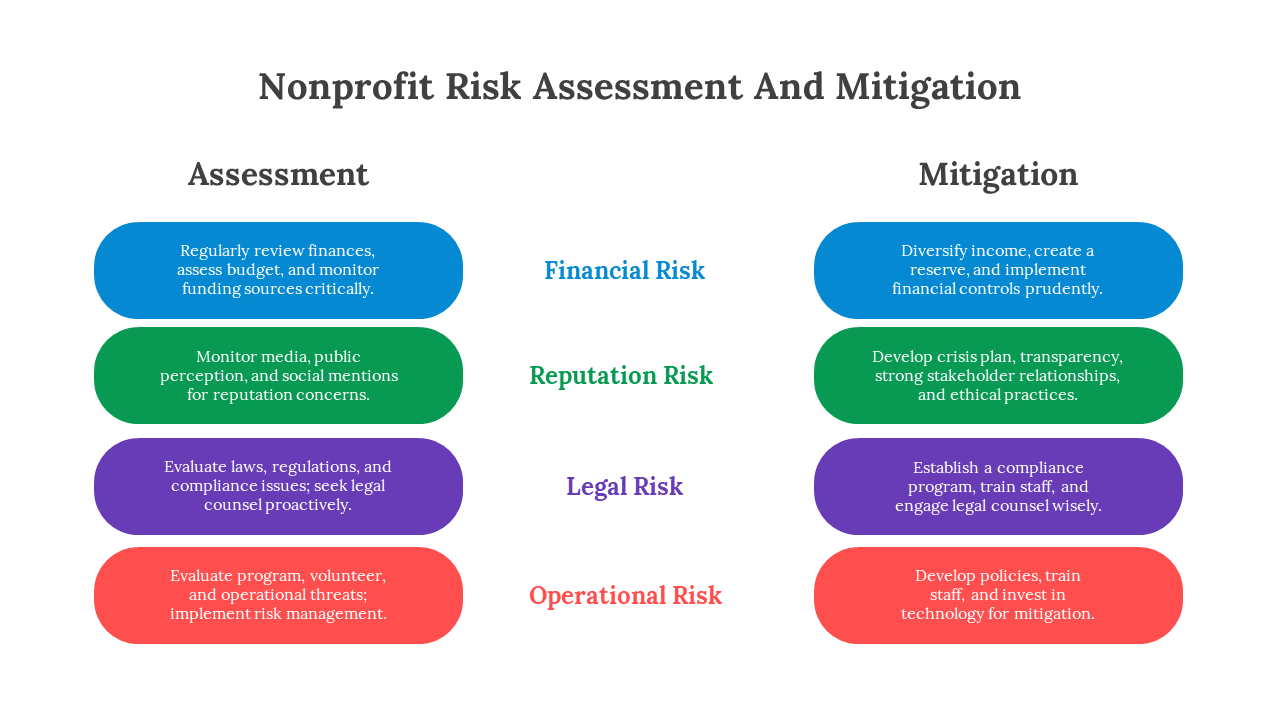

Consider the diverse challenges: financial stability can be threatened by economic downturns or grant funding changes; operational risks may arise from volunteer safety issues or facility maintenance; reputational damage can stem from a mishandled incident or a data security breach; and legal liabilities are always a concern, from employment practices to contractual obligations with vendors. Without a proactive strategy, these issues can quickly erode public trust, impact fundraising efforts, and divert precious resources away from program delivery. A formalized policy, facilitated by a strong Risk Management Policy Template Nonprofit, demonstrates good governance and a commitment to protecting the organization’s future.

Key Benefits of Using a Risk Management Policy Template Nonprofit

Implementing a robust risk management policy offers far more than just crisis prevention; it cultivates an environment of strategic foresight and operational excellence. One of the primary benefits is enhanced protection of your organization’s mission and assets. By systematically identifying and addressing potential threats, you safeguard financial resources, intellectual property, and critical data from harm.

Furthermore, a well-defined policy fosters greater donor confidence and trust. Funders and supporters are increasingly scrutinizing the governance and operational integrity of the organizations they support. A clear commitment to risk management, often demonstrated through a published policy, assures stakeholders that their contributions are handled responsibly and that the organization is resilient. It also improves decision-making across the board, providing a structured framework for evaluating new programs, partnerships, or initiatives by weighing potential risks against anticipated benefits. Finally, it helps ensure compliance with legal and regulatory requirements, minimizing the potential for fines, sanctions, or reputational harm from non-compliance.

How a Risk Management Policy Template Nonprofit Can Be Customized or Adapted

The beauty of a well-designed Risk Management Policy Template Nonprofit lies in its flexibility. No two nonprofits are exactly alike; a small, volunteer-run local charity faces very different risks than a large international aid organization with complex supply chains and global operations. This template isn’t a rigid, one-size-fits-all solution, but rather a robust framework designed to be a starting point, adapting to your specific needs.

Customization involves several steps. Begin by considering your organization’s size, scope, and specific mission. A nonprofit focused on youth mentorship might prioritize volunteer background checks and child protection policies, while an environmental advocacy group might focus more on legal challenges and public relations risks. Tailor the language to reflect your internal culture and existing compliance frameworks. You might need to add specific sections detailing risks unique to your sector, such as data security for organizations handling sensitive client information, or health and safety protocols for those operating in remote areas. The template provides the structure; your team provides the context and specific content to make it truly effective for your unique organizational journey.

Important Elements or Fields That Should Be Included in a Risk Management Policy Template Nonprofit

A truly effective Risk Management Policy Template Nonprofit will encompass several critical sections, ensuring a comprehensive approach to identifying, assessing, mitigating, and monitoring risks. These elements provide a structured blueprint for action and accountability.

- Policy Statement and Objectives: Clearly articulate the organization’s commitment to risk management, defining its purpose and overall goals, such as safeguarding assets, ensuring operational continuity, and protecting reputation.

- Scope and Definitions: Define what the policy covers (e.g., all departments, programs, staff, volunteers, and operations) and provide clear definitions for key terms like “risk,” “likelihood,” “impact,” and “mitigation.”

- Roles and Responsibilities: Clearly assign who is responsible for what. This often includes the Board of Directors for oversight, the Executive Director for implementation, and specific staff or committees for day-to-day risk identification and monitoring.

- Risk Identification Process: Outline the systematic methods for identifying potential risks, including brainstorming sessions, internal audits, external reviews, incident reporting, and stakeholder feedback.

- Risk Assessment and Prioritization: Detail how identified risks will be analyzed, including evaluating the likelihood of occurrence and the potential impact on the organization. This section should also explain how risks are prioritized based on severity.

- Risk Mitigation and Treatment Strategies: Describe the various approaches to address risks: avoidance (eliminating the risk), reduction (minimizing impact or likelihood), transfer (sharing the risk, e.g., insurance), and acceptance (acknowledging and monitoring the risk).

- Monitoring, Review, and Reporting: Establish a schedule and process for regularly monitoring identified risks, reviewing the effectiveness of mitigation strategies, and reporting on the overall risk profile to relevant stakeholders, especially the Board.

- Crisis Management and Business Continuity Planning: While distinct, these are often closely related. Outline procedures for responding to significant events, ensuring essential operations can continue during a disruption, and managing communication during a crisis.

- Training and Communication: Emphasize the importance of training staff and volunteers on risk management principles and ensuring effective communication channels for reporting and discussing risks.

- Documentation and Record-Keeping: Specify how risk assessments, mitigation plans, incident reports, and policy reviews will be documented and maintained for audit purposes and continuous improvement.

Tips on Design, Usability, and Implementation

Creating a robust Risk Management Policy Template Nonprofit is only half the battle; ensuring it’s usable, accessible, and effectively implemented is crucial. Design plays a significant role in readability and engagement. Opt for clear, concise language, avoiding jargon where possible. Use headings, subheadings, bullet points, and white space to break up text, making it easy to scan and digest. For digital versions, ensure it’s a searchable PDF and compatible with various devices. For print, consider a binder format that allows for easy updates and distribution to key personnel.

Usability extends to how the policy integrates into your existing organizational culture. Don’t let it become a document gathering dust on a virtual shelf. Actively train all relevant staff and volunteers on its contents and their roles within it. Develop practical tools, like simple risk assessment forms or incident report templates, that align with the policy. Encourage a culture where risk discussion is open and proactive, rather than reactive. Review the Risk Management Policy Template Nonprofit annually, or whenever significant organizational changes occur, to ensure it remains relevant and effective. Implementation is an ongoing process, not a one-time event; regular review and adaptation are key to its long-term success.

Embracing a comprehensive Risk Management Policy Template Nonprofit is more than just fulfilling a governance requirement; it’s an investment in your organization’s future. It empowers you to navigate uncertainties with confidence, protecting the invaluable work you do for your community. By proactively addressing potential challenges, you not only safeguard your resources and reputation but also strengthen your ability to deliver on your mission, ensuring that every effort contributes meaningfully to the cause.

Ultimately, this template provides a structured yet adaptable approach, allowing your nonprofit to build resilience and ensure continuity, no matter what external pressures arise. It transforms the daunting task of risk management into a manageable and strategic undertaking, providing peace of mind and allowing your dedicated team to focus on what truly matters: making a positive impact in the world. Consider making the Risk Management Policy Template Nonprofit a cornerstone of your operational strategy – it’s a decision that will pay dividends for years to come.