In an age where digital transactions are the norm and data breaches frequently make headlines, safeguarding sensitive information isn’t just a best practice—it’s an absolute necessity. Businesses of all sizes, from bustling e-commerce sites to local boutiques, regularly handle credit card information, placing a significant responsibility on their shoulders. This is precisely where a robust Credit Card Privacy Policy Template becomes an indispensable tool, acting as the cornerstone of trust and accountability between a business and its customers.

Understanding and implementing a comprehensive privacy policy isn’t merely about ticking a compliance box; it’s about transparency, consumer confidence, and mitigating significant risks. For merchants, financial technology companies, and any entity processing payments, having a well-defined Credit Card Privacy Policy Template can streamline the creation of a clear, legally sound document that outlines how personal financial data is collected, used, stored, and protected. It provides a foundational framework, allowing organizations to adapt and present their commitment to data security in an understandable and professional manner.

Why a Credit Card Privacy Policy Template is Essential Today

The modern digital landscape is fraught with potential perils, from sophisticated cyberattacks to evolving regulatory frameworks. In this environment, a Credit Card Privacy Policy Template isn’t just a document; it’s a declaration of a business’s commitment to data protection. It directly addresses the heightened concerns consumers have about their financial data, especially given the continuous stream of news about data breaches affecting major corporations.

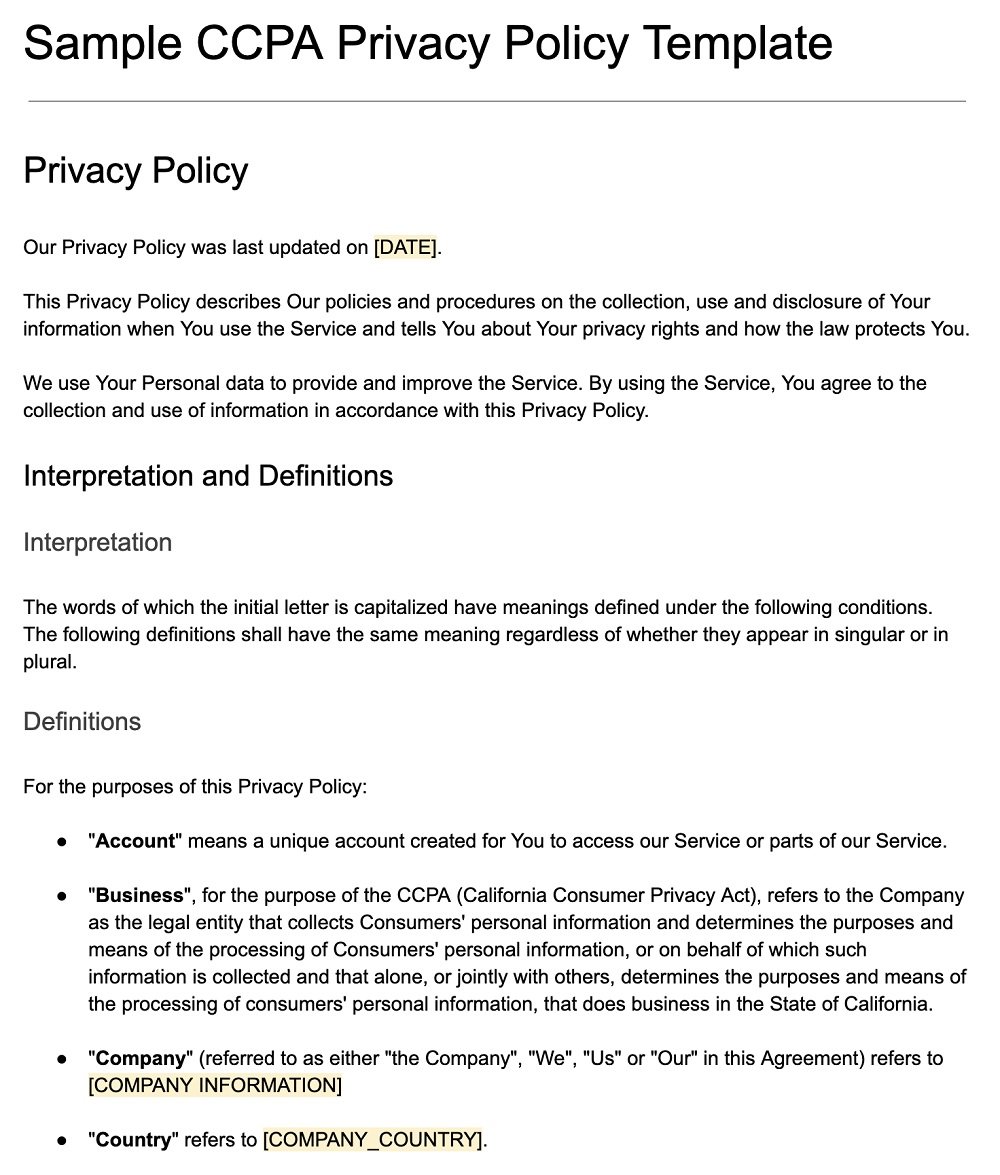

For any business handling credit card information, meeting compliance obligations is paramount. This includes adherence to standards like the Payment Card Industry Data Security Standard (PCI DSS), as well as various state and federal privacy regulations such as the California Consumer Privacy Act (CCPA) and, increasingly, principles drawn from international benchmarks like GDPR. A well-crafted Credit Card Privacy Policy Template provides a structured approach to addressing these legal requirements, ensuring that businesses clearly articulate their data governance practices. Without such a policy, companies expose themselves to not only reputational damage but also significant legal liabilities, fines, and a severe erosion of customer trust.

Key Benefits of Using a Credit Card Privacy Policy Template

Leveraging a specialized Credit Card Privacy Policy Template offers a multitude of advantages that extend beyond mere compliance. It provides a standardized and professional approach to managing critical information, saving both time and resources.

Firstly, a template ensures consistency and completeness. It guides businesses through all the essential sections that must be included, preventing omissions that could lead to compliance gaps or legal vulnerabilities. Secondly, it significantly reduces development time and costs. Instead of starting from scratch, companies can adapt an existing framework, focusing their efforts on customizing the specifics rather than drafting an entire document. This streamlined approach allows for quicker implementation.

Furthermore, using a Credit Card Privacy Policy Template inherently enhances customer trust. When consumers see a clear, accessible, and comprehensive privacy policy, it signals that the business takes its data security obligations seriously. This transparency can be a significant differentiator in a competitive market. Finally, it serves as a critical component of risk management. By clearly outlining data handling practices, a business proactively addresses potential legal challenges, demonstrates due diligence, and establishes clear internal guidelines for employees, reinforcing overall data security measures.

Customizing Your Credit Card Privacy Policy Template

While a Credit Card Privacy Policy Template provides an excellent starting point, its true power lies in its adaptability. No two businesses are exactly alike, and neither are their data processing practices. Therefore, effective customization is crucial to ensure the policy accurately reflects your specific operations and legal obligations.

Begin by considering your business model. An e-commerce platform will have different data collection and sharing practices than a physical retail store or a SaaS provider that integrates payment processing. The template should be tailored to describe exactly what information is collected (e.g., card number, expiration date, CVV, billing address, cardholder name), how it’s collected (e.g., online forms, POS systems, API integrations), and where it’s stored.

Crucially, any Credit Card Privacy Policy Template must be reviewed by legal counsel. While a template offers a strong foundation, an attorney specializing in privacy law can ensure that the customized policy fully complies with all applicable state, federal, and industry-specific regulations relevant to your specific business and geographic reach. They can help integrate company-specific practices, such as particular fraud prevention measures or unique third-party vendor relationships, ensuring that the final document is both comprehensive and legally sound for your unique circumstances.

Important Elements for Your Credit Card Privacy Policy Template

A robust Credit Card Privacy Policy Template must encompass several key sections to effectively inform users and meet regulatory requirements. Each element plays a crucial role in transparency and legal compliance.

- Information Collected: Clearly enumerate the types of personal and financial information gathered during credit card transactions. This typically includes the cardholder’s name, billing address, credit card number, expiration date, and CVV code.

- Purpose of Collection: Explain precisely why this information is collected. The primary reasons are usually for processing payments, completing transactions, fraud prevention, and complying with legal obligations.

- Data Usage and Processing: Detail how the collected credit card information will be used. This should cover transaction authorization, settlement, dispute resolution, and any internal analytical purposes, always within the bounds of data protection principles.

- Data Storage and Security Measures: Describe the security protocols in place to protect sensitive financial data. This includes encryption methods, secure servers, access controls, and adherence to PCI DSS requirements. Mentioning whether data is tokenized or truncated can also enhance clarity.

- Third-Party Disclosures: Identify any third parties with whom credit card information might be shared. This commonly includes payment processors, acquiring banks, fraud detection services, and potentially third-party service providers essential for transaction fulfillment. Explain the purpose of such sharing.

- User Rights and Choices: Inform users about their rights regarding their personal data, which might include rights to access, correct, or delete their information, depending on applicable privacy regulations like CCPA.

- Data Retention Policy: Specify how long credit card data is retained and the criteria used to determine retention periods, typically driven by legal requirements for financial records and fraud prevention needs.

- Policy Updates: Include a statement about how and when the privacy policy may be updated, and how users will be informed of such changes (e.g., notification on the website, email).

- Contact Information: Provide clear contact details for users to ask questions or raise concerns about their privacy or the policy itself. This demonstrates accountability and accessibility.

Design, Usability, and Implementation Tips

Crafting a comprehensive Credit Card Privacy Policy Template is only half the battle; ensuring it’s accessible, understandable, and properly implemented is equally vital. A well-designed policy enhances trust and minimizes user frustration.

Clarity and Simplicity: Avoid legal jargon wherever possible. Write in plain, straightforward language that an average user can understand. Use clear headings, short paragraphs, and bullet points to break up text and improve readability. The goal is to inform, not to confuse. A reader should be able to quickly find answers to their most pressing privacy questions without needing a law degree.

Accessibility: For digital implementation, ensure your policy is easy to find. Typically, a prominent link in your website’s footer, on your checkout page, or within your terms of service is standard practice. Consider using a dedicated privacy policy page that is easily navigable. If your business operates internationally or caters to diverse linguistic groups, offering the policy in multiple languages might be necessary for broader understanding and compliance with various data protection regulations.

Version Control: For digital policies, implement a version control system. Clearly indicate the "Last Updated" date at the top of the policy page. This demonstrates transparency and helps track changes over time, especially when new regulations or business practices necessitate updates to your Credit Card Privacy Policy Template.

Print and In-Store Considerations: While primarily a digital document, if your business also processes payments in a physical setting, consider how the policy’s key tenets are communicated. This might involve concise summaries on physical signage, clear instructions on transaction receipts directing customers to the full online policy, or ensuring employees are trained to answer basic privacy questions.

Integration with Other Documents: Ensure your Credit Card Privacy Policy Template is consistent with, and ideally linked from, other relevant legal documents like your Terms of Service or Terms and Conditions. This creates a cohesive legal framework for your operations, covering all aspects from customer obligations to data security.

In a world where digital transactions are increasingly prevalent, a well-defined Credit Card Privacy Policy Template is no longer a luxury but a fundamental necessity for any business. It serves as a powerful declaration of your commitment to protecting sensitive financial information, fostering trust with your customer base, and navigating the complex landscape of data protection regulations. By adopting and diligently customizing such a template, you not only fortify your legal defenses but also build a reputation as a responsible and trustworthy entity in the eyes of your consumers.

Embracing a robust Credit Card Privacy Policy Template provides a tangible solution for meeting intricate compliance requirements while simultaneously bolstering consumer confidence. It empowers businesses to articulate their data handling practices with clarity and precision, ensuring that both legal obligations and ethical responsibilities are met without compromise. Consider integrating this practical framework into your operational strategy today to secure your business and build enduring customer relationships grounded in transparency and trust.