In the bustling environment of a modern medical office, efficiency and clarity are paramount. Beyond the crucial work of patient care, managing the financial aspects of a practice can often feel like navigating a complex maze of insurance plans, deductibles, and co-pays. Without a clear framework, financial interactions can lead to confusion, frustration, and even revenue loss.

This is where a robust Financial Policy Template For Medical Office becomes not just beneficial, but truly indispensable. It serves as a foundational document, outlining the financial expectations and obligations for both the practice and its patients. For practice managers, billing staff, and healthcare providers alike, it’s a vital tool for streamlining operations, improving patient relations, and ensuring the financial health of the practice.

Why a Financial Policy Template is Essential Today

The landscape of healthcare finance is constantly shifting, marked by rising costs, increasingly complex insurance plans, and a greater burden of out-of-pocket expenses for patients. In this environment, patients are more financially sensitive than ever, and misunderstandings about billing can quickly erode trust. A well-defined financial policy acts as a beacon of clarity amidst this complexity.

It’s essential for ensuring compliance with various billing regulations and avoiding costly disputes. By clearly articulating payment expectations and procedures, a practice can significantly reduce the incidence of unpaid bills and bad debt, protecting its revenue stream. Moreover, it empowers staff with a standardized approach, fostering consistent application of workplace rules regarding patient financial obligations.

In an era demanding greater transparency from healthcare providers, a comprehensive Financial Policy Template For Medical Office demonstrates a commitment to open communication. It allows patients to understand their financial obligations upfront, reducing surprises and enabling them to make informed decisions about their care. This proactive approach builds a stronger, more trusting relationship between the patient and the practice.

Key Benefits of Implementing a Standardized Financial Policy

Adopting and consistently applying a standardized financial policy offers a multitude of advantages that extend far beyond simply collecting payments. These benefits touch every aspect of a medical office’s operations and its relationship with patients.

Firstly, it ensures unparalleled clarity and transparency. Patients will have a clear understanding of their financial responsibilities, including co-pays, deductibles, co-insurance, and payment due dates. This upfront communication eliminates ambiguity and sets appropriate expectations from the start of the patient-provider relationship.

Secondly, a robust policy leads to significantly reduced billing errors and administrative overhead. By standardizing procedures for insurance claims, patient billing, and payment processing, staff can work more efficiently and accurately. This directly translates to improved cash flow for the practice, as timely and correct billing accelerates revenue collection.

Furthermore, a well-communicated financial policy enhances patient relationships. When patients understand what to expect financially, they are less likely to experience "sticker shock" or develop resentment over unexpected bills. This fosters greater trust and satisfaction, improving the overall patient experience and potentially leading to better patient retention.

Finally, it provides crucial legal protection for the practice. A signed financial policy serves as a contract, clearly outlining the obligations of both parties and establishing the legal terms under which services are rendered and paid for. This documentation is invaluable in resolving disputes and demonstrating due diligence in billing practices, supporting your operational compliance efforts.

Customizing Your Financial Policy Template

While a comprehensive Financial Policy Template For Medical Office provides an excellent starting point, it’s crucial to recognize that no single policy fits every practice perfectly. Customization is key to ensuring the document accurately reflects your specific operational procedures, specialty, and local regulations.

Consider your medical specialty; a primary care office might have different billing nuances than a surgical center or a specialized mental health clinic. The types of services offered, the common insurance plans accepted, and the typical patient demographics will all influence how you adapt the policy. For instance, a practice serving a high-needs community might emphasize flexible payment plans more heavily.

Geographical location also plays a role, as state-specific consumer protection laws or insurance regulations might require particular disclosures. Your practice size and internal administrative capacity will also inform elements like collection procedures or how financial hardship cases are managed. The core framework of the Financial Policy Template For Medical Office is adaptable, allowing you to tailor specific sections like no-show fees, refund policies, or specific non-covered services.

The goal is to personalize the template so that it accurately represents your practice’s unique approach to patient financial responsibility while maintaining clarity and legal soundness. This tailored approach ensures the policy is both effective and practical for your specific environment, seamlessly integrating with your broader practice management strategy.

Essential Elements of a Comprehensive Financial Policy Template

To be truly effective, a Financial Policy Template For Medical Office must cover all critical aspects of patient financial responsibility and practice billing procedures. Here are the key elements that should be included:

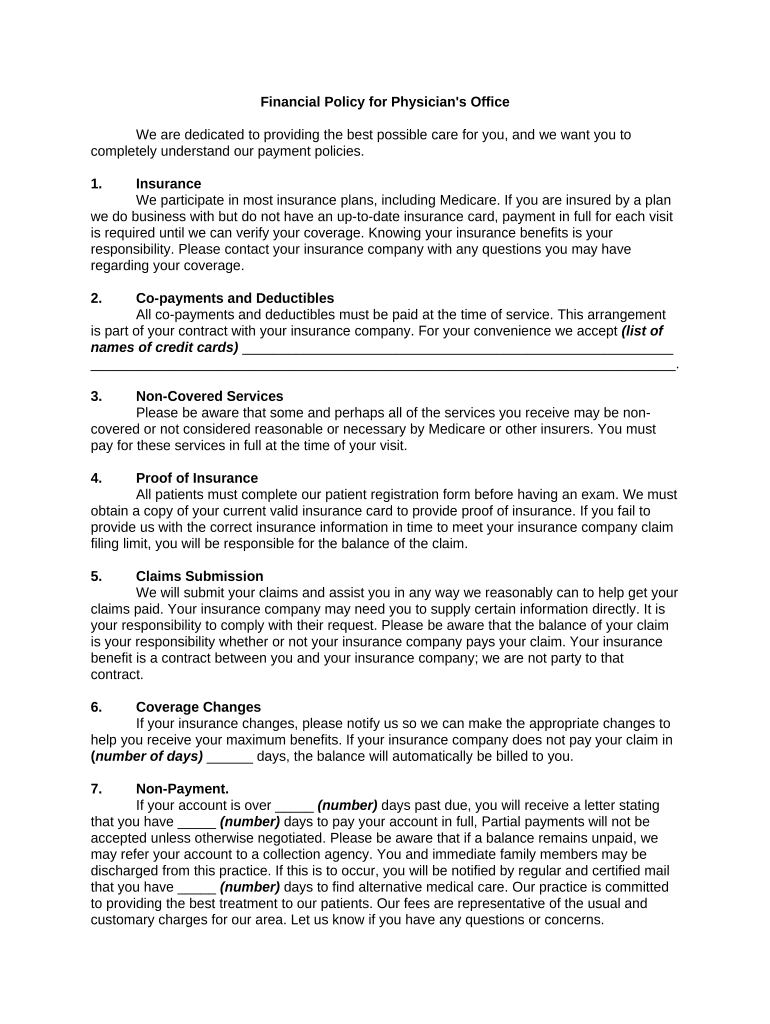

- Patient Responsibility Statement: Clearly defines the patient’s obligation for co-payments, deductibles, co-insurance, and any other out-of-pocket expenses at the time of service.

- Insurance Billing Procedures: Explains how the practice will handle insurance claims, what information the patient is required to provide (e.g., current insurance card), and clarifies that the patient is ultimately responsible for charges not covered by insurance.

- Non-Covered Services Policy: Details how services not covered by insurance will be handled, including payment expectations for such services.

- Payment Options: Outlines accepted forms of payment (e.g., credit cards, cash, checks, online payments) and any available payment plans for larger balances, including the terms and conditions for these plans.

- Late Payment Policy and Fees: Specifies the conditions under which late fees may be applied and the amount of those fees.

- Collection Procedures: Describes the steps the practice will take for past-due accounts, including communication protocols and the potential use of third-party collection agencies. This should adhere to relevant legal terms and obligations.

- No-Show/Cancellation Policy: Explains the practice’s policy regarding missed appointments or late cancellations, including any associated fees.

- Refund Policy: Lays out the circumstances under which refunds may be issued and the process for obtaining them.

- Financial Hardship Policy: Details any options available for patients experiencing financial difficulties, such as payment arrangements or discounts, and the eligibility criteria.

- Patient Acknowledgment and Signature: Includes a section where the patient (or guardian) can acknowledge that they have read, understood, and agree to the terms of the financial policy. This acts as a signed contract.

- HIPAA and Financial Privacy: Briefly mentions the practice’s commitment to protecting the privacy of patient financial and health information, aligning with data security principles.

- Effective Date and Version Control: Crucial for compliance and tracking changes over time, indicating when the policy was last updated and its current version.

Tips for Design, Usability, and Implementation

A financial policy, no matter how comprehensive, is only as effective as its design, usability, and the way it’s implemented. Thinking beyond just the content is crucial for maximizing its impact.

Design and Usability: First and foremost, the policy must be easy to read and understand. Use clear, concise language, avoiding medical or financial jargon wherever possible. Employ a readable font size and ample white space to prevent it from looking dense or intimidating. Utilize headings and bullet points to break up text and highlight key information, making it scannable for patients. The goal is clarity, not complexity.

Implementation – Print and Digital: For print, ensure the policy is professionally presented, perhaps on practice letterhead. Provide physical copies to all new patients during their initial intake and offer them to existing patients if there are significant updates. A designated signature line for patient acknowledgment is vital for creating a legally binding agreement. Digitally, make the Financial Policy Template For Medical Office readily available on your practice’s website, ideally as a downloadable PDF. Integrate it into your patient portal for easy access, ensuring it’s accessible and searchable. Some practices might even consider a concise video explanation or an FAQ section online to further clarify complex points.

Training and Education: Simply handing over the document isn’t enough. All staff members, especially front-desk personnel and billing specialists, must be thoroughly trained on the policy’s contents. They should be able to confidently explain it to patients, answer questions, and consistently apply its guidelines. Regular refresher training ensures ongoing compliance and consistency in applying workplace rules.

Ongoing Review: Financial policies are not static documents. The healthcare landscape, insurance plans, and even your practice’s services can change. Make it a practice to review and update your Financial Policy Template For Medical Office annually, or whenever significant changes occur in regulations, billing practices, or service offerings. This ensures it remains current, relevant, and compliant.

In the complex and ever-evolving world of healthcare, having a clear and well-defined financial policy is no longer an option, but a necessity. A thoughtfully developed Financial Policy Template For Medical Office acts as a cornerstone for operational efficiency, ensuring that your practice runs smoothly while fostering trust and open communication with your patients. It simplifies intricate financial processes, reduces administrative burdens, and proactively mitigates potential disputes.

By investing the time to create or refine your own practice’s financial policy using a comprehensive template, you are not just managing money; you are building a more stable, transparent, and patient-friendly environment. It’s a strategic move that solidifies your practice’s financial health, enhances patient satisfaction, and empowers your team with clear guidelines. Embrace this practical solution, and watch as your medical office thrives with greater clarity and confidence in its financial dealings.