In the vibrant ecosystem of non-profit organizations, passion fuels purpose, and dedication drives change. Yet, even the most inspiring missions hinge on a bedrock of sound financial management. Without a clear financial roadmap, even the most innovative programs can falter, hindering impact and eroding the trust of donors and stakeholders. This is precisely where a robust program budget becomes not just a tool, but an indispensable strategic asset.

Think of your organization’s budget as the detailed blueprint for turning your vision into reality. It’s more than just a list of numbers; it’s a living document that articulates how resources will be allocated to achieve specific programmatic goals, ensures transparency, and serves as a critical communication piece for funding requests and accountability. For any non-profit, especially those relying on grants and donor contributions, mastering the art of program-specific budgeting is paramount to both short-term success and long-term sustainability.

Why a Dedicated Program Budget is Non-Negotiable

A comprehensive financial planning guide for your initiatives offers a multitude of benefits, extending far beyond simple accounting. It acts as your organization’s financial compass, guiding decisions and ensuring every dollar spent contributes directly to your mission. Without a clear program spending outline, organizations risk misallocating precious funds, missing crucial compliance requirements, and struggling to demonstrate impact effectively.

Firstly, a well-defined project spending outline dramatically enhances accountability. Donors, foundations, and government agencies want to see exactly how their contributions will be used. A detailed budget provides this transparency, fostering trust and demonstrating responsible stewardship of funds. Secondly, it is crucial for strategic resource allocation. It forces organizations to prioritize expenses, align spending with program objectives, and ensure that resources are deployed where they will have the greatest impact. Lastly, it is a powerful tool for grant applications, often a prerequisite for securing funding, providing a credible and persuasive argument for financial need and capacity.

Key Components of an Effective Program Budget Template

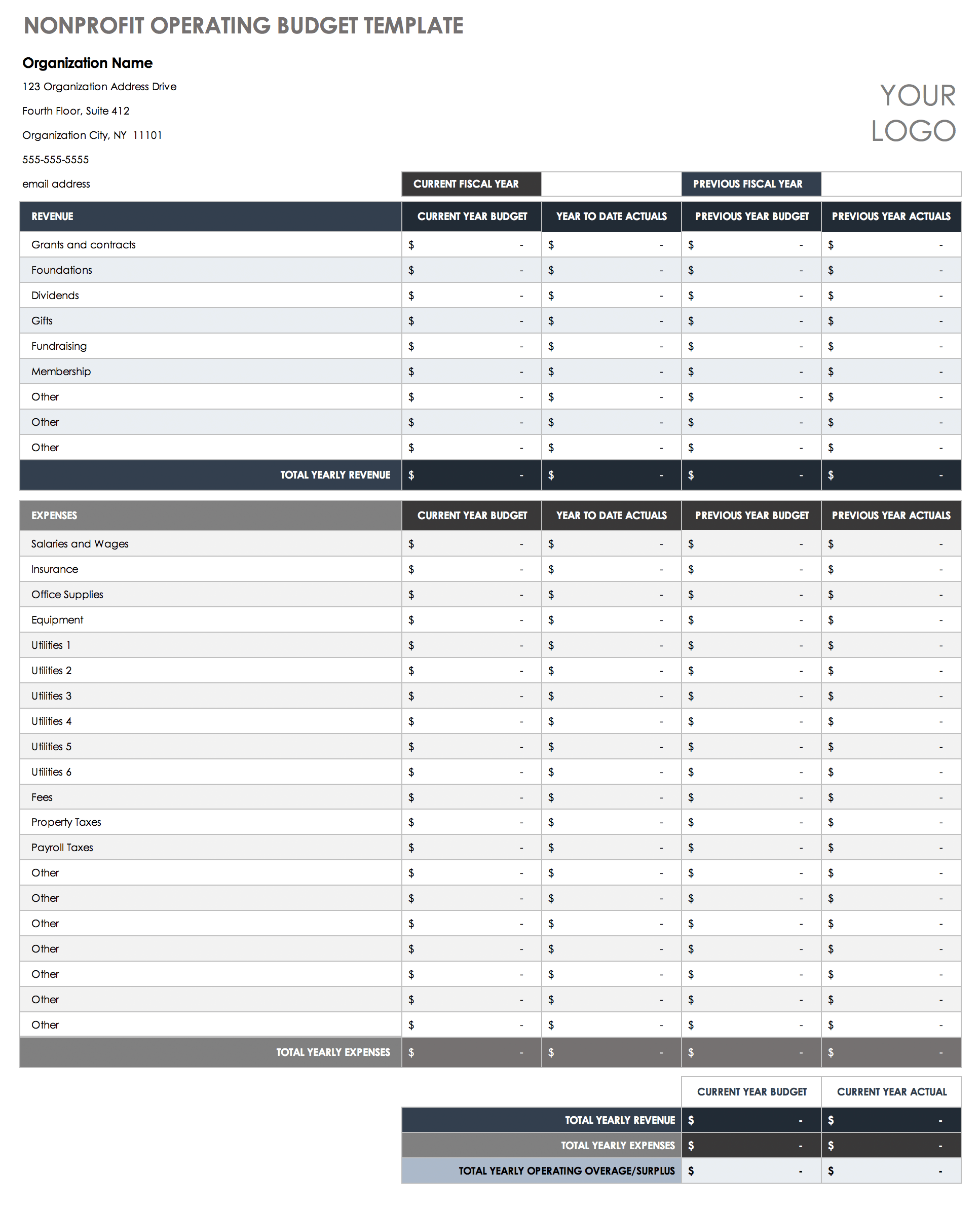

Developing a powerful budget template for your charitable program requires understanding its core elements. While specific line items will vary based on your program’s nature, certain categories are universally essential for a complete and transparent financial picture. These components ensure that all aspects of your program’s financial needs and resources are accounted for, from incoming funds to outgoing expenditures.

Revenue Sources: Where the Money Comes From

This section outlines all anticipated income for your program. It’s crucial to be realistic and to diversify where possible. Common sources include:

- Grants: From foundations, corporations, or government agencies, often restricted to specific program activities.

- Individual Donations: Contributions from individual supporters, usually unrestricted but sometimes earmarked for particular programs.

- Fundraising Events: Income generated from galas, runs, online campaigns, and other fundraising activities.

- Earned Income: Fees for services, product sales, or membership dues related to the program.

- In-Kind Contributions: Non-cash donations like donated space, volunteer time, professional services, or materials. These should be valued and included for a full picture, even if they don’t involve cash transactions.

Direct Program Expenses: The Costs of Doing Business

These are the expenditures directly attributable to the specific program. Each item should clearly link to a program activity or objective.

- Personnel Costs: Salaries, wages, and benefits for staff directly working on the program (e.g., program managers, educators, case workers).

- Consultant/Contractor Fees: Payments for external experts or organizations hired for specific program tasks.

- Program Supplies & Materials: Items essential for program delivery, such as educational kits, art supplies, food for clients, or specific equipment.

- Travel & Accommodation: Costs associated with staff or participant travel for program activities.

- Marketing & Outreach: Expenses for promoting the program, including printing brochures, social media ads, or website development.

- Client Support Costs: Direct financial assistance, transportation vouchers, or other direct benefits provided to program beneficiaries.

Indirect/Administrative Costs (Overhead): The Foundation of Support

Often misunderstood, these are the essential “behind-the-scenes” costs that enable your programs to run smoothly. Properly allocating these is vital for organizational health and sustainability.

- Rent & Utilities: A portion of the organization’s overall office space and utility costs.

- Administrative Salaries: A portion of salaries for executive directors, finance staff, and administrative assistants who support multiple programs.

- Insurance: General liability, D&O, and other insurance policies.

- Office Supplies & Equipment: General office needs not tied to a specific program.

- Technology & Software: IT support, general software licenses, website maintenance.

- Professional Fees: Audit fees, legal counsel, and other organizational overhead services.

Contingency Fund: The “What If” Buffer

A crucial, yet often overlooked, component. This allocation sets aside a percentage (typically 5-15%) of the total budget to cover unforeseen expenses, delays, or emergencies. It’s a critical safety net that prevents minor disruptions from derailing your entire program.

Crafting Your Program Budget: A Step-by-Step Guide

Developing a robust budget for a non-profit program isn’t just about plugging numbers into a spreadsheet; it’s a thoughtful process that ensures alignment with your mission and maximizes impact. Following a structured approach can simplify this complex task and lead to a more accurate and defensible funding allocation document.

This systematic method helps to break down the budgeting process into manageable steps, ensuring that every financial decision is intentional and supports the overall program objectives. By moving methodically through these stages, organizations can create a realistic and strategic financial plan that truly reflects their operational needs and aspirations.

- **Define Program Scope and Goals:** Before estimating a single dollar, clearly articulate what the program aims to achieve, its target audience, and its duration. What specific outcomes are you striving for? This foundational step ensures every budget line item serves a purpose directly linked to the program’s objectives.

- **Identify Activities and Resources:** Break down the program into specific activities required to reach your goals. For each activity, list all necessary resources: staff time, materials, equipment, technology, and services. This granular approach prevents overlooked expenses and helps in accurate estimation.

- **Estimate Expenses:** For each identified resource, research and estimate its cost. Be as specific as possible. Get quotes for services, research market prices for supplies, and factor in benefits for personnel. Distinguish between one-time start-up costs and ongoing operational expenses.

- **Project Revenue Sources:** Determine all potential funding streams for the program. Be realistic about the likelihood and timing of receiving funds. Factor in grant cycles, fundraising timelines, and anticipated donation levels. Avoid overestimating income, as this can lead to serious shortfalls.

- **Allocate Indirect Costs:** Systematically allocate a fair share of your organization’s overhead to the program. This might involve using a negotiated indirect cost rate with a funder or developing an internal methodology based on factors like staff time, direct costs, or space usage.

- **Build in a Contingency Fund:** Set aside a percentage of the total budget (typically 5-15%) for unexpected costs or revenue shortfalls. This buffer is crucial for managing risks and maintaining program stability in the face of unforeseen circumstances.

- **Review and Refine:** Share the draft budget with key stakeholders, including program managers, finance staff, and even board members. Gather feedback, challenge assumptions, and make adjustments as needed. Ensure the budget tells a clear story that aligns with the program narrative.

- **Monitor and Adjust:** Once approved, the budget isn’t static. Regularly track actual expenditures and revenue against the budget. Identify variances, understand their causes, and make necessary adjustments to future spending or revenue strategies. This ongoing process is vital for financial health.

Beyond the Numbers: Strategic Budgeting for Impact

While the immediate purpose of an organizational budget framework is financial planning, its true power lies in its capacity as a strategic planning tool. A thoughtfully constructed budget doesn’t just manage money; it articulates your mission, prioritizes your values, and signals your commitment to donors. It is a communication device that helps tell your story with numbers, demonstrating how every dollar translates into tangible impact.

Effective budgeting transcends mere compliance; it’s about making informed decisions that amplify your mission. It enables organizations to proactively plan for growth, identify potential funding gaps, and showcase their financial health and responsibility. By integrating the budget into strategic discussions, non-profits can ensure that financial decisions are always aligned with their overarching goals, leading to greater effectiveness and long-term sustainability.

Common Pitfalls to Avoid

Even with the best intentions, non-profit organizations can stumble into common budgeting traps. Being aware of these potential missteps is the first step toward creating a more resilient and effective financial plan. Proactive avoidance of these issues can save significant time, resources, and potential embarrassment down the line, ensuring a smoother operation of your mission-driven financial plan.

One prevalent error is **underestimating indirect costs**. Neglecting overhead or not allocating a fair share to specific programs leaves organizations financially vulnerable. Another pitfall is **unrealistic revenue projections**, often fueled by optimism rather than data. It’s crucial to base income forecasts on historical trends and solid commitments, not just hopeful prospects. Furthermore, failing to **involve key program staff** in the budgeting process can lead to inaccurate estimates and a lack of ownership, making budget adherence challenging.

Lastly, **lack of flexibility and continuous monitoring** can quickly render a budget obsolete. Budgets are living documents that require regular review and adjustment as circumstances change. Ignoring these updates can lead to poor decision-making and a disconnect between financial plans and operational realities.

Leveraging Technology for Budget Management

In today’s digital age, relying solely on paper ledgers or basic spreadsheets for a comprehensive non-profit budget template is often insufficient. Technology offers powerful tools to streamline budget creation, monitoring, and reporting, enhancing accuracy and efficiency. From simple spreadsheet applications to sophisticated accounting software, the right tools can transform your expenditure tracking sheet from a tedious task into an insightful analytical process.

For many smaller non-profits, robust spreadsheet programs like Microsoft Excel or Google Sheets provide a flexible and customizable platform for building a program budgeting tool. They allow for detailed categorization, formula-driven calculations, and easy sharing. However, as organizations grow, specialized non-profit accounting software such as QuickBooks for Non-Profits, Aplos, or Sage Intacct can offer integrated solutions for budgeting, fundraising, grant tracking, and financial reporting, providing a holistic view of your financial health.

These advanced platforms not only automate many manual processes but also offer sophisticated reporting capabilities, helping organizations visualize their financial data and make more informed decisions. By embracing appropriate technology, non-profits can reduce administrative burden, improve data integrity, and focus more resources on their core mission.

The creation and diligent management of a Non Profit Program Budget Template is more than a financial exercise; it’s a testament to your organization’s commitment to impact, transparency, and sustainability. It serves as the bridge between your ambitious vision and the practical steps required to achieve it, ensuring that every resource is thoughtfully utilized and accounted for.

By embracing a comprehensive approach to program budgeting, incorporating robust components, following a meticulous process, and leveraging modern technology, your non-profit can solidify its financial foundation. This strategic focus empowers you to not only meet the expectations of donors and stakeholders but also to truly maximize the positive change you seek to bring into the world, transforming dreams into demonstrable results.