In today’s interconnected global economy, no business operates in a vacuum. Companies increasingly rely on a complex web of third parties – from vendors and suppliers to distributors, agents, and joint venture partners – to drive innovation, expand market reach, and optimize operations. While these relationships are indispensable, they also introduce a unique set of risks that can have profound financial, operational, and reputational consequences. Without a structured approach to understanding who you’re doing business with, a company can unwittingly expose itself to regulatory penalties, data breaches, corruption scandals, and significant brand damage.

This is precisely where a robust Third Party Due Diligence Policy Template becomes not just an asset, but a critical safeguard. It provides a foundational framework, a blueprint that guides organizations through the meticulous process of vetting and monitoring external entities. Far from being a mere bureaucratic exercise, this template is an indispensable tool for compliance officers, legal teams, procurement departments, and C-suite executives who bear the ultimate responsibility for an organization’s ethical conduct and regulatory adherence. It empowers businesses to proactively identify, assess, and mitigate the inherent risks associated with their external ecosystem.

Why a Third Party Due Diligence Policy Template is Essential Today

The modern business landscape is characterized by accelerating regulatory scrutiny and an ever-evolving threat environment. Governments worldwide are intensifying their focus on corporate accountability, particularly concerning anti-bribery and corruption (ABC) laws like the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act. Beyond corruption, companies face stringent data privacy regulations such as GDPR and CCPA, anti-money laundering (AML) laws, and complex sanctions programs enforced by bodies like OFAC. A lapse by a third party can directly implicate the primary organization, leading to substantial fines, debarment, and severe reputational damage.

Moreover, operational risks stemming from third-party relationships are increasingly prevalent. Supply chain disruptions, cybersecurity vulnerabilities, and breaches of sensitive data often originate with an external partner. Without a clear and comprehensive Third Party Due Diligence Policy Template, organizations are left to react to crises rather than prevent them. It’s no longer enough to trust; organizations must verify. This template ensures that every new relationship, and ongoing ones, is subjected to a consistent level of scrutiny, aligning the company’s risk management strategy with its strategic objectives and regulatory obligations. It acts as a shield, protecting against unforeseen liabilities and fostering a culture of informed decision-making across all external engagements.

Key Benefits of Using a Third Party Due Diligence Policy Template

Implementing and adhering to a well-crafted Third Party Due Diligence Policy Template offers a multitude of strategic advantages beyond mere compliance. Firstly, it drives standardization and consistency. By providing a uniform set of procedures and criteria, the template ensures that every third-party relationship, regardless of its origin or nature, undergoes a comparable level of scrutiny. This eliminates ad-hoc approaches and reduces the likelihood of critical risks being overlooked.

Secondly, it significantly enhances risk mitigation. The template facilitates the proactive identification of potential financial, operational, legal, and reputational risks before they materialize. This includes screening for adverse media, sanctions, politically exposed persons (PEPs), and assessing financial stability or ethical track records. Thirdly, it provides demonstrable compliance assurance. Regulators often require evidence of a robust compliance program, and a comprehensive Third Party Due Diligence Policy Template serves as concrete proof of an organization’s commitment to ethical conduct and legal adherence.

Furthermore, leveraging such a template leads to operational efficiency. By streamlining the due diligence process with clear guidelines, checklists, and documentation requirements, it reduces the time and resources expended on vetting, allowing teams to allocate efforts more effectively. Lastly, it fosters improved decision-making and enhanced reputation. With better information about prospective partners, businesses can make more informed choices, selecting third parties that align with their values and risk appetite. This proactive stance bolsters stakeholder trust, reinforces brand integrity, and positions the company as a responsible and ethical market player.

How a Third Party Due Diligence Policy Template Can Be Customized or Adapted

While the core principles of due diligence remain universal, a one-size-fits-all approach rarely suffices. A well-designed Third Party Due Diligence Policy Template is inherently flexible and can—and should—be tailored to an organization’s specific context. Customization begins with understanding the company’s unique industry and risk profile. For instance, a financial institution will require more stringent anti-money laundering and sanctions screening protocols than a manufacturing firm, which might focus more on supply chain ethics and environmental compliance.

The size and complexity of the organization also dictate the level of adaptation. A small startup might begin with a streamlined version, focusing on critical vendors, while a multinational corporation will need a more elaborate framework to manage thousands of diverse third parties across multiple jurisdictions. Geographic scope is another crucial factor; a company operating in high-risk corruption zones will necessitate enhanced due diligence procedures for local partners.

Furthermore, the types of third parties engaged play a significant role. Due diligence for a critical IT vendor handling sensitive data will differ greatly from that required for a marketing agency or a temporary staffing service. The Third Party Due Diligence Policy Template can be adapted to define tiered approaches, where the depth of scrutiny correlates with the level of risk posed by the third party. Integration with existing Governance, Risk, and Compliance (GRC) platforms or other enterprise systems is also key. The template can be modified to align with existing data capture methods, workflow automation, and reporting mechanisms, ensuring a cohesive and efficient risk management ecosystem. The ability to adapt this template ensures that it remains a relevant, practical, and effective tool as your business evolves.

Important Elements to Include in a Third Party Due Diligence Policy Template

A truly effective Third Party Due Diligence Policy Template must be comprehensive, covering all critical aspects of managing third-party risk. Here are the essential elements it should contain:

- Purpose and Scope: Clearly articulate the policy’s objectives (e.g., risk mitigation, regulatory compliance) and define which types of third-party relationships it applies to (e.g., all vendors, agents, distributors, joint venture partners, independent contractors).

- Definitions: Provide clear, unambiguous definitions for key terms such as "third party," "high-risk third party," "beneficial ownership," "politically exposed person (PEP)," and "due diligence."

- Roles and Responsibilities: Delineate who is accountable for what. This includes identifying policy owners, risk owners, procurement teams, legal counsel, compliance officers, and business units involved in managing third-party relationships.

- Risk Assessment Framework: Establish a clear methodology for categorizing third parties based on their inherent risk (e.g., low, medium, high). Factors might include geographic location, industry, services provided, access to sensitive data, and transaction volume.

- Due Diligence Procedures (Tiered Approach):

- Initial Screening: Basic checks for all third parties, including identity verification, sanctions list screening, and adverse media checks.

- Standard Due Diligence: For medium-risk third parties, including questionnaires on compliance programs, financial stability, and basic background checks.

- Enhanced Due Diligence (EDD): For high-risk third parties, involving in-depth background checks, forensic audits, site visits, interviews, beneficial ownership analysis, and detailed anti-bribery and anti-corruption assessments.

- Contractual Requirements: Mandate the inclusion of specific compliance clauses in all third-party agreements, such as anti-corruption provisions, data protection clauses, audit rights, and termination rights for non-compliance.

- Ongoing Monitoring: Outline procedures for continuous or periodic monitoring of third parties, including regular reviews, performance assessments, event-driven monitoring (e.g., news alerts, changes in ownership), and re-screening processes.

- Training and Awareness: Specify requirements for training employees and, where appropriate, third parties on the policy’s requirements, relevant laws, and ethical conduct.

- Reporting and Escalation: Establish clear channels and procedures for reporting red flags, potential violations, or material changes in a third party’s risk profile, along with an escalation matrix for addressing such issues.

- Record Keeping: Define requirements for documenting all due diligence activities, findings, and decisions, ensuring a comprehensive audit trail for internal review and regulatory scrutiny.

- Policy Review and Updates: Set a schedule for regular review and updates of the Third Party Due Diligence Policy Template to ensure it remains current with regulatory changes, evolving risks, and organizational needs.

- Consequences of Non-Compliance: Outline the repercussions for employees or third parties failing to adhere to the policy, ranging from disciplinary action to contract termination.

Tips on Design, Usability, and Implementation

A robust Third Party Due Diligence Policy Template is only as effective as its adoption and practical application within an organization. Thoughtful design, usability, and a strategic implementation plan are paramount. For design, prioritize clarity and conciseness. Avoid overly legalistic jargon; instead, use plain language that is easily understood by all stakeholders, from procurement specialists to executive leadership. Employ clear headings, subheadings, and bullet points to break down complex information, making the document digestible. Flowcharts or decision trees, though not directly renderable in this HTML structure, can be conceptualized within the text to guide users through the due diligence process steps.

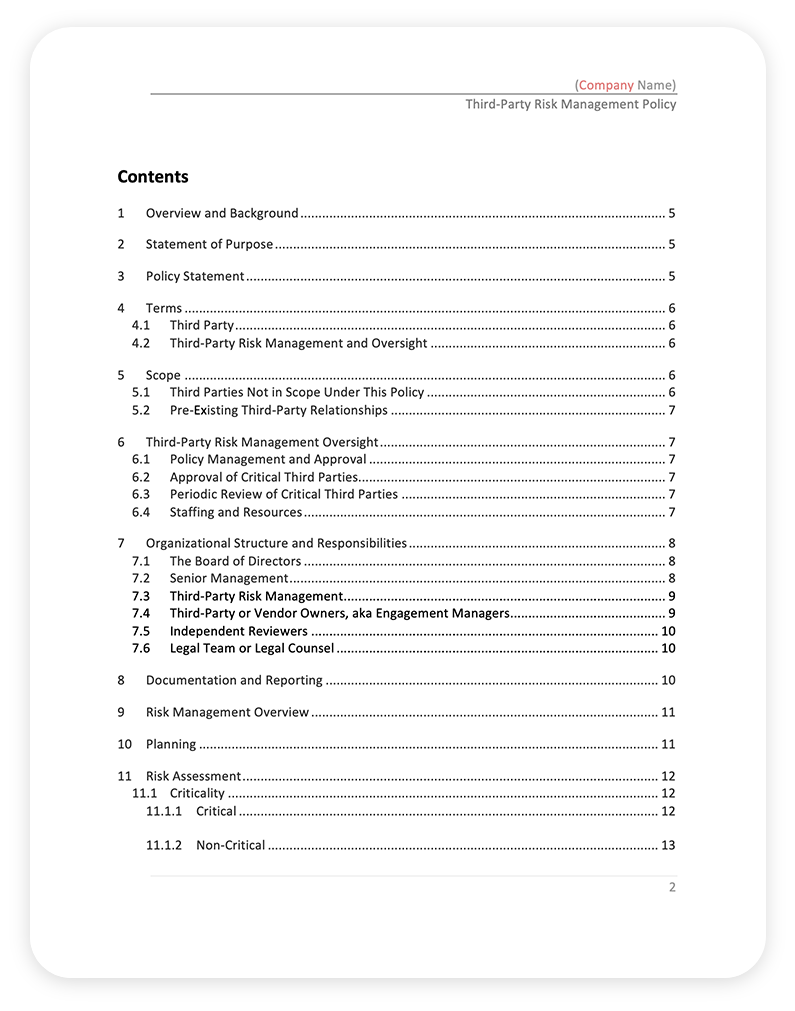

Regarding usability, the policy should be accessible and easy to navigate. Whether it’s distributed digitally as a PDF or integrated into an online GRC platform, ensure that users can quickly find the information they need. A comprehensive table of contents and an index of key terms can significantly enhance user experience. For digital versions, incorporate search functionality and hyperlinks to relevant internal documents or external resources. When considering print formats, ensure the layout is clean, with adequate white space, making it easy to read and annotate if necessary for training purposes.

Implementation requires a multifaceted approach. Start with comprehensive training and awareness programs for all relevant employees. This isn’t just about reading the policy; it’s about understanding its spirit and practical application. Develop supporting job aids, checklists, and FAQs that can be used day-to-day. Integrate the Third Party Due Diligence Policy Template seamlessly into existing business workflows, such as procurement processes, contract management, and onboarding procedures, possibly through automation tools or compliance software. Establish a communication plan to regularly reinforce the policy’s importance and disseminate updates. Finally, ensure a strong version control system is in place, especially for digital templates, so that employees always refer to the most current iteration of the policy. Regular audits of policy adherence will also identify areas for improvement and reinforce its importance.

Cultivating a Culture of Vigilance

The journey to effective third-party risk management is ongoing, evolving alongside global regulations and technological advancements. A meticulously developed Third Party Due Diligence Policy Template is far more than just a document; it is a living commitment to integrity, compliance, and strategic resilience. It serves as the bedrock upon which trust is built – trust with your partners, your customers, your regulators, and ultimately, your own internal teams. By investing in its creation and consistent application, organizations are not merely ticking a compliance box; they are fortifying their defenses against a myriad of potential threats that could otherwise derail their success.

Embracing the principles outlined within a comprehensive Third Party Due Diligence Policy Template allows businesses to navigate the complexities of external partnerships with confidence and clarity. It transforms what could be a source of significant vulnerability into an area of strength, enabling more secure, ethical, and sustainable growth. We encourage all organizations to consider how a robust Third Party Due Diligence Policy Template can serve as a cornerstone of their risk management strategy, fostering a culture of vigilance and proactive compliance that pays dividends for years to come.