In today’s interconnected business landscape, the concept of operating in isolation is largely a myth. Organizations, regardless of their size or industry, increasingly rely on a vast ecosystem of third-party vendors, suppliers, and service providers to power everything from IT infrastructure and cloud services to HR functions and specialized manufacturing. While these partnerships offer immense benefits in terms of efficiency, scalability, and access to specialized expertise, they also introduce a complex web of risks that, if left unmanaged, can lead to significant financial, reputational, and operational damage.

Navigating this intricate web requires more than just good intentions; it demands a structured, proactive approach. This is where a robust Third Party Vendor Risk Management Policy Template becomes not just useful, but absolutely indispensable. It serves as the foundational blueprint for establishing clear guidelines, procedures, and responsibilities for identifying, assessing, mitigating, and monitoring the risks associated with engaging external entities. For risk managers, compliance officers, legal teams, IT security professionals, and even senior leadership, understanding and implementing such a template is key to safeguarding organizational assets and maintaining trust.

Why a Third Party Vendor Risk Management Policy Template is Essential Today

The modern business environment is characterized by an ever-growing reliance on external partners, making a comprehensive Third Party Vendor Risk Management Policy Template more critical than ever before. Data breaches, often originating through a third-party weak link, are headline news, underscoring the severe financial and reputational fallout. Regulatory bodies worldwide, from the European Union’s GDPR to California’s CCPA, and industry standards like HIPAA and PCI DSS, are placing stringent demands on organizations to demonstrate diligent oversight of their vendors’ security and data privacy practices.

Without a well-defined policy, companies risk non-compliance, which can result in hefty fines and legal action. Beyond regulatory pressures, operational continuity is at stake. A vendor’s service disruption, cybersecurity incident, or even financial instability can directly impact a company’s ability to deliver its own products or services. A robust Third Party Vendor Risk Management Policy Template acts as a shield, helping organizations systematically identify potential threats, establish due diligence processes, and ensure that all contractual agreements adequately address risk mitigation and incident response. It moves risk management from a reactive scramble to a proactive, strategic imperative.

Key Benefits of Using a Third Party Vendor Risk Management Policy Template

Implementing a well-crafted Third Party Vendor Risk Management Policy Template offers a multitude of tangible benefits that extend across various facets of an organization. Firstly, it provides a much-needed framework for standardization. By outlining consistent procedures for vendor selection, onboarding, monitoring, and offboarding, it eliminates ad-hoc approaches and ensures that all third-party relationships are managed with the same level of scrutiny and rigor. This consistency not only enhances efficiency but also reduces the likelihood of oversights.

Secondly, it significantly strengthens an organization’s security posture and compliance framework. A clearly defined policy ensures that data security requirements, privacy obligations, and industry-specific regulations are integrated into every vendor engagement from the outset. This proactive stance helps prevent security incidents, reduces the attack surface, and demonstrates due care to regulators and auditors. Moreover, a robust Third Party Vendor Risk Management Policy Template aids in cost savings by identifying and mitigating risks before they lead to costly breaches, legal disputes, or operational downtime. It empowers better decision-making by providing a clear understanding of the risks and rewards associated with each vendor relationship, ultimately protecting the organization’s reputation and long-term viability.

Customizing Your Third Party Vendor Risk Management Policy Template

While a Third Party Vendor Risk Management Policy Template provides an invaluable starting point, its true power lies in its adaptability. No two organizations are exactly alike, and therefore, no single template can perfectly fit every business context without some degree of customization. The process of tailoring this essential document involves considering several key factors to ensure it aligns perfectly with your specific operational needs, risk appetite, and regulatory landscape.

For instance, a small startup might focus on foundational elements, while a large financial institution will require more extensive detail regarding regulatory compliance, financial stability assessments, and complex service level agreements. Industry-specific nuances are also paramount; a healthcare provider will prioritize HIPAA compliance and data privacy, whereas a manufacturing firm might focus more on supply chain resilience and operational risk. Consider the types of vendors you engage—SaaS providers, physical goods suppliers, consultants, or business process outsourcing (BPO) firms—as each presents unique risk profiles that your policy needs to address. The key is to view the Third Party Vendor Risk Management Policy Template as a living document, one that can be refined and expanded over time to reflect evolving business strategies, new technologies, and changes in the regulatory environment.

Essential Elements of a Robust Third Party Vendor Risk Management Policy Template

A truly effective Third Party Vendor Risk Management Policy Template must be comprehensive, addressing all critical stages of the vendor lifecycle and associated risks. While specific details will vary, certain foundational elements are universally crucial for a robust policy.

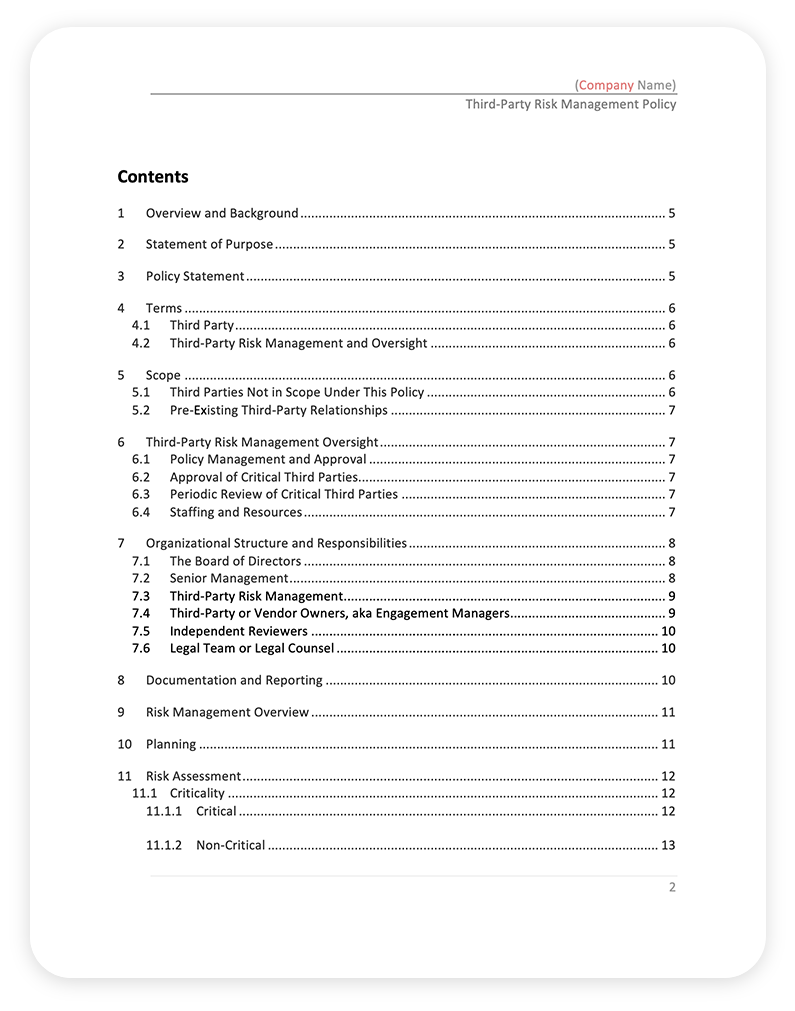

Here are the important sections and fields that should be included:

- Policy Statement and Purpose: Clearly articulate the organization’s commitment to managing third-party risks and the overall objectives of the policy.

- Scope: Define which third parties and types of engagements are covered by the policy (e.g., all vendors handling sensitive data, critical service providers, etc.).

- Definitions: Provide clear, unambiguous definitions for key terms such as "third party," "critical vendor," "vendor risk," "due diligence," and "incident."

- Roles and Responsibilities: Delineate who is accountable for what, including executive oversight, risk management teams, procurement, legal, IT security, and business unit owners.

- Vendor Risk Assessment Methodology: Detail the process for identifying, assessing, and categorizing vendor risks (e.g., inherent risk, residual risk, risk scoring). This should cover information security, data privacy, financial stability, operational resilience, and compliance risks.

- Due Diligence Requirements: Outline the steps and documentation required before engaging a new vendor, including background checks, security assessments, financial reviews, and references.

- Contractual Requirements: Specify essential clauses that must be included in all vendor contracts, such as service level agreements (SLAs), data security obligations, right-to-audit clauses, incident reporting requirements, and termination procedures. These legal terms are critical for enforceable obligations.

- Ongoing Monitoring and Oversight: Describe the continuous process for evaluating vendor performance, compliance with contractual agreements, and changes in risk posture. This might include regular security reviews, performance reviews, and vulnerability assessments.

- Incident Response and Reporting: Establish clear procedures for how vendor-related security incidents or disruptions are to be identified, reported, investigated, and remediated, including communication protocols.

- Third-Party Access Management: Define controls for managing and reviewing third-party access to internal systems and data.

- Termination and Offboarding Procedures: Detail the steps for safely ending vendor relationships, including data return/destruction, access revocation, and final security audits.

- Training and Awareness: Outline requirements for educating employees on their roles in third-party risk management.

- Policy Review and Updates: Specify the frequency and process for reviewing and updating the Third Party Vendor Risk Management Policy Template to ensure its continued relevance and effectiveness.

Design, Usability, and Implementation Tips

Beyond the robust content, the presentation and practical implementation of your Third Party Vendor Risk Management Policy Template significantly impact its effectiveness. A well-designed policy is one that is not only comprehensive but also easy to understand, navigate, and utilize by all relevant stakeholders.

For usability, aim for clarity and conciseness in your language. Avoid overly technical jargon where possible, or ensure such terms are clearly defined in the definitions section. Use clear headings and subheadings, along with bullet points and numbered lists, to break up text and improve readability—much like this article. When considering print versus digital formats, remember that a digital version allows for easy searchability and hyperlinking to related documents or resources, while a print-friendly PDF ensures consistent formatting and ease of distribution for physical records.

Implementation should involve more than just drafting the document. Consider integrating the Third Party Vendor Risk Management Policy Template with your existing Governance, Risk, and Compliance (GRC) tools or enterprise risk management framework. Establish a version control system to track changes and ensure everyone is always referencing the most current iteration. Crucially, successful implementation requires thorough training and awareness programs for all employees involved in vendor relationships, from procurement to legal and IT. Regular communication about the policy’s importance and its impact on the organization’s security and compliance posture will foster a culture of vigilance and accountability, making the policy a living, breathing component of your operational strategy rather than just a document gathering dust.

In a business world increasingly defined by interconnectedness, embracing a proactive approach to third-party vendor risk is no longer optional—it’s a strategic imperative. A well-constructed, thoughtfully implemented Third Party Vendor Risk Management Policy Template provides the critical framework needed to navigate these complexities with confidence and control. It acts as an anchor, ensuring that while you leverage external expertise and innovation, you never compromise on your organization’s security, compliance, or reputation.

By investing the time and resources into developing and maintaining a robust Third Party Vendor Risk Management Policy Template, you’re not just creating a document; you’re building resilience. You’re safeguarding your data, protecting your customers, and ensuring the long-term stability and success of your enterprise. It’s a foundational step towards mature risk governance, empowering your organization to thrive securely in an outsourced and interconnected global economy.